equipment has a useful life of five years and a residual value of $75,000. Depreciati using the straight-line method. The expected net cash inflows from the investment Year 1 $275,000 Year 2 220,000 200,000 200,000 180,000 $1,075,000 Year 3 Year 4 Year 5 Compute the accounting rate of return on the investment, Show your calculations.

equipment has a useful life of five years and a residual value of $75,000. Depreciati using the straight-line method. The expected net cash inflows from the investment Year 1 $275,000 Year 2 220,000 200,000 200,000 180,000 $1,075,000 Year 3 Year 4 Year 5 Compute the accounting rate of return on the investment, Show your calculations.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 14E

Related questions

Question

??

Transcribed Image Text:أبجد هوز

أبجد هوز

- Aa

A

A

1.- Palatin

ill

ssle 1

X,

abe

blai

فقرة

11

10

6.

7.

5 1

1

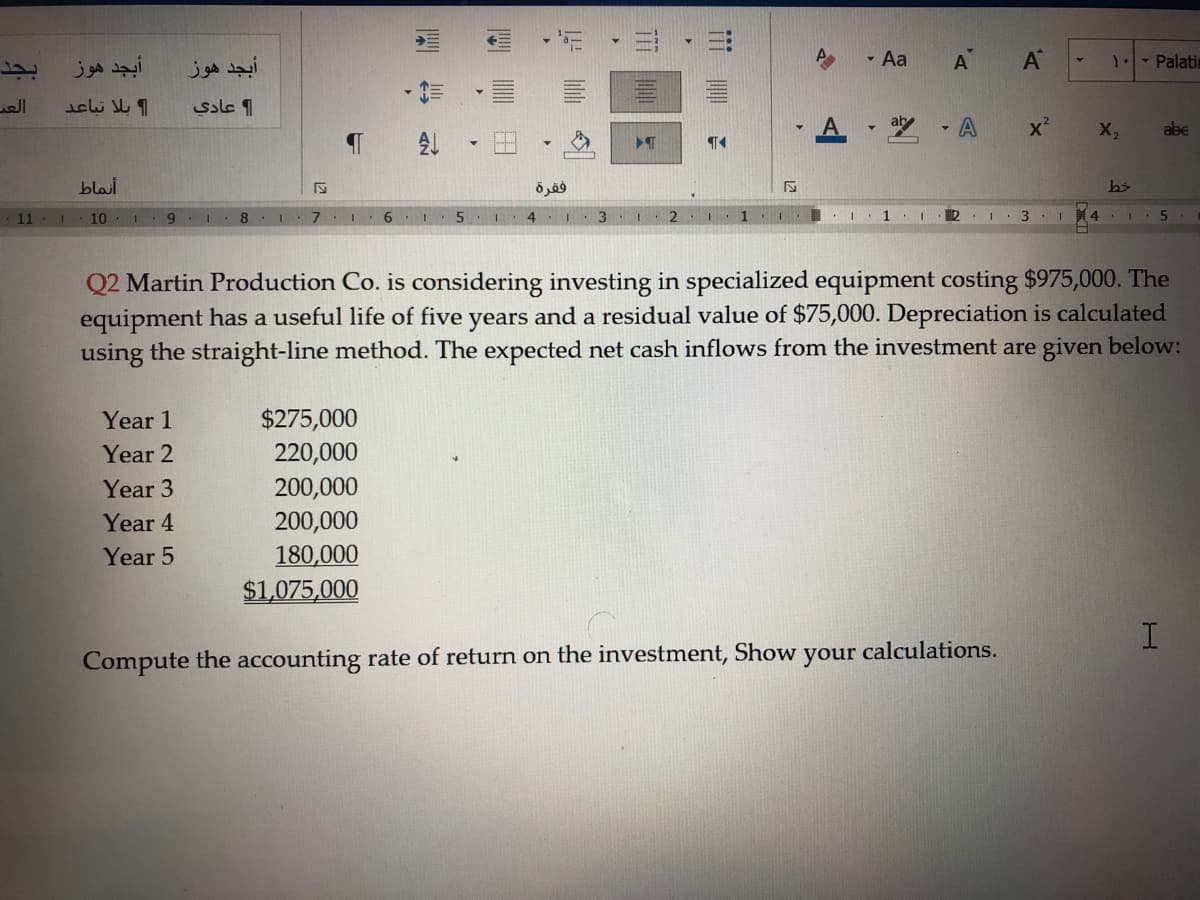

Q2 Martin Production Co. is considering investing in specialized equipment costing $975,000. The

equipment has a useful life of five years and a residual value of $75,000. Depreciation is calculated

using the straight-line method. The expected net cash inflows from the investment are given below:

$275,000

220,000

Year 1

Year 2

200,000

200,000

180,000

Year 3

Year 4

Year 5

$1,075,000

I.

Compute the accounting rate of return on the investment, Show

your

calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning