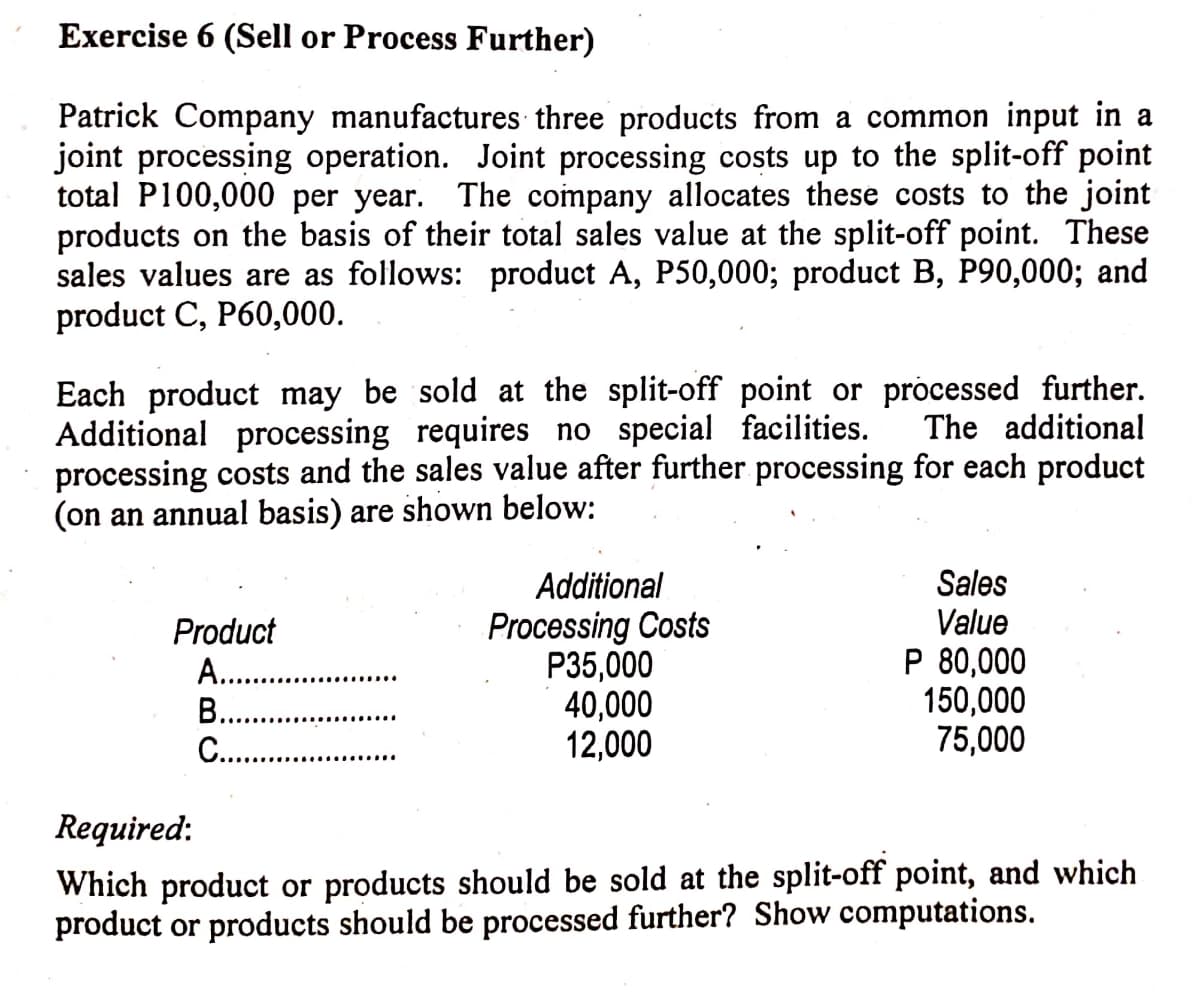

Exercise 6 (Sell or Process Further) Patrick Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total P100,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: product A, P50,000; product B, P90,000; and product C, P60,000. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. processing costs and the sales value after further processing for each product (on an annual basis) are shown below: The additional Sales Value P 80,000 150,000 75,000 Additional Product A. . B.. C... Processing Costs P35,000 40,000 12,000 Required: Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Exercise 6 (Sell or Process Further) Patrick Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total P100,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: product A, P50,000; product B, P90,000; and product C, P60,000. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. processing costs and the sales value after further processing for each product (on an annual basis) are shown below: The additional Sales Value P 80,000 150,000 75,000 Additional Product A. . B.. C... Processing Costs P35,000 40,000 12,000 Required: Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter8: Tactical Decision-making And Relevant Analysis

Section: Chapter Questions

Problem 64P: Sell or Process Further, Basic Analysis Shenista Inc. produces four products (Alpha, Beta, Gamma,...

Related questions

Question

Transcribed Image Text:Exercise 6 (Sell or Process Further)

Patrick Company manufactures three products from a common input in a

joint processing operation. Joint processing costs up to the split-off point

total P100,000 per year. The company allocates these costs to the joint

products on the basis of their total sales value at the split-off point. These

sales values are as follows: product A, P50,000; product B, P90,000; and

product C, P60,000.

Each product may be sold at the split-off point or processed further.

Additional processing requires no special facilities.

processing costs and the sales value after further processing for each product

(on an annual basis) are shown below:

The additional

Sales

Value

P 80,000

150,000

75,000

Additional

Product

A. .

В..

C...

Processing Costs

P35,000

40,000

12,000

Required:

Which product or products should be sold at the split-off point, and which

product or products should be processed further? Show computations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning