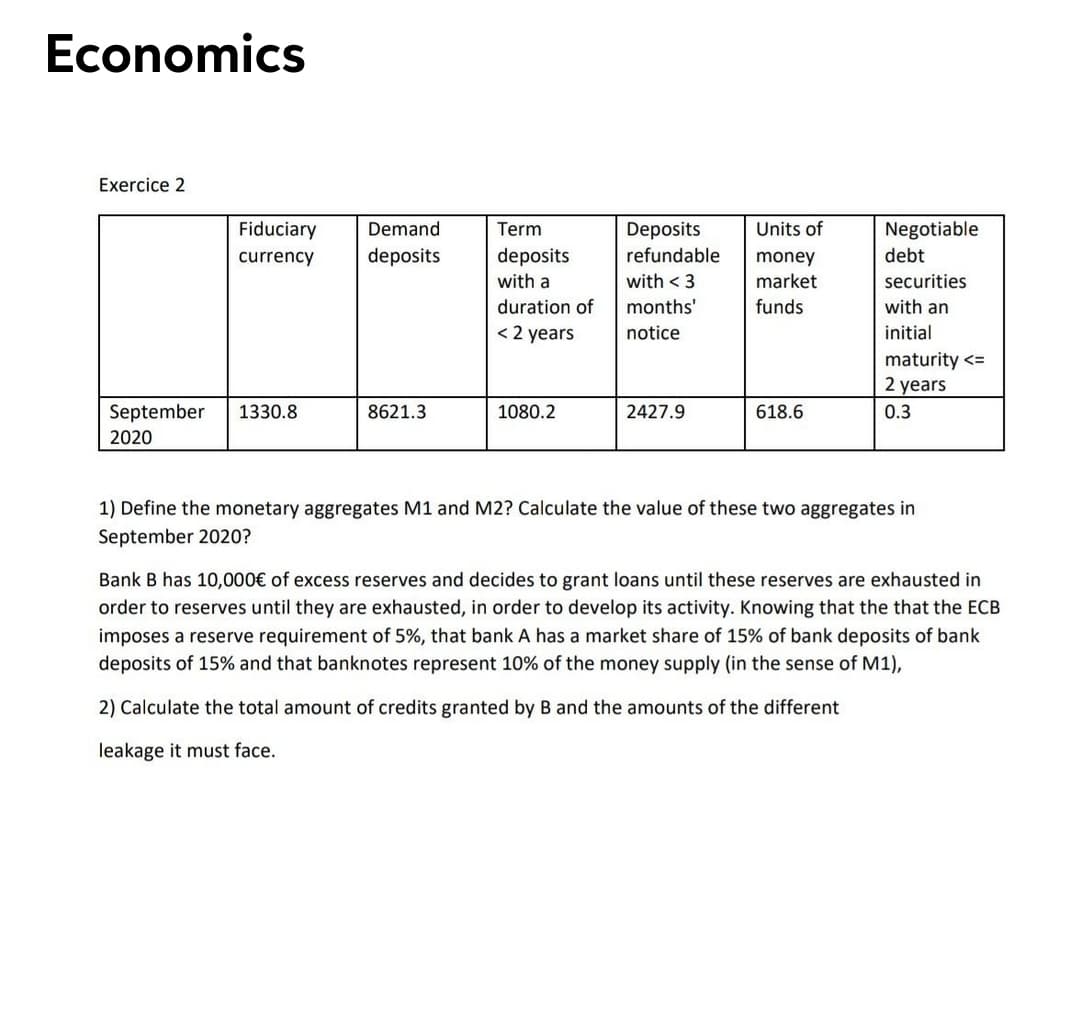

Exercice 2 Fiduciary Demand Units of Deposits refundable Term Negotiable deposits deposits with a currency debt money market with < 3 securities duration of months' funds with an < 2 years notice initial maturity <= 2 years September 1330.8 8621.3 1080.2 2427.9 618.6 0.3 2020 1) Define the monetary aggregates M1 and M2? Calculate the value of these two aggregates in September 2020?

Exercice 2 Fiduciary Demand Units of Deposits refundable Term Negotiable deposits deposits with a currency debt money market with < 3 securities duration of months' funds with an < 2 years notice initial maturity <= 2 years September 1330.8 8621.3 1080.2 2427.9 618.6 0.3 2020 1) Define the monetary aggregates M1 and M2? Calculate the value of these two aggregates in September 2020?

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.7P

Related questions

Question

Transcribed Image Text:Economics

Exercice 2

Fiduciary

Demand

Term

Units of

Negotiable

Deposits

refundable

currency

deposits

deposits

money

debt

with a

with < 3

market

securities

duration of

months'

funds

with an

< 2 years

notice

initial

maturity <=

2 years

September

1330.8

8621.3

1080.2

2427.9

618.6

0.3

2020

1) Define the monetary aggregates M1 and M2? Calculate the value of these two aggregates in

September 2020?

Bank B has 10,000€ of excess reserves and decides to grant loans until these reserves are exhausted in

order to reserves until they are exhausted, in order to develop its activity. Knowing that the that the ECB

imposes a reserve requirement of 5%, that bank A has a market share of 15% of bank deposits of bank

deposits of 15% and that banknotes represent 10% of the money supply (in the sense of M1),

2) Calculate the total amount of credits granted by B and the amounts of the different

leakage it must face.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you