You have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $114,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $25,000 plus an initial investment of $5,200 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? , eve Identify the relevant incremental cash flows below: (Select all the choices that apply.) -2.42 bur c A. Feasibility study for the new coffee shop. B. Capital expenditure to outfit the space. your C. Price you paid for the space two years ago. 18 D. Amount you would net after taxes should you sell the space today. E. Initial investment in inventory. og Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar) $ -8 1 2 $ P $ 3 $ r 4/ 4 Free Cash Flow Char bunt y off. RUNNI t your

You have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $114,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $25,000 plus an initial investment of $5,200 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? , eve Identify the relevant incremental cash flows below: (Select all the choices that apply.) -2.42 bur c A. Feasibility study for the new coffee shop. B. Capital expenditure to outfit the space. your C. Price you paid for the space two years ago. 18 D. Amount you would net after taxes should you sell the space today. E. Initial investment in inventory. og Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar) $ -8 1 2 $ P $ 3 $ r 4/ 4 Free Cash Flow Char bunt y off. RUNNI t your

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

100%

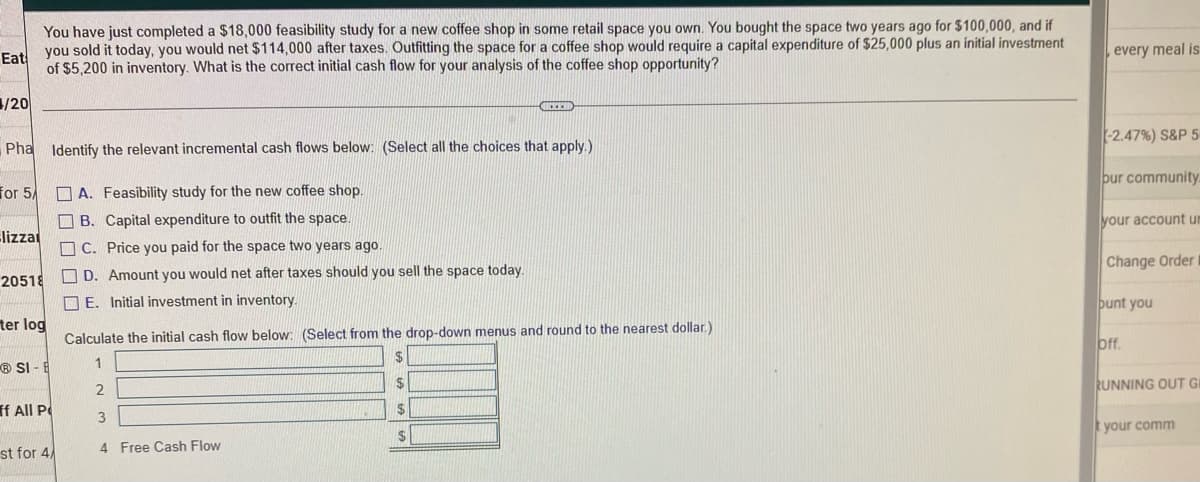

18. You have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $114,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $25,000 plus an initial investment of $5,200 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity?

**round to the nearest dollar**

Transcribed Image Text:You have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if

Eat you sold it today, you would net $114,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $25,000 plus an initial investment

of $5,200 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity?

/20

REED

Pha Identify the relevant incremental cash flows below: (Select all the choices that apply.)

for 5/

A. Feasibility study for the new coffee shop.

B. Capital expenditure to outfit the space.

Blizza

C. Price you paid for the space two years ago.

20518

D. Amount you would net after taxes should you sell the space today.

E. Initial investment in inventory.

ter log

Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar)

$

1

SI-E

S

2

ff All P

$

3

$

st for 4

4 Free Cash Flow

every meal is

(-2.47%) S&P 5

bur community.

your account un

Change Order

bunt you

off.

RUNNING OUT GI

t your comm

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College