Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.5CP

Communication

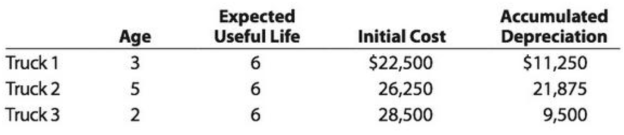

Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow:

• At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of $4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered.

• At the beginning of the year, the engine of Truck 2 is overhauled at a cost of $5,000. The engine overhaul will extend the truck’s useful life by three years.

Write a short memo to Godwin’s chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts.

Machine A Machine B Machine C

Cost of the asset $10,600 $39,800 $23,600

Installation costs 850 3,700 2,800

Renovation costs prior to use 650 3,300 3,800

Repairs after production began 500 700 2,300

By the end of the first year, each machine had been operating 8,000 hours.

Required:

Compute the cost of each machine.

Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following:

Estimates…

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts.

Machine A

Machine B

Machine C

Cost of the asset

$

10,800

$

40,000

$

23,800

Installation costs

950

3,900

3,000

Renovation costs prior to use

750

3,500

4,000

Repairs after production began

700

900

2,500

By the end of the first year, each machine had been operating 8,000 hours.

Required:

Compute the cost of each machine.

Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following:

Estimates

Machine

Life

Residual Value

Depreciation Method

A

5

years

$

2,800

Straight-line

B

20,000

hours

2,400

Units-of-production

C

10

years

1,600

Double-declining-balance

A consumer electronics company was formed to sell a portable handset system. The company purchased a warehouse and converted it into a manufacturing plant for $2,000,000 (including the purchase price of the warehouse). It completed the installation of assembly equipment worth $1,500,000 on December 3l. The plant began operation on January 1. The company had a gross income of $2,500,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $1,280,000. The depreciation expenses for capital expenditures amounted to $128,000.(a) Compute the taxable income of this company.(b) How much will the company pay in federal income taxes for the year?

Chapter 10 Solutions

Accounting

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - a. Under what conditions is the use of the...Ch. 10 - Prob. 7DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - For some of the fixed assets of a business, the...Ch. 10 - a. Over what period of time should the cost of a...

Ch. 10 - Straight-line depreciation A building acquired at...Ch. 10 - Straight-line depreciation Equipment acquired at...Ch. 10 - Units-of-activity depreciation A truck acquired at...Ch. 10 - Units-of-activity depreciation A tractor acquired...Ch. 10 - Double declining-balance depreciation A building...Ch. 10 - Double-declining-balance depreciation Equipment...Ch. 10 - Revision of depreciation Equipment with a cost of...Ch. 10 - Revision of depreciation A truck with a cost of...Ch. 10 - Capital and revenue expenditures On February 14,...Ch. 10 - Capital and revenue expenditures On August 7,...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Prob. 10.7APECh. 10 - Prob. 10.7BPECh. 10 - Prob. 10.8APECh. 10 - Prob. 10.8BPECh. 10 - Fixed asset turnover ratio Financial statement...Ch. 10 - Fixed asset turnover ratio Financial statement...Ch. 10 - Costs of acquiring fixed assets Melinda Stoffers...Ch. 10 - Prob. 10.2EXCh. 10 - Prob. 10.3EXCh. 10 - Nature of depreciation Tri-City Ironworks Co....Ch. 10 - Straight-line depreciation rates Convert each of...Ch. 10 - Straight-line depreciation A refrigerator used by...Ch. 10 - Depreciation by units-of-activity method A...Ch. 10 - Depreciation by units-of-activity method Prior to...Ch. 10 - Depreciation by two methods A Kubota tractor...Ch. 10 - Depreciation by two methods A storage tank...Ch. 10 - Partial-year depreciation Equipment acquired at a...Ch. 10 - Revision of depreciation A building with a cost of...Ch. 10 - Capital and revenue expenditures US Freight Lines...Ch. 10 - Prob. 10.14EXCh. 10 - Capital and revenue expenditures Quality Move...Ch. 10 - Capital expenditure and depreciation; parital-year...Ch. 10 - Entries for sale of fixed asset Equipment acquired...Ch. 10 - Disposal of fixed asset Equipment acquired on...Ch. 10 - Prob. 10.19EXCh. 10 - Amortization entries Kleen Company acquired patent...Ch. 10 - Book value of fixed assets Apple Inc. designs,...Ch. 10 - Balance sheet presentation List the errors you...Ch. 10 - Fixed asset turnover ratio Amazon.com, Inc. is the...Ch. 10 - Fixed asset turnover ratio Verizon Communications...Ch. 10 - Fixed asset turnover ratio FedEx Corporation and...Ch. 10 - Fixed asset turnover ratio The following table...Ch. 10 - Asset traded for similar asset A printing press...Ch. 10 - Prob. 10.28EXCh. 10 - Entries for trade of fixed asset On July 1, Twin...Ch. 10 - Entries for trade of fixed asset On October 1,...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Dexter...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Waylander...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Ethics in Action Hard Bodies Co. is a fitness...Ch. 10 - Prob. 10.2CPCh. 10 - Communication Godwin Co. owns three delivery...Ch. 10 - Prob. 10.6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Communication Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow: At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of 4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered. At the beginning of the year, the engine of Truck 2 is overhauled at a cost of 5,000. The engine overhaul will extend the trucks useful life by three years. Write a short memo to Godwins chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.arrow_forwardSand River Sales has a fork truck used in its warehouse operations. The truck had an original useful life of five years. However, after depreciating the asset for three years, the company makes a major repair that extends the life by four years. What is the remaining useful life after the major repair?arrow_forwardBaglias Wholesale Trinkets has a 3-D printer used in operations. The original useful life was estimated to be six years. However, after two years of use, the printer was overhauled, and its total useful life was extended to eight years. How many years of depreciation remain after the overhaul in year 2?arrow_forward

- Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?arrow_forwardJada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?arrow_forwardDuring the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated five machines for $100,000 to improve efficiency in production of their remaining useful life of five years Low-cost repairs throughout the year totaled $70,000 Replaced a broken gear on a machine for $10,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?arrow_forward

- Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardRicks Towing Company owns three tow trucks. During the current year, Rick performed maintenance on the trucks and realized he had to make improvements to the engines on two of his trucks. The improvements totaled 55,000. Prepare the journal entries Rick may make under two alternative methods for the improvements made to his trucks.arrow_forwardSt. Johns Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMCs Cath Lab. Each technician is paid a salary of 36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for 250,000. It is expected to last five years. The equipments capacity is 25,000 procedures over its life. Depreciation is computed on a straight-line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is 120 per test. The technicians report with the outside physicians note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends 50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMCs business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging 850 for the procedureenough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services). At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be 550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporaryfor one year only. The HMO expects to have its own testing capabilities within one year. Required: 1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources. 2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning. 3. Assume that SJMC will accept the HMO offer if it reduces the hospitals operating costs. Should the HMO offer be accepted? 4. Jerold Bosserman, SJMCs hospital controller, argued against accepting the HMOs offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesnt even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for 550. Discuss the merits of Jerolds position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation. 5. Chandra Denton, SJMCs administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC wont need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of 2,000 per year. How does this outcome affect the analysis of the HMO offer? 6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activitys first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?arrow_forward

- Johnson, Incorporated, had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for extraordinary repairs Depreciation expense recorded for the year is $15,000. If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Johnsons balance sheet resulting from this years transactions? What amount did Johnson report on the income statement for expenses for the year?arrow_forwardMontello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forwardMontezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License