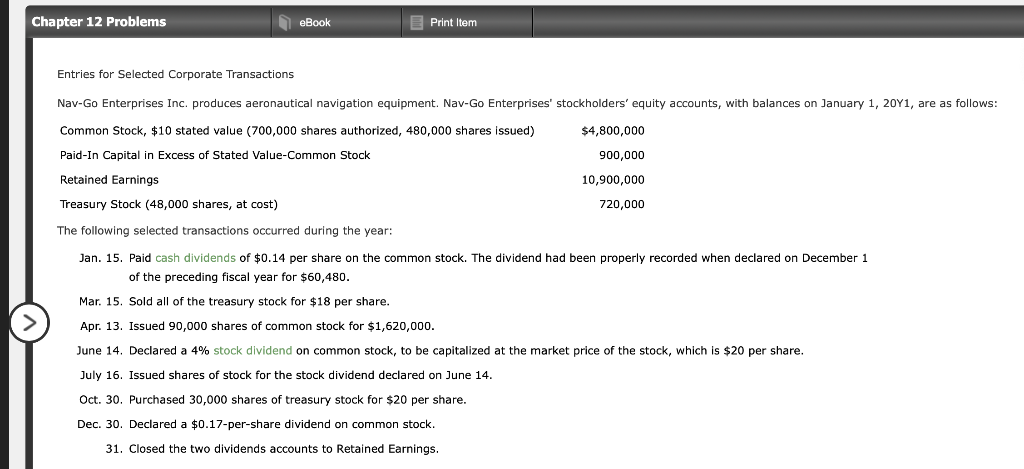

Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (700,000 shares authorized, 480,000 shares issued) $4,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 900,000 Retained Earnings 10,900,000 Treasury Stock (48,000 shares, at cost) 720,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $60,480. Mar. 15. Sold all of the treasury stock for $18 per share. Apr. 13. Issued 90,000 shares of common stock for $1,620,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 30,000 shares of treasury stock for $20 per share.

Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (700,000 shares authorized, 480,000 shares issued) $4,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 900,000 Retained Earnings 10,900,000 Treasury Stock (48,000 shares, at cost) 720,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $60,480. Mar. 15. Sold all of the treasury stock for $18 per share. Apr. 13. Issued 90,000 shares of common stock for $1,620,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 30,000 shares of treasury stock for $20 per share.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4BPR: Entries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation...

Related questions

Question

Transcribed Image Text:Chapter 12 Problems

N eBook

E Print Item

Entries for Selected Corporate Transactions

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows:

Common Stock, $10 stated value (700,000 shares authorized, 480,000 shares issued)

$4,800,000

Paid-In Capital in Excess of Stated Value-Common Stock

900,000

Retained Earnings

10,900,000

Treasury Stock (48,000 shares, at cost)

720,000

The following selected transactions occurred during the year:

Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1

of the preceding fiscal year for $60,480.

Mar. 15. Sold all of the treasury stock for $18 per share.

Apr. 13. Issued 90,000 shares of common stock for $1,620,000.

June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share.

July 16. Issued shares of stock for the stock dividend declared on June 14.

Oct. 30. Purchased 30,000 shares of treasury stock for $20 per share.

Dec. 30. Declared a $0.17-per-share dividend on common stock.

31. Closed the two dividends accounts to Retained Earnings.

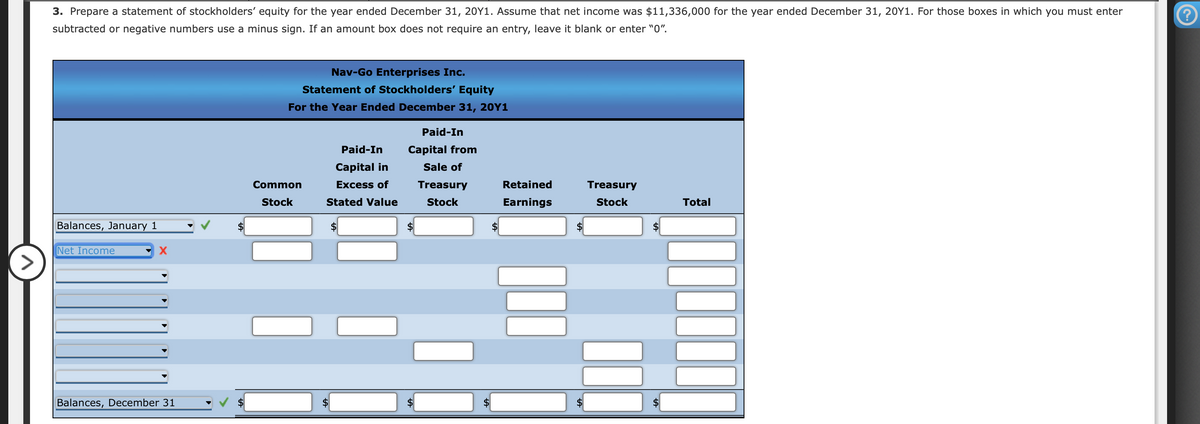

Transcribed Image Text:3. Prepare a statement of stockholders' equity for the year ended December 31, 20Y1. Assume that net income was $11,336,000 for the year ended December 31, 20Y1. For those boxes in which you must enter

subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter "0".

Nav-Go Enterprises Inc.

Statement of Stockholders' Equity

For the Year Ended December 31, 20Y1

Paid-In

Paid-In

Capital from

Capital in

Sale of

Common

Excess of

Treasury

Retained

Treasury

Stock

Stated Value

Stock

Earnings

Stock

Total

Balances, January 1

$

2$

Net Income

Balances, December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning