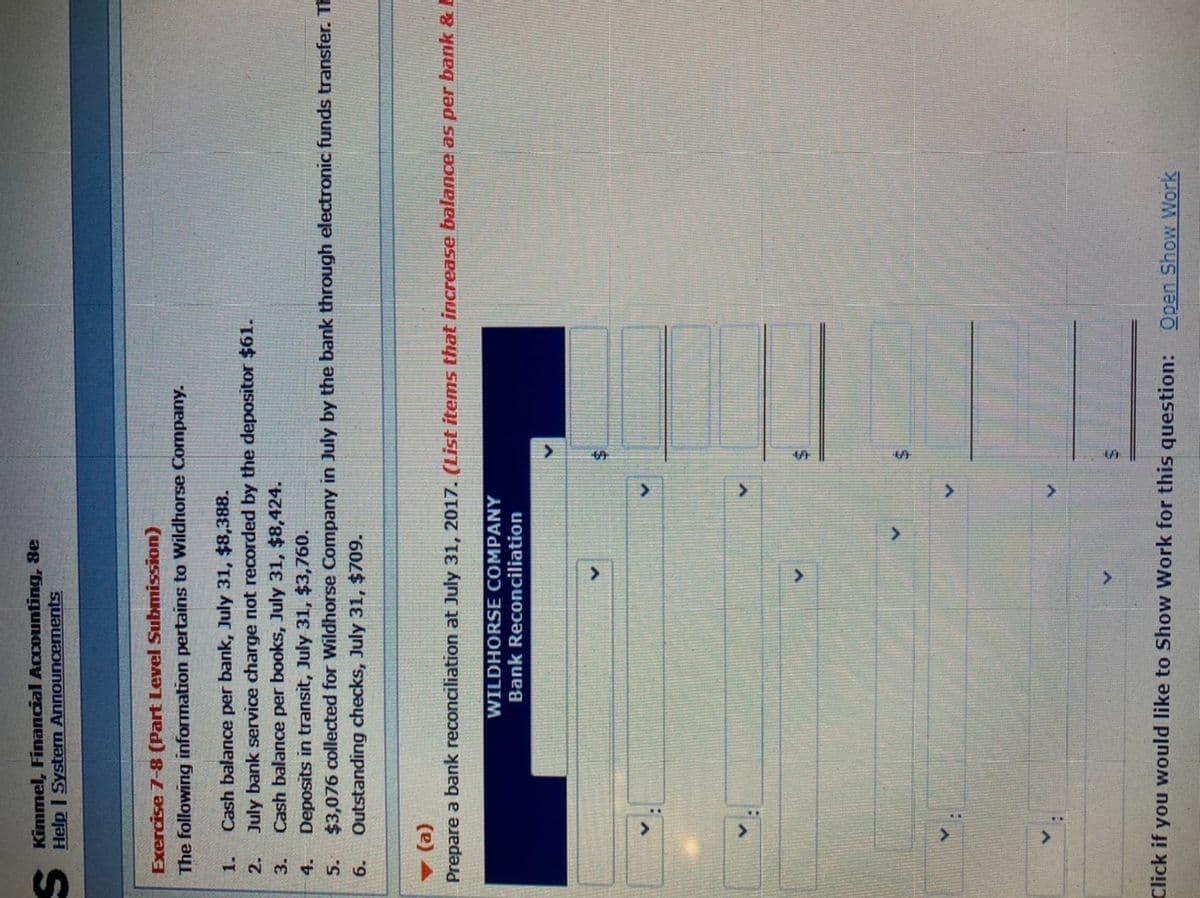

Exercise 7-8 (Part Level Submission) The following information pertains to Wildhorse Company. Cash balance per bank, July 31, $8,388. 1. 2. July bank service charge not recorded by the depositor $61. Cash balance per books, July 31, $8,424. 3. Deposits in transit, July 31, $3,760. 5. $3,076 collected for Wildhorse Company in July by the bank through electronic funds transfer.T Outstanding checks, July 31, $709. 4. 6. (e) A Prepare a bank reconciliation at July 31, 2017. (List items that increase balance as per bank &

Bank reconciliation statement is a document prepared at every month end to reconcile the difference between the cash balance as per the bank statement and the cash balance as per the books of accounts. There are many reasons for which these two balances are different. The reasons of such differences are shown through the bank reconciliation statement.

First step to bank reconciliation statement is to determine the adjusted cash balance starting from the cash balance as per the books of accounts. Any direct debit in terms of service charges, check printing charges etc., direct credit or credit transfers are taken into account to determine the adjusted cash balance.

Second step is to start with the cash balance as per the bank and all the outstanding checks and deposits in transit etc. are taken into account to determine the adjusted cash balance. The adjusted cash balance under both of these steps should be the same.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images