Newton Company is involved in litigation regarding a faulty The entity has consulted with an attorney and determined that the entity may lose the case. The attorney estimated Problem 4-16 Newton Company is involved in litigation regarding a product sold in a prior year. The entity has consulted with an attorney and determined that there is a 50% chance of losing. If this is the case, the attorney estimated that the amount of any payment would be P5,000,000. What is the required journal entry as a result of this litigation? a. Debit litigation expense and credit litigation liability P5,000,000. b. No journal entry is required. c. Debit litigation expense and credit litigation liability P2,000,000. d. Debit litigation expense and credit litigation liability P3,000,000.

Newton Company is involved in litigation regarding a faulty The entity has consulted with an attorney and determined that the entity may lose the case. The attorney estimated Problem 4-16 Newton Company is involved in litigation regarding a product sold in a prior year. The entity has consulted with an attorney and determined that there is a 50% chance of losing. If this is the case, the attorney estimated that the amount of any payment would be P5,000,000. What is the required journal entry as a result of this litigation? a. Debit litigation expense and credit litigation liability P5,000,000. b. No journal entry is required. c. Debit litigation expense and credit litigation liability P2,000,000. d. Debit litigation expense and credit litigation liability P3,000,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 4MC

Related questions

Question

Prob. 4-16

Transcribed Image Text:Newton Company is involved in litigation regarding a faulty

The entity has consulted with an attorney and determined

that the entity may lose the case. The attorney estimated

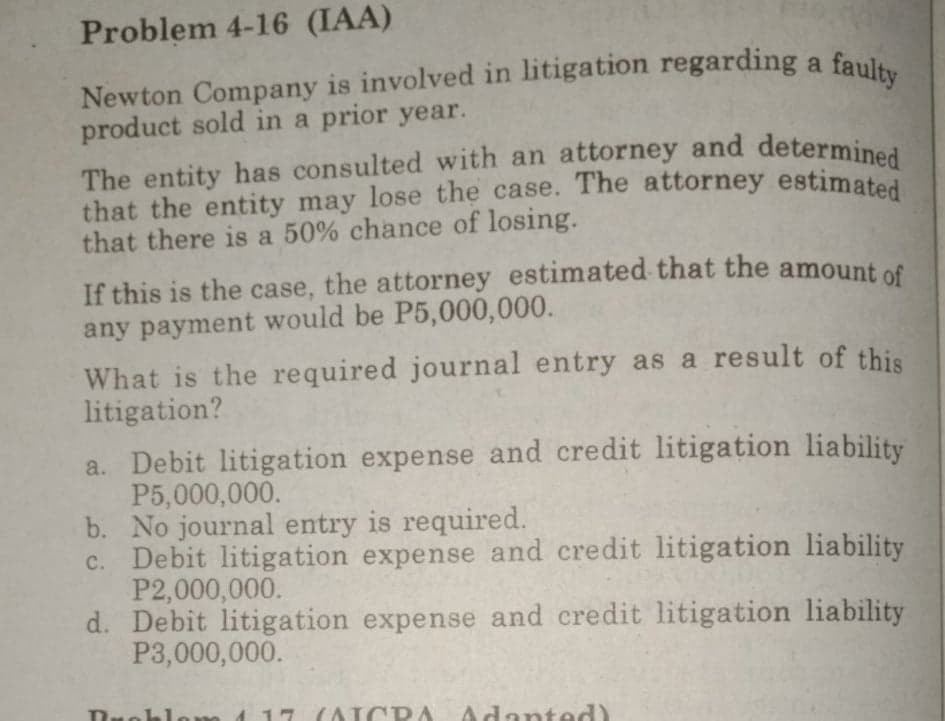

Problem 4-16 (IAA)

Newton Company is involved in litigation regarding a

product sold in a prior year.

that there is a 50% chance of losing.

If this is the case, the attorney estimated that the amount of

any payment would be P5,000,000.

What is the required journal entry as a result of this

litigation?

a. Debit litigation expense and credit litigation liability

P5,000,000.

b. No journal entry is required.

c. Debit litigation expense and credit litigation liability

P2,000,000.

d. Debit litigation expense and credit litigation liability

P3,000,000.

7 (AICDA

Adanted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning