Entries for Receipt and Dishonor of Notes Receivable Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino. Assume 360 days in a year. If an amount box does not require an entry, leave it blank, Round final answers to the nearest cent when necessary. Mar. 29. Received a $14,400, 60-day, 8% note dated March 29 from Karie Platt on account. Apr. 30. Received a $30,600, 60-day, 6% note dated April 30 from Jon Kelly on account. May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged for the note, including interest. June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for the note, including interest. Aug. 26. Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days at 12% on the total amount debited to Karie Platt on May 28. Oct. 22. Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the dishonored note dated April 30. Mar. 29 Notes Receivable ▪ 14,400 V Accounts Receivable-Karie Platt 14,400 Apr. 30 Notes Receivable • 30,600 Accounts Receivable-Jon Kelly 30,600 May 28 Accounts Receivable-Karie Platt - 14,592 Notes Receivable - 14,400 Interest Revenue - v 192 June 29 Accounts Receivable-Jon Kelly • v 30,906V Notes Receivable - 30,600 Interest Revenue - 306 Aug. 26 Cash V 15,400 X Accounts Receivable-Karie Platt - 14,952 x Interest Revenue ▪ 448 X Oct. 22 Allowance for Doubtful Accounts V 30,906 V Accounts Receivable-Jon Kelly - 30,906

Entries for Receipt and Dishonor of Notes Receivable Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino. Assume 360 days in a year. If an amount box does not require an entry, leave it blank, Round final answers to the nearest cent when necessary. Mar. 29. Received a $14,400, 60-day, 8% note dated March 29 from Karie Platt on account. Apr. 30. Received a $30,600, 60-day, 6% note dated April 30 from Jon Kelly on account. May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged for the note, including interest. June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for the note, including interest. Aug. 26. Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days at 12% on the total amount debited to Karie Platt on May 28. Oct. 22. Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the dishonored note dated April 30. Mar. 29 Notes Receivable ▪ 14,400 V Accounts Receivable-Karie Platt 14,400 Apr. 30 Notes Receivable • 30,600 Accounts Receivable-Jon Kelly 30,600 May 28 Accounts Receivable-Karie Platt - 14,592 Notes Receivable - 14,400 Interest Revenue - v 192 June 29 Accounts Receivable-Jon Kelly • v 30,906V Notes Receivable - 30,600 Interest Revenue - 306 Aug. 26 Cash V 15,400 X Accounts Receivable-Karie Platt - 14,952 x Interest Revenue ▪ 448 X Oct. 22 Allowance for Doubtful Accounts V 30,906 V Accounts Receivable-Jon Kelly - 30,906

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 5SEA: UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current...

Related questions

Question

Please correct

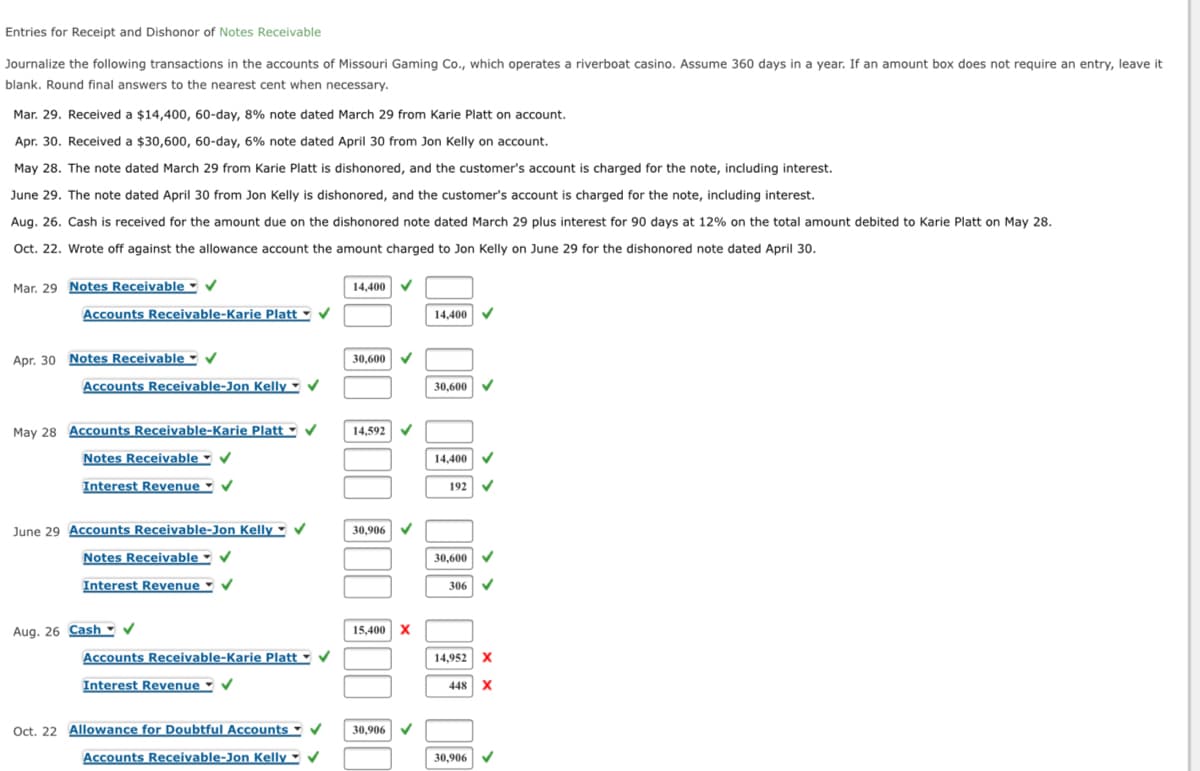

Transcribed Image Text:Entries for Receipt and Dishonor of Notes Receivable

Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino. Assume 360 days in a year. If an amount box does not require an entry, leave it

blank. Round final answers to the nearest cent when necessary.

Mar. 29. Received a $14,400, 60-day, 8% note dated March 29 from Karie Platt on account.

Apr. 30. Received a $30,600, 60-day, 6% note dated April 30 from Jon Kelly on account.

May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged for the note, including interest.

June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for the note, including interest.

Aug. 26. Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days at 12% on the total amount debited to Karie Platt on May 28.

Oct. 22. Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the dishonored note dated April 30.

Mar. 29 Notes Receivable - v

14,400

Accounts Receivable-Karie Platt - V

14,400 V

Apr. 30 Notes Receivable -

30,600 V

Accounts Receivable-Jon Kelly -

30,600

May 28 Accounts Receivable-Karie Platt -

14,592

Notes Receivable - v

14,400

Interest Revenue - V

192

June 29 Accounts Receivable-Jon Kelly v

30,906

Notes Receivable - v

30,600

Interest Revenue V

306

Aug. 26 Cash - v

15,400 X

Accounts Receivable-Karie Platt

14,952 X

Interest Revenue V

448

X

Oct. 22 Allowance for Doubtful Accounts ♥

30,906

Accounts Receivable-Jon Kelly -

30,906

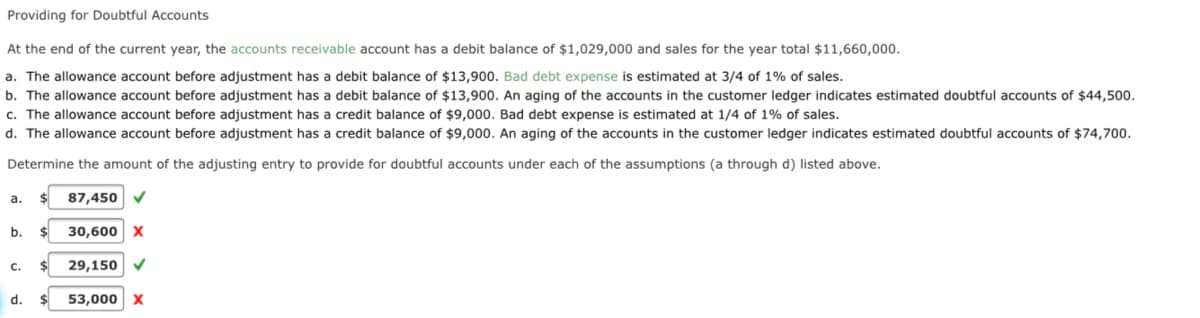

Transcribed Image Text:Providing for Doubtful Accounts

At the end of the current year, the accounts receivable account has a debit balance of $1,029,000 and sales for the year total $11,660,000.

a. The allowance account before adjustment has a debit balance of $13,900. Bad debt expense is estimated at 3/4 of 1% of sales.

b. The allowance account before adjustment has a debit balance of $13,900. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $44,500.

c. The allowance account before adjustment has a credit balance of $9,000. Bad debt expense is estimated at 1/4 of 1% of sales.

d. The allowance account before adjustment has a credit balance of $9,000. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $74,700.

Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.

87,450 V

a.

b.

30,600 x

29,150 V

C.

d.

53,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,