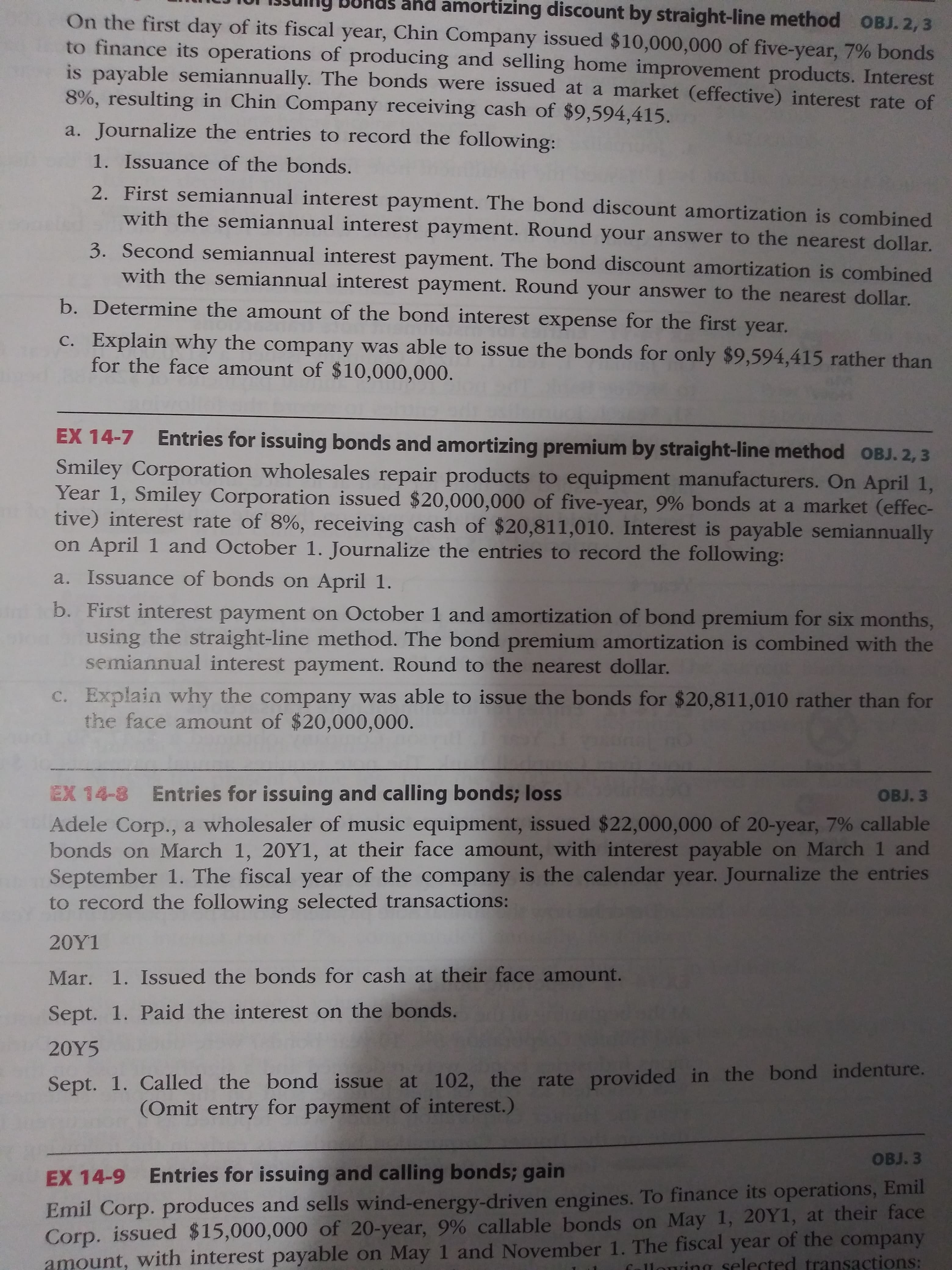

EX 14-7 Entries for issuing bonds and amortizing premium by straight-line method OBJ. 2, 3 Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Smiley Corporation issued $20,000,000 of five-year, 9% bonds at a market (effec- tive) interest rate of 8%, receiving cash of $20,811,010. Interest is payable semiannually on April 1 and October 1. Journalize the entries to record the following: a. Issuance of bonds on April 1. b. First interest payment on October 1 and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. Round to the nearest dollar. C. Explain why the company was able to issue the bonds for $20,811,010 rather than for the face amount of $20,000,000.

EX 14-7 Entries for issuing bonds and amortizing premium by straight-line method OBJ. 2, 3 Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Smiley Corporation issued $20,000,000 of five-year, 9% bonds at a market (effec- tive) interest rate of 8%, receiving cash of $20,811,010. Interest is payable semiannually on April 1 and October 1. Journalize the entries to record the following: a. Issuance of bonds on April 1. b. First interest payment on October 1 and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. Round to the nearest dollar. C. Explain why the company was able to issue the bonds for $20,811,010 rather than for the face amount of $20,000,000.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter11: Liabilities: Bonds Payable

Section: Chapter Questions

Problem 11.4EX

Related questions

Question

EX. 14-7

EX. 14-16

Transcribed Image Text:EX 14-7 Entries for issuing bonds and amortizing premium by straight-line method OBJ. 2, 3

Smiley Corporation wholesales repair products to equipment manufacturers. On April 1,

Year 1, Smiley Corporation issued $20,000,000 of five-year, 9% bonds at a market (effec-

tive) interest rate of 8%, receiving cash of $20,811,010. Interest is payable semiannually

on April 1 and October 1. Journalize the entries to record the following:

a. Issuance of bonds on April 1.

b. First interest payment on October 1 and amortization of bond premium for six months,

using the straight-line method. The bond premium amortization is combined with the

semiannual interest payment. Round to the nearest dollar.

C. Explain why the company was able to issue the bonds for $20,811,010 rather than for

the face amount of $20,000,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning