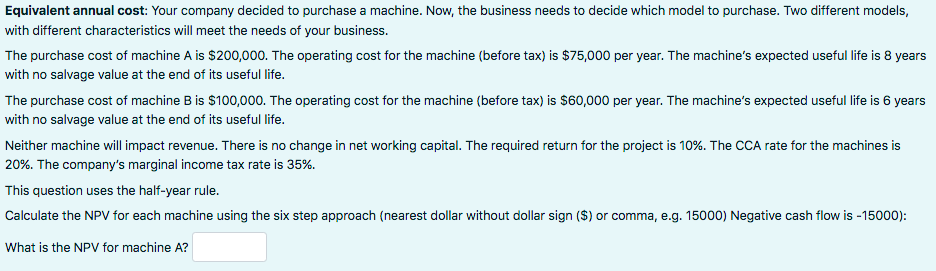

Equivalent annual cost: Your company decided to purchase a machine. Now, the business needs to decide which model to purchase. Two different models, with different characteristics will meet the needs of your business. The purchase cost of machine A is $200,000. The operating cost for the machine (before tax) is $75,000 per year. The machine's expected useful life is 8 years with no salvage value at the end of its useful life. The purchase cost of machine B is $100,000. The operating cost for the machine (before tax) is $60,000 per year. The machine's expected useful life is 6 years with no salvage value at the end of its useful life. Neither machine will impact revenue. There is no change in net working capital. The required return for the project is 10%. The CCA rate for the machines is 20%. The company's marginal income tax rate is 35%. This question uses the half-year rule. Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): What is the NPV for machine A?

Equivalent annual cost: Your company decided to purchase a machine. Now, the business needs to decide which model to purchase. Two different models, with different characteristics will meet the needs of your business. The purchase cost of machine A is $200,000. The operating cost for the machine (before tax) is $75,000 per year. The machine's expected useful life is 8 years with no salvage value at the end of its useful life. The purchase cost of machine B is $100,000. The operating cost for the machine (before tax) is $60,000 per year. The machine's expected useful life is 6 years with no salvage value at the end of its useful life. Neither machine will impact revenue. There is no change in net working capital. The required return for the project is 10%. The CCA rate for the machines is 20%. The company's marginal income tax rate is 35%. This question uses the half-year rule. Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): What is the NPV for machine A?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 18P: Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting...

Related questions

Question

MACHINE A, NOT MACHINE B.

Transcribed Image Text:Equivalent annual cost: Your company decided to purchase a machine. Now, the business needs to decide which model to purchase. Two different models,

with different characteristics will meet the needs of your business.

The purchase cost of machine A is $200,000. The operating cost for the machine (before tax) is $75,000 per year. The machine's expected useful life is 8 years

with no salvage value at the end of its useful life.

The purchase cost of machine B is $100,000. The operating cost for the machine (before tax) is $60,000 per year. The machine's expected useful life is 6 years

with no salvage value at the end of its useful life.

Neither machine will impact revenue. There is no change in net working capital. The required return for the project is 10%. The CCA rate for the machines is

20%. The company's marginal income tax rate is 35%.

This question uses the half-year rule.

Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000):

What is the NPV for machine A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College