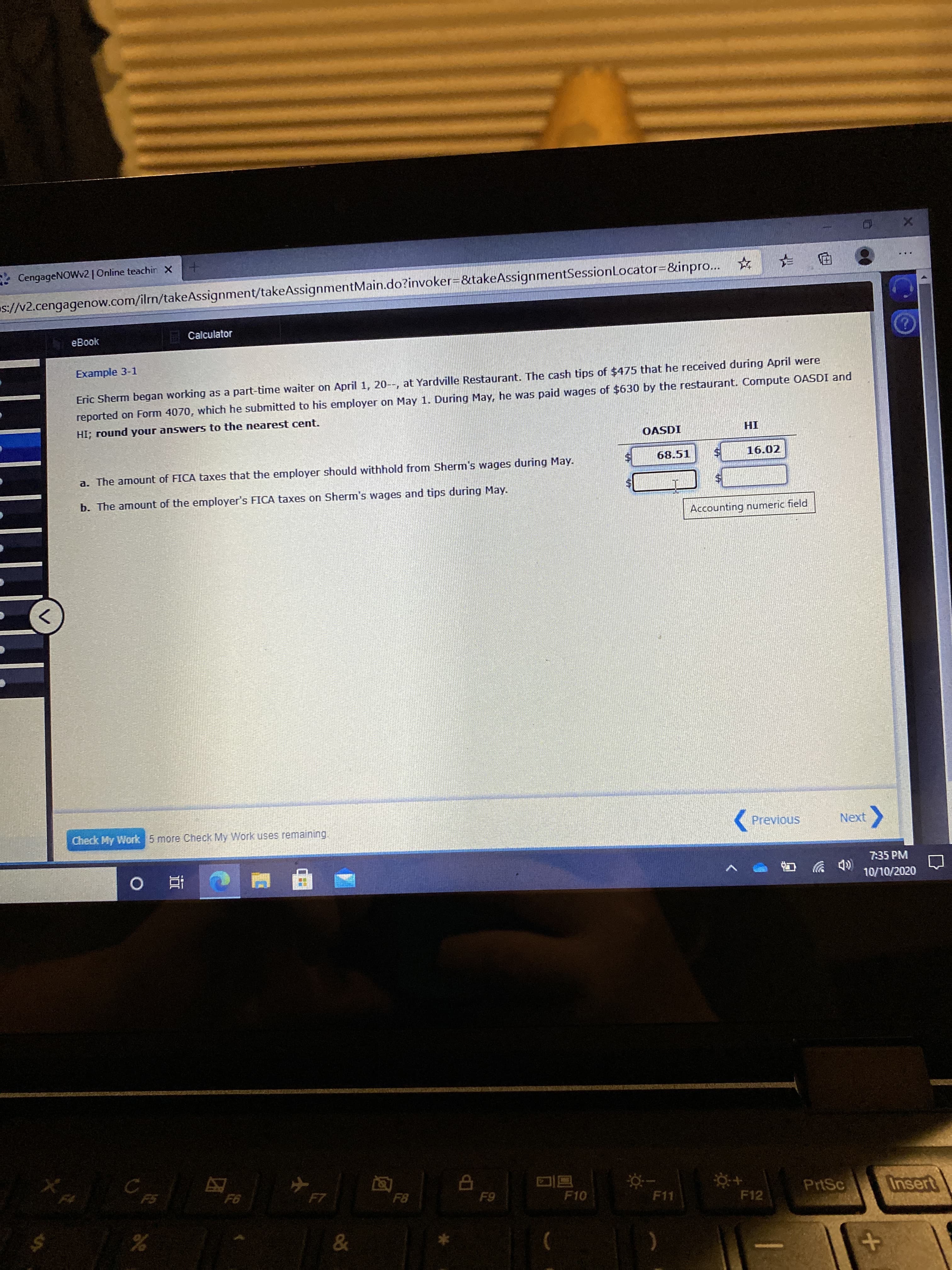

еВook Example 3-1 Eric Sherm began working as a part-time waiter on April 1, 20--, at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form 4070, which he submitted to his employer on May 1. During May, he was paid wages of $630 by the restaurant. Compute OASDI and HI; round your answers to the nearest cent. OASDI HI a. The amount of FICA taxes that the employer should withhold from Sherm's wages during May. 68.51 16.02 b. The amount of the employer's FICA taxes on Sherm's wages and tips during May. Accounting numeric field

еВook Example 3-1 Eric Sherm began working as a part-time waiter on April 1, 20--, at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form 4070, which he submitted to his employer on May 1. During May, he was paid wages of $630 by the restaurant. Compute OASDI and HI; round your answers to the nearest cent. OASDI HI a. The amount of FICA taxes that the employer should withhold from Sherm's wages during May. 68.51 16.02 b. The amount of the employer's FICA taxes on Sherm's wages and tips during May. Accounting numeric field

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 40E: Exercise 3-40 Revenue and Expense Recognition Electronic Repair Company repaired a high-definition...

Related questions

Question

erci sherm began working as a oart yime waiter om aoril 1 at yeardville resturant yhr vash tipa of 475 that be recived durung april wer reports of firm 4069 which he submitted to his employer on may 1 during mqy be paid wages of 639 bt the restaurant compute oasdi and hi

Transcribed Image Text:еВook

Example 3-1

Eric Sherm began working as a part-time waiter on April 1, 20--, at Yardville Restaurant. The cash tips of $475 that he received during April were

reported on Form 4070, which he submitted to his employer on May 1. During May, he was paid wages of $630 by the restaurant. Compute OASDI and

HI; round your answers to the nearest cent.

OASDI

HI

a. The amount of FICA taxes that the employer should withhold from Sherm's wages during May.

68.51

16.02

b. The amount of the employer's FICA taxes on Sherm's wages and tips during May.

Accounting numeric field

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning