Exercise 19-29 (Algorithmic) (LO. 7) What are the tax consequences to Euclid from the following independent events? In your computations, do not round intermediate division. If required, round the per share answer to two decimal places. Round all other answers to the nearest dollar. a. Euclid bought 500 shares of common stock five years ago for $120,000. This year, Euclid receives 20 shares of common stock as a nontaxable stock dividend. As a result of the stock dividend, Euclid's per share basis is $ b. Assume instead that Euclid received a nontaxable preferred stock dividend of 20 shares. The preferred stock has a fair market value of $12,000, and the common stock, on which the preferred is distributed, has a fair market value of $180,000. After the receipt of the stock dividend, the basis of the preferred stock is $ , and the basis of the common stock is

Exercise 19-29 (Algorithmic) (LO. 7) What are the tax consequences to Euclid from the following independent events? In your computations, do not round intermediate division. If required, round the per share answer to two decimal places. Round all other answers to the nearest dollar. a. Euclid bought 500 shares of common stock five years ago for $120,000. This year, Euclid receives 20 shares of common stock as a nontaxable stock dividend. As a result of the stock dividend, Euclid's per share basis is $ b. Assume instead that Euclid received a nontaxable preferred stock dividend of 20 shares. The preferred stock has a fair market value of $12,000, and the common stock, on which the preferred is distributed, has a fair market value of $180,000. After the receipt of the stock dividend, the basis of the preferred stock is $ , and the basis of the common stock is

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 43P

Related questions

Question

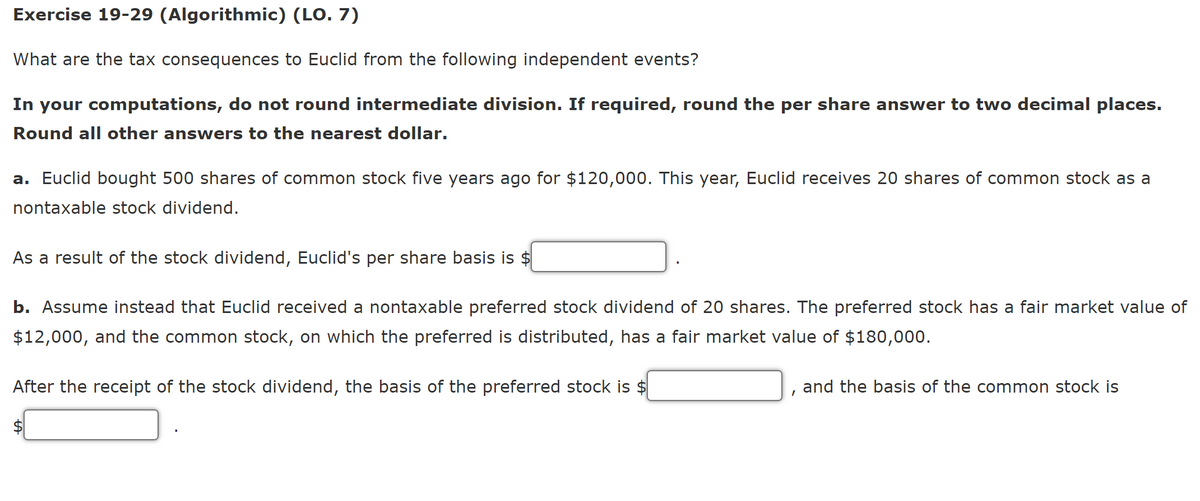

Transcribed Image Text:Exercise 19-29 (Algorithmic) (LO. 7)

What are the tax consequences to Euclid from the following independent events?

In your computations, do not round intermediate division. If required, round the per share answer to two decimal places.

Round all other answers to the nearest dollar.

a. Euclid bought 500 shares of common stock five years ago for $120,000. This year, Euclid receives 20 shares of common stock as a

nontaxable stock dividend.

As a result of the stock dividend, Euclid's per share basis is $

b. Assume instead that Euclid received a nontaxable preferred stock dividend of 20 shares. The preferred stock has a fair market value of

$12,000, and the common stock, on which the preferred is distributed, has a fair market value of $180,000.

After the receipt of the stock dividend, the basis of the preferred stock is $

and the basis of the common stock is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT