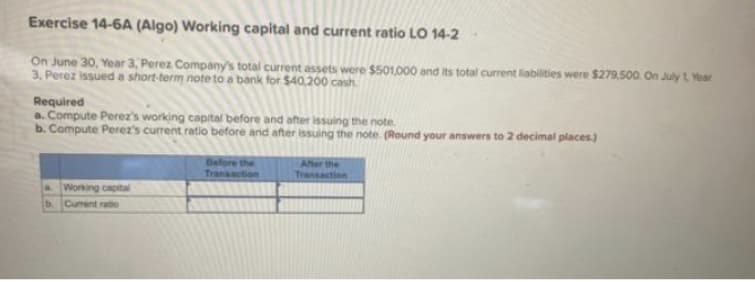

Exercise 14-6A (Algo) Working capital and current ratio LO 14-2 On June 30, Year 3, Perez Company's total current assets were $501,000 and its total current liabilities were $279,500. On July 1 Year 3. Perez issued a short-term note to a bank for $40,200 cash. Required a. Compute Perez's working capital before and after issuing the note. b. Compute Perez's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) Working capital b. Current ratio Before the Transaction After the Transaction

Exercise 14-6A (Algo) Working capital and current ratio LO 14-2 On June 30, Year 3, Perez Company's total current assets were $501,000 and its total current liabilities were $279,500. On July 1 Year 3. Perez issued a short-term note to a bank for $40,200 cash. Required a. Compute Perez's working capital before and after issuing the note. b. Compute Perez's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) Working capital b. Current ratio Before the Transaction After the Transaction

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6EX: a. (1) Current year working capital. 1,090,000 Current position analysis The following data were...

Related questions

Question

Transcribed Image Text:Exercise 14-6A (Algo) Working capital and current ratio LO 14-2

On June 30, Year 3, Perez Company's total current assets were $501,000 and its total current liabilities were $279,500. On July 1 Year

3. Perez issued a short-term note to a bank for $40,200 cash

Required

a. Compute Perez's working capital before and after issuing the note.

b. Compute Perez's current ratio before and after issuing the note. (Round your answers to 2 decimal places.)

Working capital

b. Current ratio

Before the

Transaction

After the

Transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,