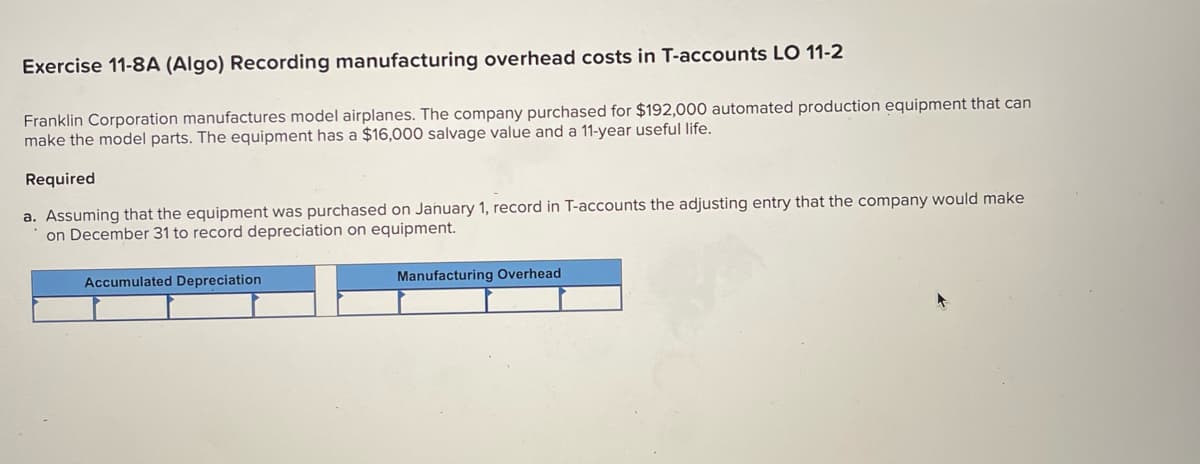

Exercise 11-8A (Algo) Recording manufacturing overhead costs in T-accounts LO 11-2 Franklin Corporation manufactures model airplanes. The company purchased for $192,000 automated production equipment that can make the model parts. The equipment has a $16,000 salvage value and a 11-year useful life. Required a. Assuming that the equipment was purchased on January 1, record in T-accounts the adjusting entry that the company would make on December 31 to record depreciation on equipment. Accumulated Depreciation Manufacturing Overhead

Exercise 11-8A (Algo) Recording manufacturing overhead costs in T-accounts LO 11-2 Franklin Corporation manufactures model airplanes. The company purchased for $192,000 automated production equipment that can make the model parts. The equipment has a $16,000 salvage value and a 11-year useful life. Required a. Assuming that the equipment was purchased on January 1, record in T-accounts the adjusting entry that the company would make on December 31 to record depreciation on equipment. Accumulated Depreciation Manufacturing Overhead

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 63P: (Appendix 4A) Journal Entries, T-Accounts Lowder Inc. builds custom conveyor systems for warehouses...

Related questions

Question

100%

All information included

Transcribed Image Text:Exercise 11-8A (Algo) Recording manufacturing overhead costs in T-accounts LO 11-2

Franklin Corporation manufactures model airplanes. The company purchased for $192,000 automated production equipment that can

make the model parts. The equipment has a $16,000 salvage value and a 11-year useful life.

Required

a. Assuming that the equipment was purchased on January 1, record in T-accounts the adjusting entry that the company would make

on December 31 to record depreciation on equipment.

Accumulated Depreciation

Manufacturing Overhead

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning