Exercise 3 Sipho runs a bottle store. He prices everything so as to give him a gross profit % of 50% These figures are for his year ended 30 June 1995 All figures are in Rands For the purposes of this exercise, ignore VAT Cash received Rent paid Vehicle running expenses paid Purchases of stock for the year Wages paid Electricity paid insurance paid advertising paid nterest paid rawings 149,705 3,600 2.400 82,656 8,580 1.313 600 284 1,200 30,000

Exercise 3 Sipho runs a bottle store. He prices everything so as to give him a gross profit % of 50% These figures are for his year ended 30 June 1995 All figures are in Rands For the purposes of this exercise, ignore VAT Cash received Rent paid Vehicle running expenses paid Purchases of stock for the year Wages paid Electricity paid insurance paid advertising paid nterest paid rawings 149,705 3,600 2.400 82,656 8,580 1.313 600 284 1,200 30,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Question

Transcribed Image Text:Exercise 3

•

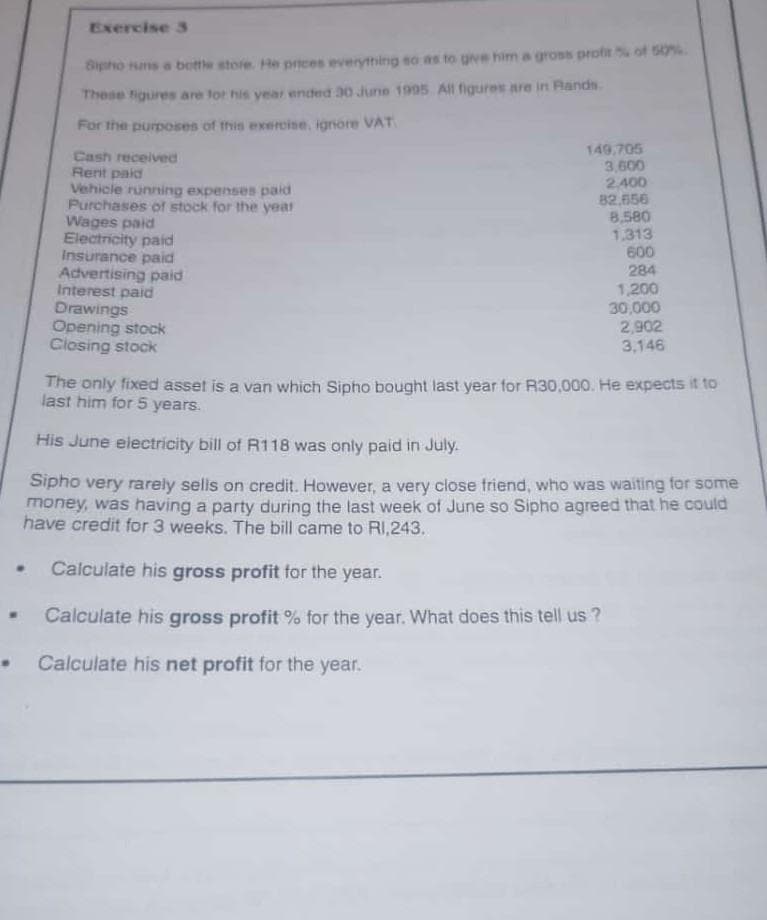

Sipho runs a bottle store. He prices everything so as to give him a gross profit % of 50%

These figures are for his year ended 30 June 1995 All figures are in Rands

For the purposes of this exercise, ignore VAT

Cash received

Rent paid

Vehicle running expenses paid

Purchases of stock for the year

Wages paid

Electricity paid

Insurance paid

Advertising paid

Interest paid

Drawings

Opening stock

Closing stock

149,705

3,600

2.400

82,656

8,580

1.313

600

284

1,200

30,000

2,902

3,146

The only fixed asset is a van which Sipho bought last year for R30,000. He expects it to

last him for 5 years.

His June electricity bill of R118 was only paid in July.

Sipho very rarely sells on credit. However, a very close friend, who was waiting for some

money, was having a party during the last week of June so Sipho agreed that he could

have credit for 3 weeks. The bill came to R1,243.

•

Calculate his gross profit for the year.

Calculate his gross profit % for the year. What does this tell us ?

Calculate his net profit for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT