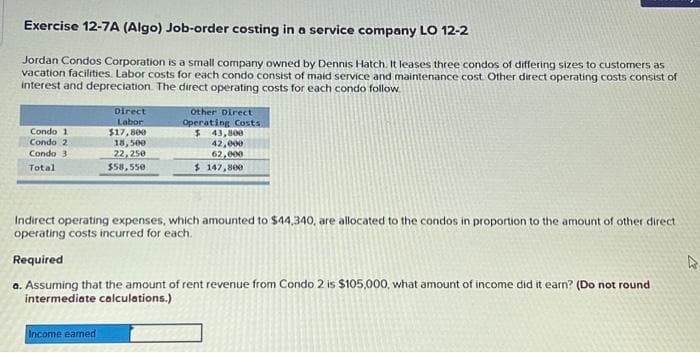

Exercise 12-7A (Algo) Job-order costing in a service company LO 12-2 Jordan Condos Corporation is a small company owned by Dennis Hatch. It leases three condos of differing sizes to customers as vacation facilities. Labor costs for each condo consist of maid service and maintenance cost. Other direct operating costs consist of interest and depreciation. The direct operating costs for each condo follow Condo 1 Condo 2 Condo 3 Total Direct Labor $17,800 18,500 22,250 $58,550 Income eamed Other Direct Operating Costs. $ 43,800 42,000 62,000 $147,800 Indirect operating expenses, which amounted to $44,340, are allocated to the condos in proportion to the amount of other direct operating costs incurred for each. Required a. Assuming that the amount of rent revenue from Condo 2 is $105,000, what amount of income did it earn? (Do not round. intermediate calculations.) A

Exercise 12-7A (Algo) Job-order costing in a service company LO 12-2 Jordan Condos Corporation is a small company owned by Dennis Hatch. It leases three condos of differing sizes to customers as vacation facilities. Labor costs for each condo consist of maid service and maintenance cost. Other direct operating costs consist of interest and depreciation. The direct operating costs for each condo follow Condo 1 Condo 2 Condo 3 Total Direct Labor $17,800 18,500 22,250 $58,550 Income eamed Other Direct Operating Costs. $ 43,800 42,000 62,000 $147,800 Indirect operating expenses, which amounted to $44,340, are allocated to the condos in proportion to the amount of other direct operating costs incurred for each. Required a. Assuming that the amount of rent revenue from Condo 2 is $105,000, what amount of income did it earn? (Do not round. intermediate calculations.) A

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter10: Accounting Systems For Manufacturing Operations

Section: Chapter Questions

Problem 10.4.3C: Factory overhead rate Fabricator Inc., a specialized equipment manufacturer, uses a job order cost...

Related questions

Question

Do not give image format

Transcribed Image Text:Exercise 12-7A (Algo) Job-order costing in a service company LO 12-2

Jordan Condos Corporation is a small company owned by Dennis Hatch. It leases three condos of differing sizes to customers as

vacation facilities. Labor costs for each condo consist of maid service and maintenance cost. Other direct operating costs consist of

interest and depreciation. The direct operating costs for each condo follow

Condo 1

Condo 2

Condo 3

Total

Direct

Labor

$17,800

18,500

22,250

$58,550

Other Direct

Operating Costs.

$ 43,800

42,000

62,000

$147,800

Indirect operating expenses, which amounted to $44,340, are allocated to the condos in proportion to the amount of other direct

operating costs incurred for each.

Required

Income earned

a. Assuming that the amount of rent revenue from Condo 2 is $105,000, what amount of income did it earn? (Do not round

intermediate calculations.)

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning