You must complete part 1 before completing part 2. on the following data, prepare a bank reconciliation for December of the ca nce according to the bank statement at December 31, $283,000. nce according to the ledger at December 31, $245,410. ks outstanding at December 31, $68,540. osit in transit, not recorded by bank, $29,500. debit memo for service charges, $750. eck for $12,700 in payment of an invoice was incorrectly recorded in the a

You must complete part 1 before completing part 2. on the following data, prepare a bank reconciliation for December of the ca nce according to the bank statement at December 31, $283,000. nce according to the ledger at December 31, $245,410. ks outstanding at December 31, $68,540. osit in transit, not recorded by bank, $29,500. debit memo for service charges, $750. eck for $12,700 in payment of an invoice was incorrectly recorded in the a

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 19E

Related questions

Question

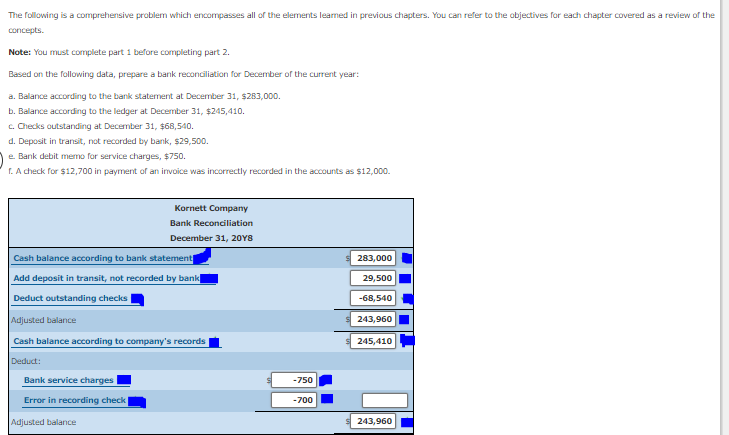

Transcribed Image Text:The following is a comprehensive problem which encompasses all of the elements learmed in previous chapters. You can refer to the objectives for each chapter covered as a review of the

concepts.

Note: You must complete part 1 before completing part 2.

Based on the following data, prepare a bank reconciliation for December of the current year:

a. Balance according to the bank statement at December 31, $283,000.

b. Balance according to the ledger at December 31, $245,410.

c. Checks outstanding at December 31, $68,540.

d. Deposit in transit, not recorded by bank, $29,500.

e. Bank debit memo for service charges, $750.

T. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000.

Kornett Company

Bank Reconciliation

December 31, 20YS

Cash balance according to bank statement

283,000

Add deposit in transit, not recorded by bank

29,500

Deduct outstanding checks

-68,540

Adjusted balance

243,960

Cash balance according to company's records

245,410

Deduct:

Bank service charges

-750

Error in recording check

-700

Adjusted balance

243,960

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning