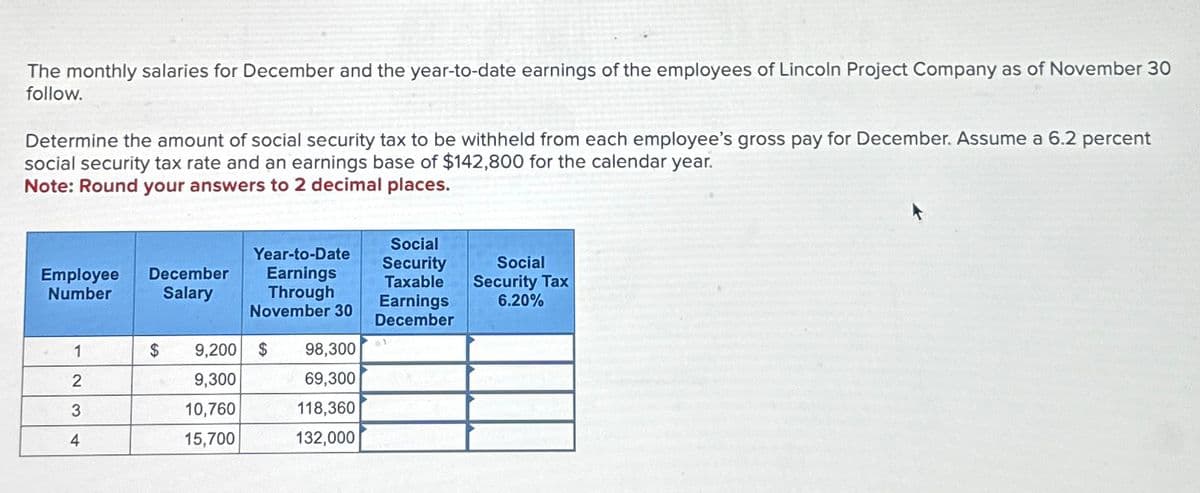

The monthly salaries for December and the year-to-date earnings of the employees of Lincoln Project Company as of November 30 follow. Determine the amount of social security tax to be withheld from each employee's gross pay for December. Assume a 6.2 percent social security tax rate and an earnings base of $142,800 for the calendar year. Note: Round your answers to 2 decimal places. Social Employee Number December Salary Year-to-Date Earnings Security Taxable Social Security Tax Through Earnings 6.20% November 30 December 1 $ 9,200 $ 98,300 2 9,300 69,300 3 10,760 118,360 4 15,700 132,000

The monthly salaries for December and the year-to-date earnings of the employees of Lincoln Project Company as of November 30 follow. Determine the amount of social security tax to be withheld from each employee's gross pay for December. Assume a 6.2 percent social security tax rate and an earnings base of $142,800 for the calendar year. Note: Round your answers to 2 decimal places. Social Employee Number December Salary Year-to-Date Earnings Security Taxable Social Security Tax Through Earnings 6.20% November 30 December 1 $ 9,200 $ 98,300 2 9,300 69,300 3 10,760 118,360 4 15,700 132,000

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:The monthly salaries for December and the year-to-date earnings of the employees of Lincoln Project Company as of November 30

follow.

Determine the amount of social security tax to be withheld from each employee's gross pay for December. Assume a 6.2 percent

social security tax rate and an earnings base of $142,800 for the calendar year.

Note: Round your answers to 2 decimal places.

Social

Employee

Number

December

Salary

Year-to-Date

Earnings

Security

Taxable

Social

Security Tax

Through

Earnings

6.20%

November 30

December

1

$

9,200 $ 98,300

2

9,300

69,300

3

10,760

118,360

4

15,700

132,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,