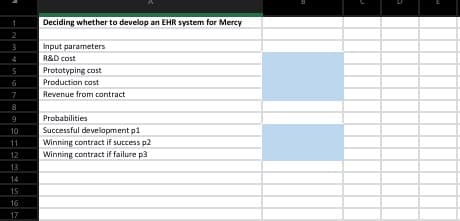

Eva Green is the director of Epic Systems Corporate, healthcare software company. In three months, a proposal is due for an electronic health record (EHR) system for Mercy Health Partners. For several years, Epic Systems Corporate has been developing new data mining system, a critical component in an EHR system that would be superior to any EHR currently on the market. However, progress in research and development has been slow, and Eva is unsure whether her staff can produce the data mining system in time. If they succeed in developing the data mining system (probability ), there is an excellent chance (probability ) that Epic System Corporate will win the $1 million contract from Mercy Health Partners. If they do not, there is a small chance (probability ) that she will still be able to win the same contract with an alternative but inferior EHR that has already been developed. If Eva continues the project, she must invest $200,000 in R&D. In addition, making a proposal (which she will decide whether to do after seeing whether the R&D is successful) requires developing a prototype data mining system at an additional cost. This additional cost is $50,000 if R&D is successful (so that she can develop the new EHR system), and it is $40,000 if R&D is unsuccessful (so that she needs to go with the older EHR system). Finally, if Eva wins the contract, the finished product will cost an additional $150,000 to produce. (1) Develop a decision tree (without Precisiontree) that can be used to solve Eva’sproblem. You can assume in this part of the problem that she is using EMV (of her net profit) as a decision criterion. Build the tree so that she can enter any values for p1 ,p2 , and p3 (in input cell) and automatically see her optimal EMV and optimal strategy from the tree. (2) If p2=0.8 and p3=0.1 , what value of p1 makes Eva indifferent between abandoning the project and going ahead with it? (3) How much would Eva benefit if she knew for certain that Mercy would guarantee her the contract? (This guarantee would be in force only if she were successful in developing the system.) Assume p1=0.4 , p2=0.8, and p3=0.1 (4) Suppose now that this is relatively big project for Eva. Therefore, she decides to use expected utility as her criterion, with an exponential utility function. Using some trial and error, see which risk tolerance changes her initial decision from “go ahead” to “abandon” when p1=0.4 , p2=0.8, and p3=0.1 .

Critical Path Method

The critical path is the longest succession of tasks that has to be successfully completed to conclude a project entirely. The tasks involved in the sequence are called critical activities, as any task getting delayed will result in the whole project getting delayed. To determine the time duration of a project, the critical path has to be identified. The critical path method or CPM is used by project managers to evaluate the least amount of time required to finish each task with the least amount of delay.

Cost Analysis

The entire idea of cost of production or definition of production cost is applied corresponding or we can say that it is related to investment or money cost. Money cost or investment refers to any money expenditure which the firm or supplier or producer undertakes in purchasing or hiring factor of production or factor services.

Inventory Management

Inventory management is the process or system of handling all the goods that an organization owns. In simpler terms, inventory management deals with how a company orders, stores, and uses its goods.

Project Management

Project Management is all about management and optimum utilization of the resources in the best possible manner to develop the software as per the requirement of the client. Here the Project refers to the development of software to meet the end objective of the client by providing the required product or service within a specified Period of time and ensuring high quality. This can be done by managing all the available resources. In short, it can be defined as an application of knowledge, skills, tools, and techniques to meet the objective of the Project. It is the duty of a Project Manager to achieve the objective of the Project as per the specifications given by the client.

Eva Green is the director of Epic Systems Corporate, healthcare software company. In three months, a proposal is due for an electronic health record (EHR) system for Mercy Health Partners. For several years, Epic Systems Corporate has been developing new data mining system, a critical component in an EHR system that would be superior to any EHR currently on the market. However, progress in research and development has been slow, and Eva is unsure whether her staff can produce the data mining system in time. If they succeed in developing the data mining system (probability ), there is an excellent chance (probability ) that Epic System Corporate will win the $1 million contract from Mercy Health Partners. If they do not, there is a small chance (probability ) that she will still be able to win the same contract with an alternative but inferior EHR that has already been developed.

If Eva continues the project, she must invest $200,000 in R&D. In addition, making a proposal (which she will decide whether to do after seeing whether the R&D is successful) requires developing a prototype data mining system at an additional cost. This additional cost is $50,000 if R&D is successful (so that she can develop the new EHR system), and it is $40,000 if R&D is unsuccessful (so that she needs to go with the older EHR system).

Finally, if Eva wins the contract, the finished product will cost an additional $150,000 to produce.

(1) Develop a decision tree (without Precisiontree) that can be used to solve Eva’sproblem. You can assume in this part of the problem that she is using EMV (of her net profit) as a decision criterion. Build the tree so that she can enter any values for p1 ,p2 , and p3 (in input cell) and automatically see her optimal EMV and optimal strategy from the tree.

(2) If p2=0.8 and p3=0.1 , what value of p1 makes Eva indifferent between abandoning the project and going ahead with it?

(3) How much would Eva benefit if she knew for certain that Mercy would guarantee her the contract? (This guarantee would be in force only if she were successful in developing the system.) Assume p1=0.4 , p2=0.8, and p3=0.1

(4) Suppose now that this is relatively big project for Eva. Therefore, she decides to use expected utility as her criterion, with an exponential utility function. Using some trial and error, see which risk tolerance changes her initial decision from “go ahead” to “abandon” when p1=0.4 , p2=0.8, and p3=0.1 .

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images