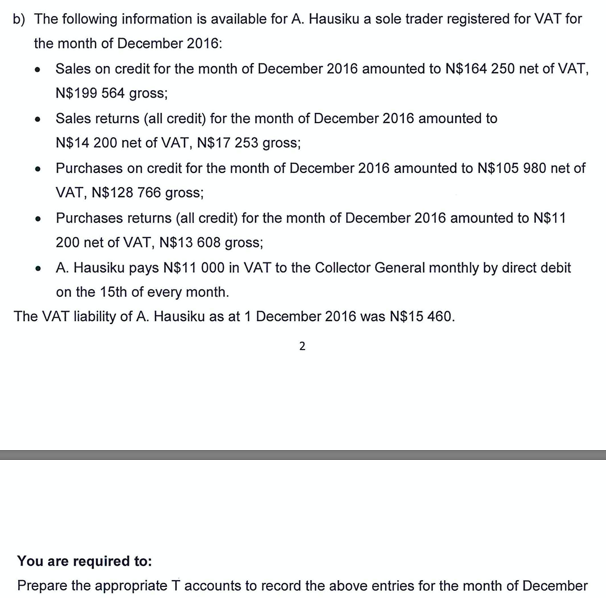

b) The following information is available for A. Hausiku a sole trader registered for VAT for the month of December 2016: • Sales on credit for the month of December 2016 amounted to N$164 250 net of VAT, N$199 564 gross; • Sales returns (all credit) for the month of December 2016 amounted to N$14 200 net of VAT, N$17 253 gross; • Purchases on credit for the month of December 2016 amounted to N$105 980 net of VAT, N$128 766 gross; • Purchases returns (all credit) for the month of December 2016 amounted to N$11 200 net of VAT, N$13 608 gross; • A. Hausiku pays N$11 000 in VAT to the Collector General monthly by direct debit on the 15th of every month. The VAT liability of A. Hausiku as at 1 December 2016 was N$15 460. 2 You are required to: Prepare the appropriate T accounts to record the above entries for the month of December

b) The following information is available for A. Hausiku a sole trader registered for VAT for the month of December 2016: • Sales on credit for the month of December 2016 amounted to N$164 250 net of VAT, N$199 564 gross; • Sales returns (all credit) for the month of December 2016 amounted to N$14 200 net of VAT, N$17 253 gross; • Purchases on credit for the month of December 2016 amounted to N$105 980 net of VAT, N$128 766 gross; • Purchases returns (all credit) for the month of December 2016 amounted to N$11 200 net of VAT, N$13 608 gross; • A. Hausiku pays N$11 000 in VAT to the Collector General monthly by direct debit on the 15th of every month. The VAT liability of A. Hausiku as at 1 December 2016 was N$15 460. 2 You are required to: Prepare the appropriate T accounts to record the above entries for the month of December

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 8PA: The following select financial statement information from Candid Photography. Compute the accounts...

Related questions

Question

Transcribed Image Text:b) The following information is available for A. Hausiku a sole trader registered for VAT for

the month of December 2016:

• Sales on credit for the month of December 2016 amounted to N$164 250 net of VAT,

N$199 564 gross;

• Sales returns (all credit) for the month of December 2016 amounted to

N$14 200 net of VAT, N$17 253 gross;

• Purchases on credit for the month of December 2016 amounted to N$105 980 net of

VAT, N$128 766 gross;

• Purchases returns (all credit) for the month of December 2016 amounted to N$11

200 net of VAT, N$13 608 gross;

• A. Hausiku pays N$11 000 in VAT to the Collector General monthly by direct debit

on the 15th of every month.

The VAT liability of A. Hausiku as at 1 December 2016 was N$15 460.

2

You are required to:

Prepare the appropriate T accounts to record the above entries for the month of December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College