Chapter1: Understanding And Working With The Federal Tax Law

Section: Chapter Questions

Problem 27DQ

Related questions

Concept explainers

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Question

| Suppose that three stocks (A, B, and C} and two common risk factors (1 and 2) have the following relationship: |

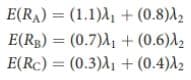

| E(RA) = (1.1)A1 + (0.8)A2 |

| E(RB) = (0.7)A1 + (0.6)A2 |

| E(RC) = (0.3)A1 + (0.4)A2 |

| a. If A1 = 4 percent and A2 = 2 percent, what are the prices expected next year for each of the stocks? Assume that all three stocks currently sell for $30 and will not pay a dividend in the next year. |

| b. Suppose that you know that next year the prices for Stocks A, B, and C will actually be $31.50, $35.00, and $30.50. Create and demonstrate a riskless, arbitrage investment to take advantage of these mispriced securities. What is the profit from your investment? You may assume that you can use the proceeds from any necessary short sale. Problems 13 and 14 refer to the data contained in Exhibit 7.23, which lists 30 monthly excess returns to two different actively managed stock portfolios (A and B) and three different common risk factors (1, 2, and 3). {Note: You may find it useful to use a computer spreadsheet program such as Microsoft Excel to calculate your answers.} |

Transcribed Image Text:E(RB) (0.7)(0.6)A2

E(Rc) (0.3) (0.4)A2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you