Exercise 6-16 Alternative cost flow assumptions-periodic LO8 Paddington Gifts made purchases of a particular product in the current year as follows: Jan. 1 Beginning inventory Mar. 7 Purchased July 28 Purchased 3 Purchased 250 units e s6.10 = $ 1,525 510 units e $5.70 = 1,100 units 890 units e$4.50 2,907 5,610 es5.10 - Oct. 4,005 Totals 2,750 units $ 14,047 Required: 1. The business uses a periodic inventory system. Ending inventory consists of 130 units. Calculate the costs to be assigned to the ending inventory and to goods sold under: (Round intermediate calculations and final answers to 2 decimal places for "Weight average cost".)

Exercise 6-16 Alternative cost flow assumptions-periodic LO8 Paddington Gifts made purchases of a particular product in the current year as follows: Jan. 1 Beginning inventory Mar. 7 Purchased July 28 Purchased 3 Purchased 250 units e s6.10 = $ 1,525 510 units e $5.70 = 1,100 units 890 units e$4.50 2,907 5,610 es5.10 - Oct. 4,005 Totals 2,750 units $ 14,047 Required: 1. The business uses a periodic inventory system. Ending inventory consists of 130 units. Calculate the costs to be assigned to the ending inventory and to goods sold under: (Round intermediate calculations and final answers to 2 decimal places for "Weight average cost".)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.7EX: FIFO and UFO costs under perpetual inventory system The following units of an item were available...

Related questions

Question

100%

Please don't draw a table, its confusing. Can you please explain step by step how you got the values for the calculations for the FIFO and Wiegheted Moving Averages. Please I need explanation in detail.

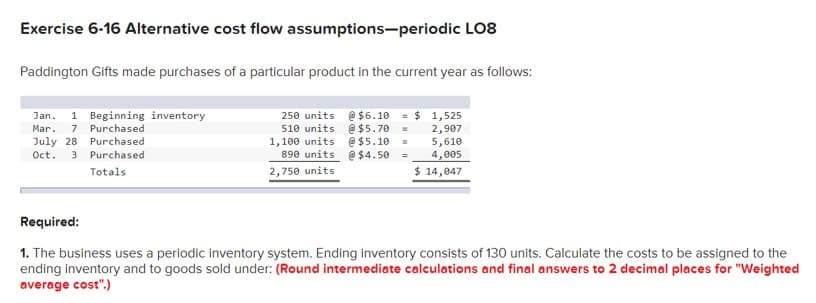

Transcribed Image Text:Exercise 6-16 Alternative cost flow assumptions-periodic LO8

Paddington Gifts made purchases of a particular product in the current year as follows:

1 Beginning inventory

250 units @ $6.10 = $ 1,525

510 units @ $5.70 =

1,100 units @$5.10

890 units e$4.50

Jan.

7 Purchased

Purchased

2,907

5,610

4,005

Mar.

July 28

Oct.

3 Purchased

Totals

2,750 units

$ 14,047

Required:

1. The business uses a periodic inventory system. Ending inventory consists of 130 units. Calculate the costs to be assigned to the

ending inventory and to goods sold under: (Round intermediate calculations and final answers to 2 decimal places for "Weighted

average cost".)

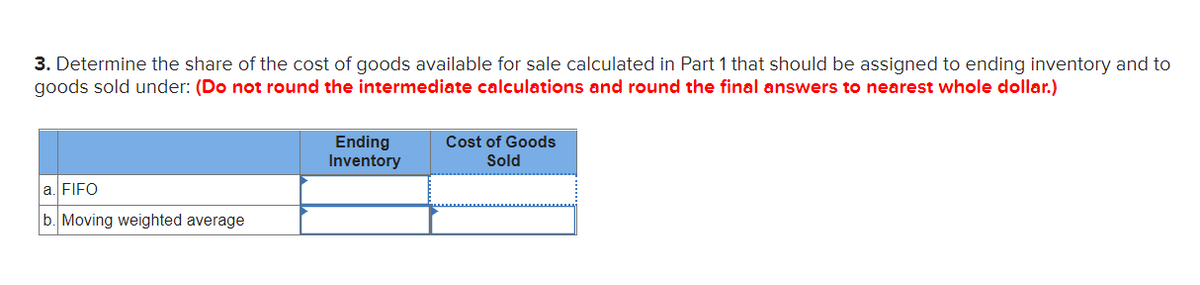

Transcribed Image Text:3. Determine the share of the cost of goods available for sale calculated in Part 1 that should be assigned to ending inventory and to

goods sold under: (Do not round the intermediate calculations and round the final answers to nearest whole dollar.)

Cost of Goods

Ending

Inventory

Sold

a. FIFO

b. Moving weighted average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning