Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) $2,400,000 Paid-In Capital in Excess of Stated Value-Common Stock 450,000 Retained Earnings 5,450,000 Treasury Stock (24,000 shares, at cost) 336,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 45,000 shares of common stock for $720,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 15,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.18-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings.

Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) $2,400,000 Paid-In Capital in Excess of Stated Value-Common Stock 450,000 Retained Earnings 5,450,000 Treasury Stock (24,000 shares, at cost) 336,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 45,000 shares of common stock for $720,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 15,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.18-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 2AP

Related questions

Question

Entries for Selected Corporate Transactions

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises'

| Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) | $2,400,000 |

| Paid-In Capital in Excess of Stated Value-Common Stock | 450,000 |

| Retained Earnings | 5,450,000 |

| 336,000 |

The following selected transactions occurred during the year:

| Jan. 15. | Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. |

| Mar. 15. | Sold all of the treasury stock for $17 per share. |

| Apr. 13. | Issued 45,000 shares of common stock for $720,000. |

| June 14. | Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. |

| July 16. | Issued shares of stock for the stock dividend declared on June 14. |

| Oct. 30. | Purchased 15,000 shares of treasury stock for $19 per share. |

| Dec. 30. | Declared a $0.18-per-share dividend on common stock. |

| 31. | Closed the two dividends accounts to Retained Earnings. |

Required:

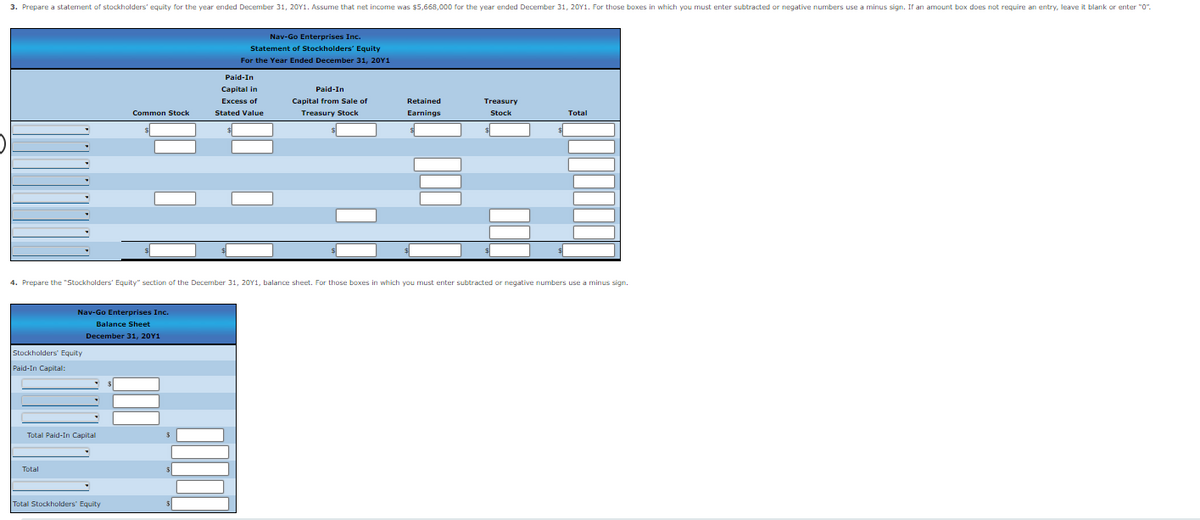

Transcribed Image Text:3. Prepare a statement of stockholders' equity for the year ended December 31, 20Y1. Assume that net income was $5,668,000 for the year ended December 31, 20Y1. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter "0".

Stockholders' Equity

Paid-In Capital:

Nav-Go Enterprises Inc.

Balance Sheet

December 31, 20Y1

Total Paid-In Capital

Total

Common Stock

Total Stockholders' Equity

Nav-Go Enterprises Inc.

Statement of Stockholders' Equity

For the Year Ended December 31, 20Y1

Paid-In

Capital in

Excess of

Stated Value

4. Prepare the "Stockholders' Equity" section of the December 31, 20Y1, balance sheet. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Paid-In

Capital from Sale of

Treasury Stock

Retained

Earnings

Treasury

Stock

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College