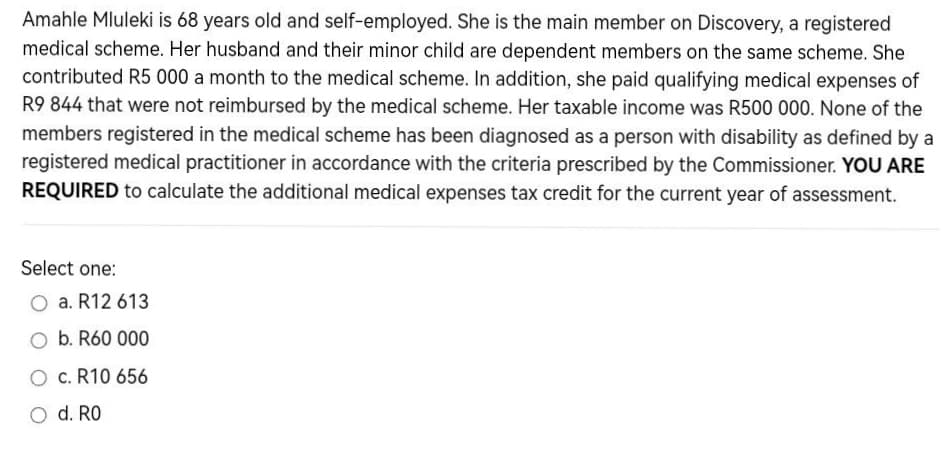

Amahle Mluleki is 68 years old and self-employed. She is the main member on Discovery, a registered medical scheme. Her husband and their minor child are dependent members on the same scheme. She contributed R5 000 a month to the medical scheme. In addition, she paid qualifying medical expenses of R9 844 that were not reimbursed by the medical scheme. Her taxable income was R500 000. None of the members registered in the medical scheme has been diagnosed as a person with disability as defined by a registered medical practitioner in accordance with the criteria prescribed by the Commissioner. YOU ARE REQUIRED to calculate the additional medical expenses tax credit for the current year of assessment. Select one: O a. R12 613 O b. R60 000 O c. R10 656 d. RO

Amahle Mluleki is 68 years old and self-employed. She is the main member on Discovery, a registered medical scheme. Her husband and their minor child are dependent members on the same scheme. She contributed R5 000 a month to the medical scheme. In addition, she paid qualifying medical expenses of R9 844 that were not reimbursed by the medical scheme. Her taxable income was R500 000. None of the members registered in the medical scheme has been diagnosed as a person with disability as defined by a registered medical practitioner in accordance with the criteria prescribed by the Commissioner. YOU ARE REQUIRED to calculate the additional medical expenses tax credit for the current year of assessment. Select one: O a. R12 613 O b. R60 000 O c. R10 656 d. RO

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:Amahle Mluleki is 68 years old and self-employed. She is the main member on Discovery, a registered

medical scheme. Her husband and their minor child are dependent members on the same scheme. She

contributed R5 000 a month to the medical scheme. In addition, she paid qualifying medical expenses of

R9 844 that were not reimbursed by the medical scheme. Her taxable income was R500 000. None of the

members registered in the medical scheme has been diagnosed as a person with disability as defined by a

registered medical practitioner in accordance with the criteria prescribed by the Commissioner. YOU ARE

REQUIRED to calculate the additional medical expenses tax credit for the current year of assessment.

Select one:

a. R12 613

O b. R60 000

O c. R10 656

O d. RO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT