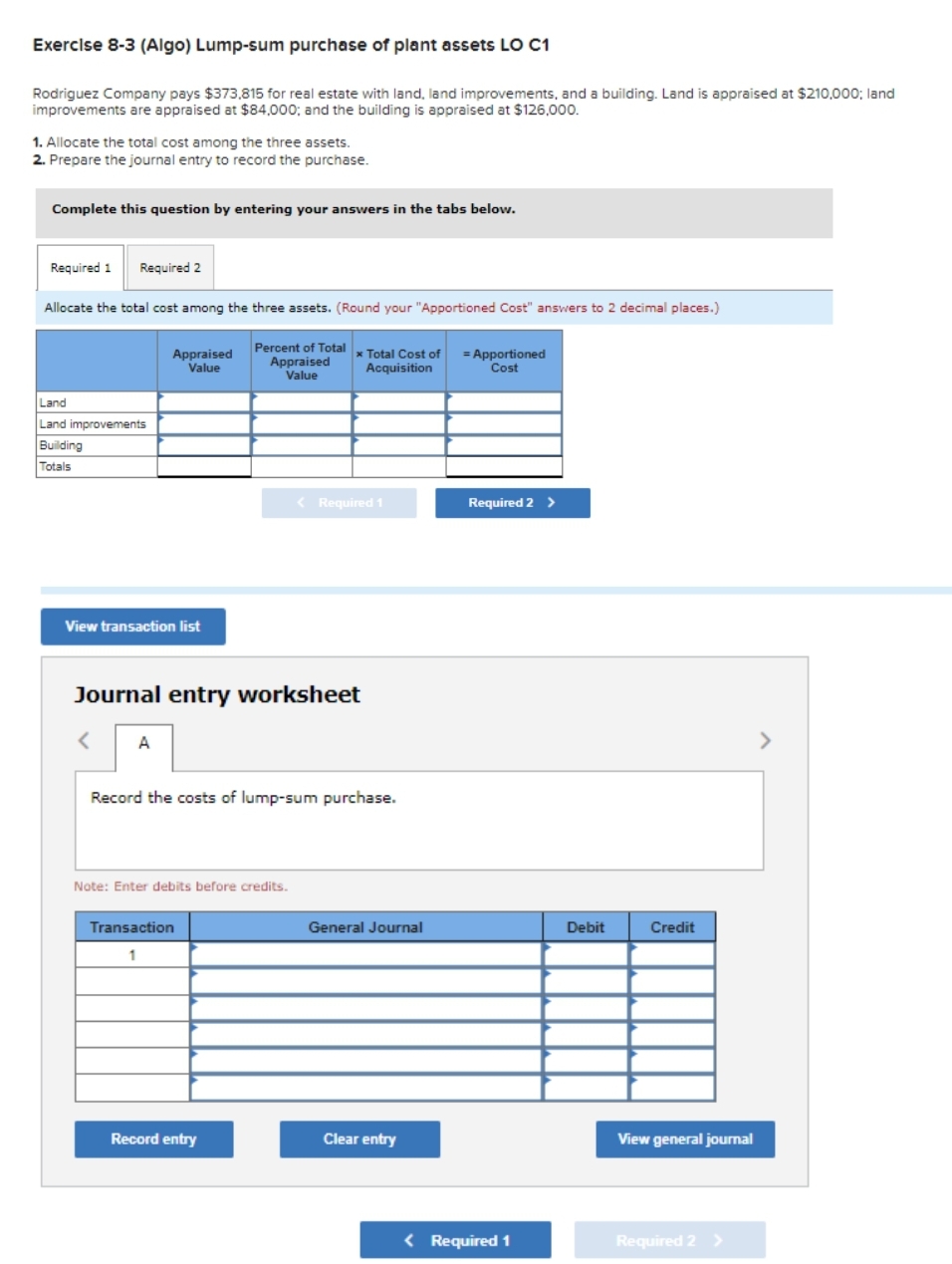

Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $373,815 for real estate with land, land improvements, and a building. Land is appraised at $210,000; land improvements are appraised at $84,000; and the building is appraised at $126,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase.

Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $373,815 for real estate with land, land improvements, and a building. Land is appraised at $210,000; land improvements are appraised at $84,000; and the building is appraised at $126,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 20E: (Appendix 11.1) Depreciation for Financial Statements and Income Tax Purposes Dinkle Company...

Related questions

Question

Transcribed Image Text:Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1

Rodriguez Company pays $373,815 for real estate with land, land improvements, and a building. Land is appraised at $210,000; land

improvements are appraised at $84,000; and the building is appraised at $126,000.

1. Allocate the total cost among the three assets.

2. Prepare the journal entry to record the purchase.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.)

Percent of Total

Appraised

Value

Land

Land improvements

Building

Totals

Appraised

Value

View transaction list

Journal entry worksheet

< A

Note: Enter debits before credits.

* Total Cost of = Apportioned

Acquisition

Cost

Record the costs of lump-sum purchase.

Transaction

1

< Required 1

Record entry

General Journal

Clear entry

Required 2 >

< Required 1

Debit

Credit

View general journal

Required 2 >

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,