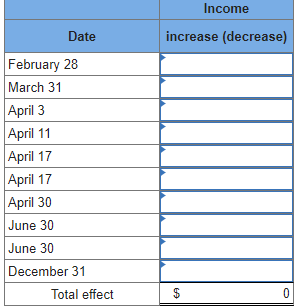

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28 Sold merchandise to Lennox, Inc., for $20,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note. Mar. 31 Sold merchandise to Maddox Co. that had a fair value of $15,040, and accepted a noninterest-bearing note for which $16,000 payment is due on March 31, 2022. Apr. 3 Sold merchandise to Carr Co. for $14,000 with terms 2/10, n/30. Evergreen uses the gross method to account for cash discounts. 11 Collected the entire amount due from Carr Co. 17 A customer returned merchandise costing $4,800. Evergreen reduced the customer’s receivable balance by $6,600, the sales price of the merchandise. Sales returns are recorded by the company as they occur. 30 Transferred receivables of $66,000 to a factor without recourse. The factor charged Evergreen a 1% finance charge on the receivables transferred. The sale criteria are met. June 30 Discounted the Lennox, Inc., note at the bank. The bank’s discount rate is 8%. The note was discounted without recourse. Sep. 30 Lennox, Inc., paid the note amount plus interest to the bank. Required: 3. Prepare a schedule showing the effect of the journal entries on 2021 income before taxes.

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred:

| Feb. | 28 |

Sold merchandise to Lennox, Inc., for $20,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note. |

||

| Mar. | 31 |

Sold merchandise to Maddox Co. that had a fair value of $15,040, and accepted a noninterest-bearing note for which $16,000 payment is due on March 31, 2022. |

||

| Apr. | 3 |

Sold merchandise to Carr Co. for $14,000 with terms 2/10, n/30. Evergreen uses the gross method to account for cash discounts. |

||

| 11 | Collected the entire amount due from Carr Co. | |||

| 17 | A customer returned merchandise costing $4,800. Evergreen reduced the customer’s receivable balance by $6,600, the sales price of the merchandise. Sales returns are recorded by the company as they occur. | |||

| 30 | Transferred receivables of $66,000 to a factor without recourse. The factor charged Evergreen a 1% finance charge on the receivables transferred. The sale criteria are met. | |||

| June | 30 |

Discounted the Lennox, Inc., note at the bank. The bank’s discount rate is 8%. The note was discounted without recourse. |

||

| Sep. | 30 | Lennox, Inc., paid the note amount plus interest to the bank. |

Required:

3. Prepare a schedule showing the effect of the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps