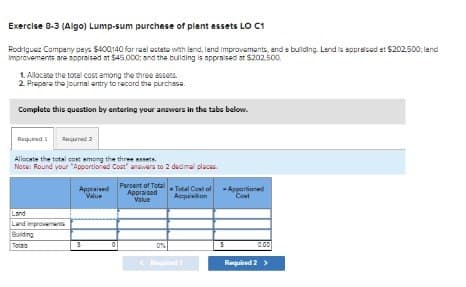

Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $400,140 for real estate with land, land improvements, and a building. Land is appraised at $202,500; land improvements are appraised at $45,000; and the building is appraised at $202,500. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required Required 2 Allocate the total cost among the three assets. Note: Round your "Apportioned Cost answers to 2 decimal places Land Land improvements Building Totals Percent of Total Appraised Value Appraised Value Total Cost of -Apportioned Acquisition Cost S 0% 0.00 Required 1 Required 2 >

Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $400,140 for real estate with land, land improvements, and a building. Land is appraised at $202,500; land improvements are appraised at $45,000; and the building is appraised at $202,500. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required Required 2 Allocate the total cost among the three assets. Note: Round your "Apportioned Cost answers to 2 decimal places Land Land improvements Building Totals Percent of Total Appraised Value Appraised Value Total Cost of -Apportioned Acquisition Cost S 0% 0.00 Required 1 Required 2 >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14RE: (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a...

Related questions

Question

None

Transcribed Image Text:Exercise 8-3 (Algo) Lump-sum purchase of plant assets LO C1

Rodriguez Company pays $400,140 for real estate with land, land improvements, and a building. Land is appraised at $202,500; land

improvements are appraised at $45,000; and the building is appraised at $202,500.

1. Allocate the total cost among the three assets.

2. Prepare the journal entry to record the purchase.

Complete this question by entering your answers in the tabs below.

Required

Required 2

Allocate the total cost among the three assets.

Note: Round your "Apportioned Cost answers to 2 decimal places

Land

Land improvements

Building

Totals

Percent of Total

Appraised

Value

Appraised

Value

Total Cost of -Apportioned

Acquisition

Cost

S

0%

0.00

Required

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,