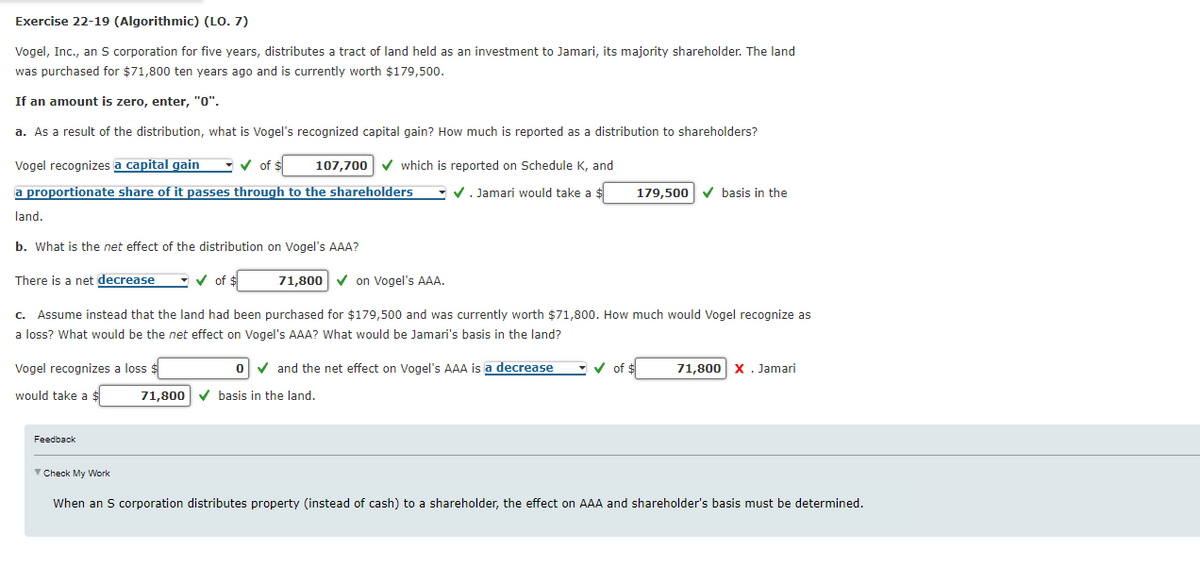

Exercise 22-19 (Algorithmic) (LO. 7) Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $71,800 ten years ago and is currently worth $179,500. If an amount is zero, enter, "0". a. As a result of the distribution, what is Vogel's recognized capital gain? How much is reported as a distribution to shareholders? Vogel recognizes a capital gain of $ a proportionate share of it passes through to the shareholders land. b. What is the net effect of the distribution on Vogel's AAA? There is a net decrease ✓of $ Vogel recognizes a loss $ would take a $ 107,700 ✓ which is reported on Schedule K, and ✓. Jamari would take a $ 71,800✔ on Vogel's AAA. c. Assume instead that the land had been purchased for $179,500 and was currently worth $71,800. How much would Vogel recognize as a loss? What would be the net effect on Vogel's AAA? What would be Jamari's basis in the land? Feedback 0✔and the net effect on Vogel's AAA is a decrease 71,800✔ basis in the land. 179,500✔ basis in the of $ 71,800 X. Jamari

Exercise 22-19 (Algorithmic) (LO. 7) Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $71,800 ten years ago and is currently worth $179,500. If an amount is zero, enter, "0". a. As a result of the distribution, what is Vogel's recognized capital gain? How much is reported as a distribution to shareholders? Vogel recognizes a capital gain of $ a proportionate share of it passes through to the shareholders land. b. What is the net effect of the distribution on Vogel's AAA? There is a net decrease ✓of $ Vogel recognizes a loss $ would take a $ 107,700 ✓ which is reported on Schedule K, and ✓. Jamari would take a $ 71,800✔ on Vogel's AAA. c. Assume instead that the land had been purchased for $179,500 and was currently worth $71,800. How much would Vogel recognize as a loss? What would be the net effect on Vogel's AAA? What would be Jamari's basis in the land? Feedback 0✔and the net effect on Vogel's AAA is a decrease 71,800✔ basis in the land. 179,500✔ basis in the of $ 71,800 X. Jamari

Chapter11: Investor Losses

Section: Chapter Questions

Problem 64P

Related questions

Question

Why is this not 71,800? What's the real answer?

Transcribed Image Text:Exercise 22-19 (Algorithmic) (LO. 7)

Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land

was purchased for $71,800 ten years ago and is currently worth $179,500.

If an amount is zero, enter, "0".

a. As a result of the distribution, what is Vogel's recognized capital gain? How much is reported as a distribution to shareholders?

Vogel recognizes a capital gain ✔ of $

a proportionate share of it passes through to the shareholders

land.

b. What is the net effect of the distribution on Vogel's AAA?

There is a net decrease

✔ of $

Vogel recognizes a loss $

would take a $

107,700 ✓ which is reported on Schedule K, and

✔. Jamari would take a $

Feedback

71,800✔ on Vogel's AAA.

c. Assume instead that the land had been purchased for $179,500 and was currently worth $71,800. How much would Vogel recognize as

a loss? What would be the net effect on Vogel's AAA? What would be Jamari's basis in the land?

o✓ and the net effect on Vogel's AAA is a decrease

71,800 ✓basis in the land.

179,500 ✓basis in the

✓of $

71,800 X . Jamari

✓ Check My Work

When an S corporation distributes property (instead of cash) to a shareholder, the effect on AAA and shareholder's basis must be determined.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT