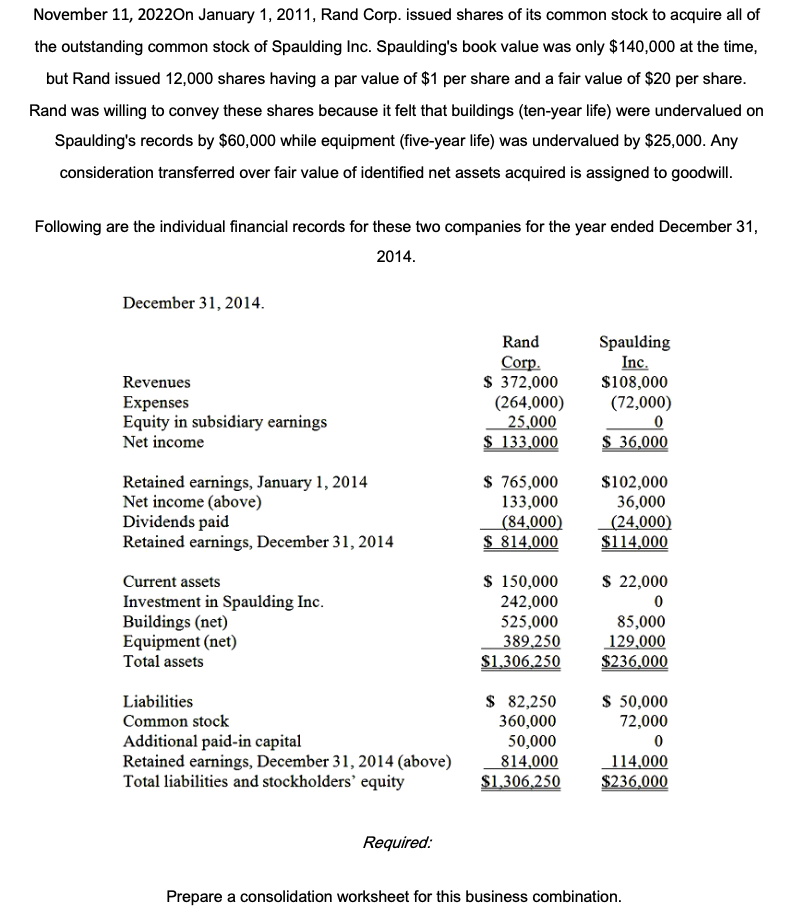

November 11, 2022On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Following are the individual financial records for these two companies for the year ended December 31, 2014. December 31, 2014. Revenues Expenses Equity in subsidiary earnings Net income Retained earnings, January 1, 2014 Net income (above) Dividends paid Retained earnings, December 31, 2014 Current assets Investment in Spaulding Inc. Buildings (net) Equipment (net) Total assets Liabilities Common stock Additional paid-in capital Retained earnings, December 31, 2014 (above) Total liabilities and stockholders' equity Required: Rand Corp. $ 372,000 (264,000) 25,000 $ 133,000 $ 765,000 133,000 (84,000) $814,000 $ 150,000 242,000 525,000 389,250 $1,306,250 $ 82,250 360,000 50,000 814,000 $1,306,250 Spaulding Inc. $108,000 (72,000) 0 $ 36,000 $102,000 36,000 (24,000) $114,000 $ 22,000 0 85,000 129,000 $236,000 $ 50,000 72,000 0 114,000 $236,000 Prepare a consolidation worksheet for this business combination.

November 11, 2022On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Following are the individual financial records for these two companies for the year ended December 31, 2014. December 31, 2014. Revenues Expenses Equity in subsidiary earnings Net income Retained earnings, January 1, 2014 Net income (above) Dividends paid Retained earnings, December 31, 2014 Current assets Investment in Spaulding Inc. Buildings (net) Equipment (net) Total assets Liabilities Common stock Additional paid-in capital Retained earnings, December 31, 2014 (above) Total liabilities and stockholders' equity Required: Rand Corp. $ 372,000 (264,000) 25,000 $ 133,000 $ 765,000 133,000 (84,000) $814,000 $ 150,000 242,000 525,000 389,250 $1,306,250 $ 82,250 360,000 50,000 814,000 $1,306,250 Spaulding Inc. $108,000 (72,000) 0 $ 36,000 $102,000 36,000 (24,000) $114,000 $ 22,000 0 85,000 129,000 $236,000 $ 50,000 72,000 0 114,000 $236,000 Prepare a consolidation worksheet for this business combination.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 27E: Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2...

Related questions

Question

Transcribed Image Text:November 11, 2022On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of

the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time,

but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.

Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on

Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any

consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

Following are the individual financial records for these two companies for the year ended December 31,

2014.

December 31, 2014.

Revenues

Expenses

Equity in subsidiary earnings

Net income

Retained earnings, January 1, 2014

Net income (above)

Dividends paid

Retained earnings, December 31, 2014

Current assets

Investment in Spaulding Inc.

Buildings (net)

Equipment (net)

Total assets

Liabilities

Common stock

Additional paid-in capital

Retained earnings, December 31, 2014 (above)

Total liabilities and stockholders' equity

Required:

Rand

Corp.

$ 372,000

(264,000)

25,000

$ 133,000

$ 765,000

133,000

(84,000)

$814,000

$ 150,000

242,000

525,000

389,250

$1,306,250

$ 82,250

360,000

50,000

814,000

$1,306,250

Spaulding

Inc.

$108,000

(72,000)

0

$ 36,000

$102,000

36,000

(24,000)

$114,000

$ 22,000

0

85,000

129,000

$236,000

$ 50,000

72,000

0

114,000

$236,000

Prepare a consolidation worksheet for this business combination.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT