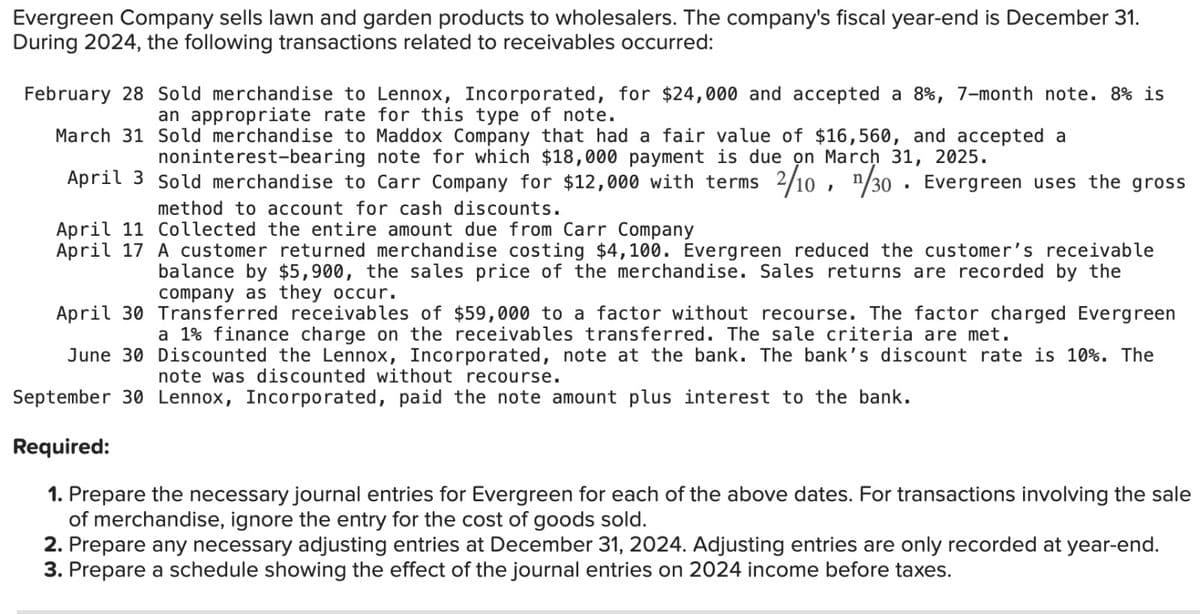

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2024, the following transactions related to receivables occurred: February 28 Sold merchandise to Lennox, Incorporated, for $24,000 and accepted a 8%, 7-month note. 8% is an appropriate rate for this type of note. March 31 Sold merchandise to Maddox Company that had a fair value of $16,560, and accepted a noninterest-bearing note for which $18,000 payment is due on March 31, 2025. April 3 Sold merchandise to Carr Company for $12,000 with terms 2/10, 1/30. Evergreen uses the gross method to account for cash discounts. April 11 Collected the entire amount due from Carr Company April 17 A customer returned merchandise costing $4,100. Evergreen reduced the customer's receivable balance by $5,900, the sales price of the merchandise. Sales returns are recorded by the company as they occur. April 30 Transferred receivables of $59,000 to a factor without recourse. The factor charged Evergreen a 1% finance charge on the receivables transferred. The sale criteria are met. June 30 Discounted the Lennox, Incorporated, note at the bank. The bank's discount rate is 10%. The note was discounted without recourse. September 30 Lennox, Incorporated, paid the note amount plus interest to the bank. Required: 1. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. 2. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end. 3. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes.

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2024, the following transactions related to receivables occurred: February 28 Sold merchandise to Lennox, Incorporated, for $24,000 and accepted a 8%, 7-month note. 8% is an appropriate rate for this type of note. March 31 Sold merchandise to Maddox Company that had a fair value of $16,560, and accepted a noninterest-bearing note for which $18,000 payment is due on March 31, 2025. April 3 Sold merchandise to Carr Company for $12,000 with terms 2/10, 1/30. Evergreen uses the gross method to account for cash discounts. April 11 Collected the entire amount due from Carr Company April 17 A customer returned merchandise costing $4,100. Evergreen reduced the customer's receivable balance by $5,900, the sales price of the merchandise. Sales returns are recorded by the company as they occur. April 30 Transferred receivables of $59,000 to a factor without recourse. The factor charged Evergreen a 1% finance charge on the receivables transferred. The sale criteria are met. June 30 Discounted the Lennox, Incorporated, note at the bank. The bank's discount rate is 10%. The note was discounted without recourse. September 30 Lennox, Incorporated, paid the note amount plus interest to the bank. Required: 1. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. 2. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end. 3. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Gadubhai

Transcribed Image Text:Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31.

During 2024, the following transactions related to receivables occurred:

February 28 Sold merchandise to Lennox, Incorporated, for $24,000 and accepted a 8%, 7-month note. 8% is

an appropriate rate for this type of note.

March 31 Sold merchandise to Maddox Company that had a fair value of $16,560, and accepted a

noninterest-bearing note for which $18,000 payment is due on March 31, 2025.

April 3 Sold merchandise to Carr Company for $12,000 with terms 2/10, 1/30. Evergreen uses the gross

method to account for cash discounts.

April 11 Collected the entire amount due from Carr Company

April 17 A customer returned merchandise costing $4,100. Evergreen reduced the customer's receivable

balance by $5,900, the sales price of the merchandise. Sales returns are recorded by the

company as they occur.

April 30 Transferred receivables of $59,000 to a factor without recourse. The factor charged Evergreen

a 1% finance charge on the receivables transferred. The sale criteria are met.

June 30 Discounted the Lennox, Incorporated, note at the bank. The bank's discount rate is 10%. The

note was discounted without recourse.

September 30 Lennox, Incorporated, paid the note amount plus interest to the bank.

Required:

1. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale

of merchandise, ignore the entry for the cost of goods sold.

2. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end.

3. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT