Ex 7- Long-Term Note Payable a) What if the Einstein Corporation decided to raise capital (Cash) by issuing a Note instead of selling Stocks or Bonds. Journalize the entries for the following 1) Issued the $500,000 3 year 8% Note to the First National Bank on January 1, 202X Account Name Debit Credit 2) Entry made on each December 31 to accrue interest expense for that year. Account Name Debit Credit 3) Entry made to pay off the Note at the end of the 3 years, after the entry for the accrual of interest for the thi vear has been made Account Name Debit Credit :8-Installment

Ex 7- Long-Term Note Payable a) What if the Einstein Corporation decided to raise capital (Cash) by issuing a Note instead of selling Stocks or Bonds. Journalize the entries for the following 1) Issued the $500,000 3 year 8% Note to the First National Bank on January 1, 202X Account Name Debit Credit 2) Entry made on each December 31 to accrue interest expense for that year. Account Name Debit Credit 3) Entry made to pay off the Note at the end of the 3 years, after the entry for the accrual of interest for the thi vear has been made Account Name Debit Credit :8-Installment

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.6P

Related questions

Question

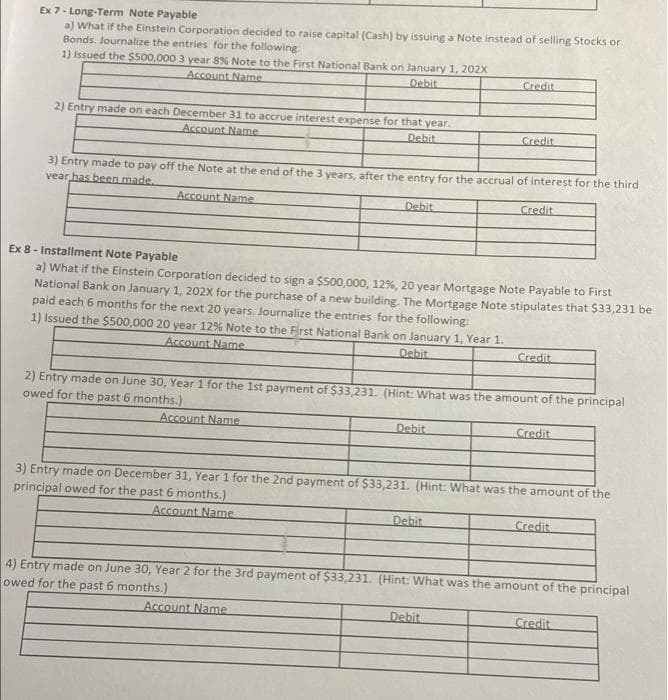

Transcribed Image Text:Ex 7- Long-Term Note Payable

a) What if the Einstein Corporation decided to raise capital (Cash) by issuing a Note instead of selling Stocks or

Bonds. Journalize the entries for the following:

1) Issued the $500,000 3 year 8% Note to the First National Bank on January 1, 202X

Account Name

Debit

Credit

2) Entry made on each December 31 to accrue interest expense for that year.

Account Name

Debit

Credit

3) Entry made to pay off the Note at the end of the 3 years, after the entry for the accrual of interest for the third

vear has been made

Account Name

Debit

Credit

Ex 8 - Installment Note Payable

a) What if the Einstein Corporation decided to sign a $500,000, 12%, 20 year Mortgage Note Payable to First

National Bank on January 1, 202X for the purchase of a new building. The Mortgage Note stipulates that $33,231 be

paid each 6 months for the next 20 years. Journalize the entries for the following:

1) Issued the $500,000 20 year 12% Note to the First National Bank on January 1, Year 1.

Account Name

Debit

Credit

2) Entry made on June 30, Year 1 for the 1st payment of $33,231. (Hint: What was the amount of the principal

owed for the past 6 months.)

Account Name

Debit

Credit

3) Entry made on December 31, Year 1 for the 2nd payment of $33,231. (Hint: What was the amount of the

principal owed for the past 6 months.)

Account Name

Debit

Credit

4) Entry made on June 30, Year 2 for the 3rd payment of $33,231. (Hint: What was the amount of the principal

owed for the past 6 months.)

Account Name

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning