Corporate Financial Accounting

15th Edition

ISBN: 9781337398169

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.5BPR

Multiple-step income statement and

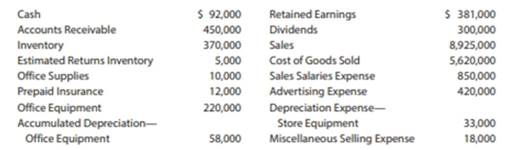

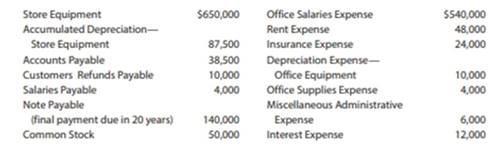

The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 20Y7:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of stockholders’ equity. Additional common stock of $7,500 was issued during the year ended June 30, 20Y7.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $7,000.

4.  Briefly explain how multiple and single-step income statements differ.

Briefly explain how multiple and single-step income statements differ.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 5 Solutions

Corporate Financial Accounting

Ch. 5 - Prob. 1DQCh. 5 - Prob. 2DQCh. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 5.3BECh. 5 - Prob. 5.4BECh. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Halm Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Purchase-related transactions Stylon Co., a...Ch. 5 - Prob. 5.8EXCh. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Customer return and refund On December 28, 20Y3,...Ch. 5 - Sales-related transactions After the amount due on...Ch. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 5.14EXCh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Prob. 5.16EXCh. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 5.18EXCh. 5 - Prob. 5.19EXCh. 5 - Normal balances of merchandise accounts What is...Ch. 5 - Income statement and accounts for merchandiser For...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for merchandiser The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a merchandiser From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 5.33EXCh. 5 - Prob. 5.34EXCh. 5 - Prob. 5.35EXCh. 5 - Discount taken in next fiscal year Using the data...Ch. 5 - Prob. 5.37EXCh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Appendix Cost of goods sold and related items The...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Appendix Sales-related and purchase-related...Ch. 5 - Prob. 5.9APRCh. 5 - Periodic inventory accounts, multiple-step income...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Prob. 5.7BPRCh. 5 - Prob. 5.8BPRCh. 5 - Prob. 5.9BPRCh. 5 - Periodic inventory accounts, multiple-step income...Ch. 5 - Comprehensive Problem 2 8. Net income: 741,455...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Prob. 5.4MADCh. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Prob. 5.6MADCh. 5 - Analyze J. C. Penney J. C. Penney Company, Inc....Ch. 5 - Prob. 5.1TIFCh. 5 - Prob. 5.2TIFCh. 5 - Prob. 5.5TIFCh. 5 - Prob. 5.6TIFCh. 5 - Prob. 5.7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple-step income statement and balance sheet The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 20Y2: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of stockholders equity. Additional common stock of 75,000 was issued during the year ended May 31, 20Y2. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple and single-step income statements differ.arrow_forwardSingle-step income Statement and balance sheet Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30. 20Y7. arc presented in Problem 5-5B. Instructions 1.Prepare a single-step income statement in the format shown in Exhibit 13. 2.Prepare a statement of stockholders equity. Additional common stock of 7.500 was issued during the year ended June 30. 20Y7. 3.Prepare a balance sheet, assuming that the current portion of the note payable is 7,000. 4.Prepare closing entries as of June 30, 20Y7.arrow_forwardMultiple-step income statement and report form of balance sheet The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30. 20Y8: Instructions Prepare a statement of stockholders’ equity. No common stock was issued during the year.arrow_forward

- Financial statements The assets and liabilities of Global Travel Agency on December 31, 20Y5, and its revenue and expenses for the year are as follows: Common stock was 525,000 and retained earnings was 1,250,000 as of January 1, 20Y5. During the year, additional common stock of 50,000 was issued for cash, and dividends of 90,000 were paid. Instructions 1. Prepare an income statement for the year ended December 31, 20Y5. 2. Prepare a statement of stockholders equity for the year ended December 31, 20Y5. 3. Prepare a balance sheet as of December 31, 20Y5. 4. What items appears on both the statement of stockholders equity and the balance sheet?arrow_forwardIncome statement, retained earnings statement, and balance sheet The following financial data were adapted from a recent annual report of Ta get Corporation (TGT) for the year ending January 31. Instructions Prepare Target’s statement of stockholders’ equity for the year ending January 31. Use the following additional information for the year:arrow_forwardRatio of liabilities to stockholders equity and times interest earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: The income before income tax expense was 480,000 and 420,000 for the current and previous years, respectively. A. Determine the ratio of liabilities to stockholders equity at the end of each year. Round to one decimal place. B. Determine the times interest earned ratio for both years. Round to one decimal place. C. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?arrow_forward

- Appendix 1 Financial statements from an end-of-period spreadsheet Based on the data in Exercise 4-22, prepare an income statement, statement of stockholders equity, and balance sheet for Alert Security Services Co. During the year ended October 31, 20Y3, common stock of 10 was issued.arrow_forwardStatement of stockholders equity; net loss Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 20Y5, are as follows: Prepare a statement of stockholders equity for the year.arrow_forwardFinancial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. The following additional information (in thousands) is available: Instructions 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012), and May 31, 2012 (fiscal 2011), rounding to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders equity i. Ratio of sales to assets j. Rate earned on total assets, assuming interest expense is 23 million for the year ending May 31, 2013, and 31 million for the year ending May 31, 2012 k. Rate earned on common stockholders equity l. Price-earnings ratio, assuming that the market price was 61.66 per share on May 31, 2013, and 53.10 per share on May 31, 2012 m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardSelected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License