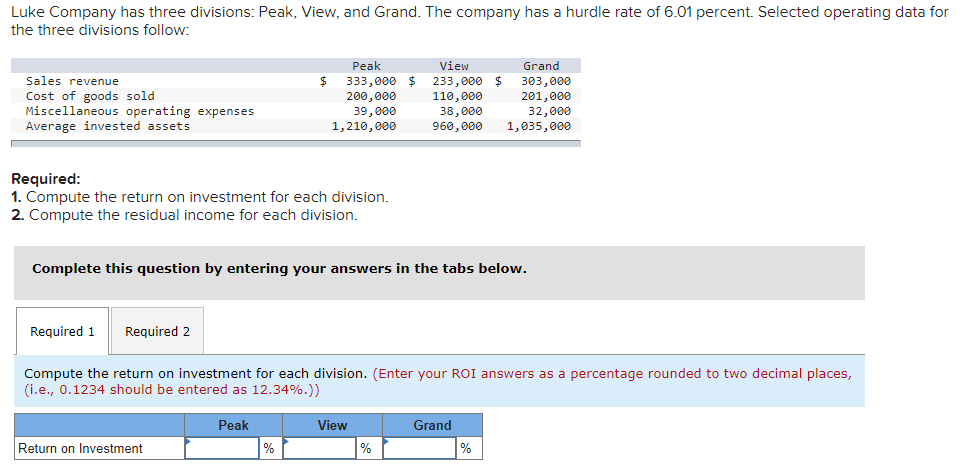

Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6.01 percent. Selected operating data for the three divisions follow: Peak View Grand $ 333,000 $ 233,000 $ 303,000 110, 000 Sales revenue Cost of goods sold Miscellaneous operating expenses Average invested assets 200,000 39,000 1,210, 000 38,000 960, 000 201,000 32,000 1,035,000 Required: 1. Compute the return on investment for each division. 2. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the return on investment for each division. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Peak View Grand Return on Investment % % %

Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6.01 percent. Selected operating data for the three divisions follow: Peak View Grand $ 333,000 $ 233,000 $ 303,000 110, 000 Sales revenue Cost of goods sold Miscellaneous operating expenses Average invested assets 200,000 39,000 1,210, 000 38,000 960, 000 201,000 32,000 1,035,000 Required: 1. Compute the return on investment for each division. 2. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the return on investment for each division. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Peak View Grand Return on Investment % % %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 16E

Related questions

Question

Transcribed Image Text:Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6.01 percent. Selected operating data for

the three divisions follow:

Peak

View

Grand

Sales revenue

333,000 $

233,000 $

110,000

38,000

960, 000

303,000

201,000

Cost of goods sold

Miscellaneous operating expenses

Average invested assets

200,000

39,000

1,210,000

32,000

1,035,000

Required:

1. Compute the return on investment for each division.

2. Compute the residual income for each division.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the return on investment for each division. (Enter your ROI answers as a percentage rounded to two decimal places,

(i.e., 0.1234 should be entered as 12.34%.))

Peak

View

Grand

Return on Investment

%

%

Transcribed Image Text:Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6.01 percent. Selected operating data for

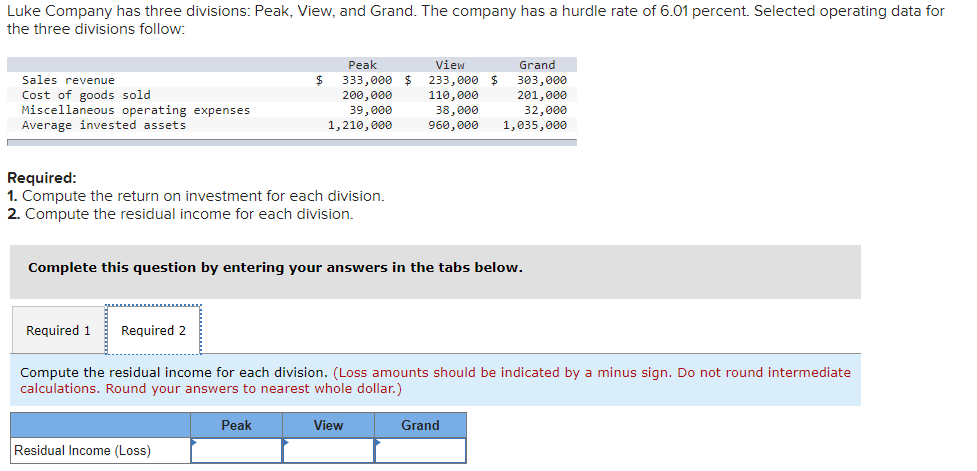

the three divisions follow:

Peak

View

Grand

333,000 $

200,000

39,000

1,210,000

303,000

201,000

32,000

Sales revenue

$4

Cost of goods sold

Miscellaneous operating expenses

Average invested assets

233,000 $

110,000

38, 000

960, 000

1,035,000

Required:

1. Compute the return on investment for each division.

2. Compute the residual income for each division.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the residual income for each division. (Loss amounts should be indicated by a minus sign. Do not round intermediate

calculations. Round your answers to nearest whole dollar.)

Peak

View

Grand

Residual Income (Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning