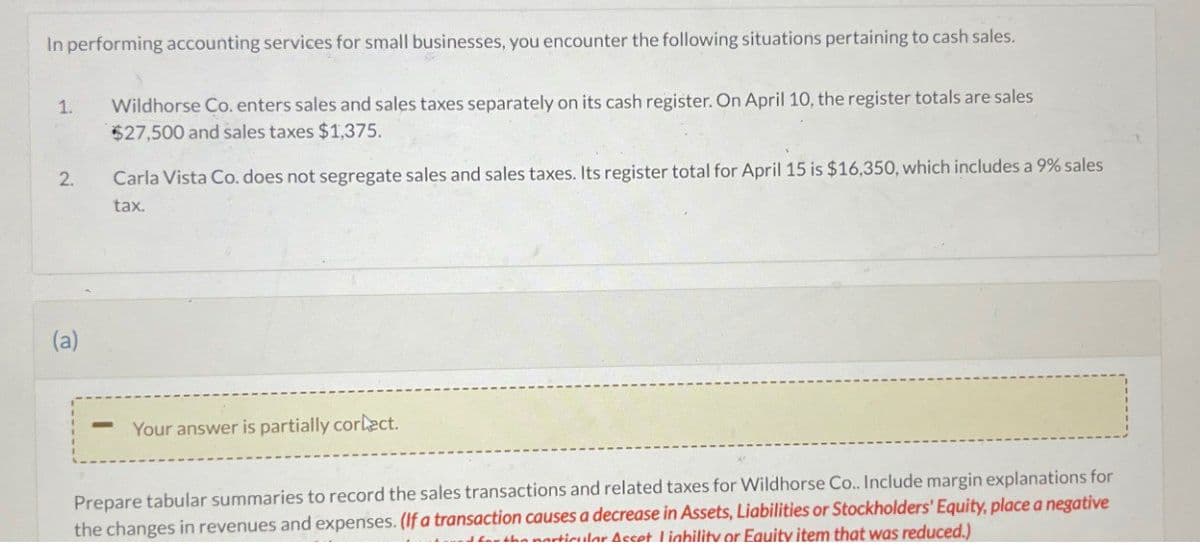

In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. 2. - Wildhorse Co. enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $27,500 and sales taxes $1,375. Carla Vista Co. does not segregate sales and sales taxes. Its register total for April 15 is $16,350, which includes a 9% sales tax. Your answer is partially correct. Prepare tabular summaries to record the sales transactions and related taxes for Wildhorse Co.. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative If the articular Accet Liability or Equity item that was reduced.)

Q: Question Content Area Motorcycle Manufacturers, Inc., projected sales of 78,000 machines for the…

A: The objective of the question is to calculate the budgeted production for the year for Motorcycle…

Q: Find account receivable for 2020 if days' sales in receivable is 73 days and revenue projected is…

A: Days' sales in receivables is the financial ratio that is used to determine the number of days the…

Q: Shadee Corporation expects to sell 510 sun shades in May and 350 in June. Each shades sells for $13.…

A: Cash Collection: It implies the process of collecting cash from the customers to whom the company…

Q: Jake's Roof Repair has provided the following data concerning its costs: Wages and salaries Parts…

A: The flexible budget is not rigid in nature and adjusts itself to the actual units produced while the…

Q: Which of the following is not a part of Other Comprehensive Income? Group of answer choices foreign…

A: The objective of the question is to identify which item among the given options is not a part of…

Q: Innovations Corp (IC) uses the percentage of credit sales method to estimate bad debts each month…

A: Under the allowance method the company makes provisions for uncollectible accounts at the end of the…

Q: a. bumalize the establishment of the fund. If an amount box does not require an entry, leave it…

A: The record of day-to-day transactions in the books of accounts is called journal entries. In a…

Q: Information on four investment proposals is given below: A Investment required Net present value. $…

A: Profitability index = Present value of cash inflows / Initial investmentHigher the profitability…

Q: For 2024, Rahal's Auto Parts estimates bad debt expense at 1% of credit sales. The company reported…

A: Accounts receivable balance at December 31, 2024 = $80,160Explanation:Following T-account for…

Q: Exercise 2-24 (Algo) Computing net income LO P1 A company had the following assets and liabilities…

A: Accounting equation is a mathematical equation that shows relationship between assets, liabilities…

Q: Required Prepare the year-end statement of revenues, expenditures, and changes in fund balances for…

A: Capital projects funds are used to account for financial resources used for the acquisition or…

Q: Actual and budgeted information about the sales of a product are presented below for June: (CIA…

A: The objective of the question is to calculate the sales price variance for June. The sales price…

Q: Motorcycle Manufacturers, Inc., projected sales of 51,200 machines for the year. The estimated…

A: The objective of this question is to calculate the budgeted production for the year for Motorcycle…

Q: McQueen Corp. issued 8.5% five-year bonds payable with a face amount of $50,000 when the market…

A: Bonds/Notes are the instruments/ securities issued by the companies to raise funds for the company…

Q: #equired: a. If the selling price increases by $4.00 per unit and the sales volume decreases by 300…

A: Net Operating Income-Net operating income (NOI) is a calculation used to analyze the profitability…

Q: None

A: Lets understand the basics.The variance is the difference between the actual data and standard…

Q: Universal uses the straight-line method. Required: 1. to 3. Prepare the journal entries to record…

A: A bond is an instrument that is a type of loan given by an investor to a borrower. It gives a fixed…

Q: Required information [The following information applies to the questions displayed below.] Victory…

A: WEIGHTED AVERAGE METHOD:— Under this method, equivalent units are calculated by adding equivalent…

Q: The following information is available from the adjusted trial balance of the Harris Vacation Rental…

A: Changes in owner's capital represent fluctuations in the financial position of a business owner due…

Q: Use the following selected account balances of Delray Manufacturing for the year ended December 31.…

A: An income statement helps in analyzing where to increase the revenue and decrease the cost to…

Q: Question Content Area A company records its inventory purchases at standard cost but also records…

A: The objective of the question is to determine the correct journal entry for the purchase of widgets…

Q: Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,950 of…

A: Cost of goods manufactured for May = $104,387Explanation:Dacosta Corporation Schedule of Cost of…

Q: Naumann Corporation produces and sells a single product. Data concerning that product appear below:…

A: Marginal Costing Income Statement, Net Income is computed by deducting Total Fixed Cost from Total…

Q: Hudson Company reports the following contribution margin income statement. HUDSON COMPANY…

A: The contribution margin represents a company's earnings following the deducting of variable costs…

Q: Sage Hill Inc. incurred a net operating loss of $440,000 in 2025. Combined income for 2023 and 2024…

A: There are financial years in which a company may incur losses instead of profits. When such a…

Q: Knapper Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one…

A: FLEXIBLE BUDGETA flexible budget is a budget that is prepared for different levels of activity or…

Q: Diaz Company owns a machine that cost $126,100 and has accumulated depreciation of $93,500. Prepare…

A: Depreciation is a non-cash expense.Depreciation is charged on fixed asset over a estimated useful…

Q: Margot's Ice Cream operates several stores in a major metropolitan city and its suburbs. Its budget…

A: Variance:Variance is a very important concept in cost accounting that lets the company analyze the…

Q: Given the following data for Handle Division: Selling price to outside customers $ 185…

A: The objective of this question is to determine the financial impact on the company if the Handle…

Q: A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires…

A: A cash budget helps the business in estimating the flow of cash i.e., inward or outward over a…

Q: What is the value of a semiannually compounded bond with 14 years to maturity, a face value of…

A: Bonds/Notes are the instruments/ securities issued by the companies to raise funds for the company…

Q: None

A: A deferred tax asset will arise if your taxable income exceeds your income as reported in your books…

Q: Turner, Roth, and Lowe are partners who share income and loss in a 1:4:5 ratio (in percents: Turner,…

A: Liquidation of a companyThe process of liquidating a company's assets to raise money for shareholder…

Q: It is December 20X1. On May 1, 20X1, the 10% debentures with a principal amount of $400,000 were…

A: Earning per share:The earning per share is popularly known in short as the EPS which means the…

Q: Aracel Engineering completed the following transactions in the month of June. a. J. Aracel, the…

A: The record of day-to-day transactions in the books of accounts is called journal entries. In a…

Q: Exact Photo Service purchased a new color printer at the beginning of Year 1 for $37,290. The…

A: The depreciation expense refers to the cost charged against the value of an asset for the wear and…

Q: company has the following information available for three of its divisions. COMPANY INFORMATION FOR…

A: Sales Revenue Is Calculated By Dividing The Net Operating Income With The Profit Margin Ratio.Sales…

Q: In each of the cases below, assume that Division X has a product that can be sold either to outside…

A: Lowest acceptable transfer price for selling division if no excess capacity = Selling price to…

Q: Miller and Sons' static budget for 10,400 units of production includes $43,400 for direct materials,…

A: A static budget is given for 10,400 units of production. And we must find the 12,200 units…

Q: Brite Ideas, Incorporated, mass-produces reading lamps. Materials used in constructing the lamp are…

A: Process Costing -A approach known as "process costing" involves putting things through two or more…

Q: Myers Corporation has the following data related to direct materials costs for November: actual cost…

A: The direct materials price variance is $3,000 (favorable) Explanation:To calculate the direct…

Q: Required Information SB Exercise E8-5 to E8-10 [The following Information applies to the questions…

A: An income statement helps in analyzing where to increase the revenue and decrease the cost to…

Q: Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year)…

A: Depreciation is a way of declining the cost of assets over the useful life of assets, The company…

Q: Roberts Company has the following direct labor budget for the current month: Budgeted production…

A: D. $742,500Explanation:To calculate the budgeted direct labor costs for the month with the adjusted…

Q: According to its original plan, Munoz Consulting Services Company plans to charge its customers for…

A: FLEXIBLE BUDGETA flexible budget is a budget that is prepared for different levels of activity or…

Q: At the beginning of the period, the Cutting Department budgeted direct labor of $136,000, direct…

A: Flexible budgeting is a dynamic financial planning approach that adjusts budgeted figures based on…

Q: Alice is single and self-employed in 2023. Her net business profit on her Schedule C for the year is…

A: Self-employment taxes are the financial obligations imposed on people who work for themselves rather…

Q: Accounts receivable transactions are provided below for J Blossom Co. Dec. 31, 2023 The company…

A: The money that a company is due by its customers or clients for goods or services that have been…

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to…

A: Under variance analysis the standard sets of estimates are compared with the actual results for…

Q: efences According to its original plan, Franklin Consulting Services Company plans to charge its…

A: FLEXIBLE BUDGETA flexible budget is a budget that is prepared for different levels of activity or…

Step by step

Solved in 3 steps

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?Screpcap Co. had the following transactions during the first week of June: June 1Purchased merchandise on account from Acme Supply, 2,700, plus freight charges of 160. 1Issued Check No. 219 to Denver Wholesalers for merchandise purchased on account, 720, less 1% discount. 1Sold merchandise on account to F. Colby, 246, plus 5% state sales tax plus 2% city sales tax. June 2Received cash on account from N. Dunlop, 315. 2Made cash sale of 413 plus 5% state sales tax plus 2% city sales tax. 2Purchased merchandise on account from Permon Co., 3,200, plus freight charges of 190. 3Sold merchandise on account to F. Ayres, 211, plus 5% state sales tax plus 2% city sales tax. 3Issued Check No. 220 to Ellis Co. for merchandise purchased on account, 847, less 1% discount. 3Received cash on account from F. Graves, 463. 4Issued Check No. 221 to Penguin Warehouse for merchandise purchased on account, 950, less 1% discount. 4Sold merchandise on account to K. Stanga, 318, plus 5% state sales tax plus 2% city sales tax. 4Purchased merchandise on account from Mason Milling, 1,630, plus freight charges of 90. 4Received cash on account from O. Alston, 381. 5Made cash sale of 319 plus 5% state sales tax plus 2% city sales tax. 5Issued Check No. 222 to Acme Supply for merchandise purchased on account, 980, less 1% discount. Required 1. Record the transactions in a general journal. 2. Assuming these are the types of transactions Screpcap Co. experiences on a regular basis, design the following special journals for Screpcap: (a) Sales journal (b) Cash receipts journal (c) Purchases journal (d) Cash payments journalFollowing is a trial balance prepared just before you were hired. Two accounts are missing, and the amount for Sales is off. Here are a few facts to consider. Our business is in a state that collects sales tax. I ran some totals, and we collected 1,800 in sales tax. Customers returned 900 in goods, which would reduce the above sales tax by 70. Our books need to reflect these events. The former accounting clerk said that she recorded everythingsomewhere. She said that she may have credited the 1,800 sales tax to Sales and not to Sales Tax Payable. And she looked confused when Sales Returns and Allowances was mentioned. She asked, Why not just debit Sales? Determine the two missing accounts and correct the accounts that are off. 1. Think about where these amounts might have been put, think about what accounts are missing, and use T accounts to solve the problems. 2. Prepare a corrected trial balance.

- Bell Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Bells sales staff fills out a sales slip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists charge sales for March: Mar. 4Sold potted plant on account to C. Morales, sales slip no. 242, 27, plus sales tax of 1.35, total 28.35. 6Sold floral arrangement on account to R. Dixon, sales slip no. 267, 54, plus sales tax of 2.70, total 56.70. 12Sold corsage on account to B. Cox, sales slip no. 279, 16, plus sales tax of 0.80, total 16.80. 16Sold wreath on account to All-Star Legion, sales slip no. 296, 104, plus sales tax of 5.20, total 109.20. 18Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, 260, plus sales tax of 13, total 273. 21Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a 30 credit plus sales tax of 1.50, credit memo no. 27. 23Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, 180, plus sales tax of 9, total 189. 24Allowed Price Savings and Loan Association credit, 25, plus sales tax of 1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance of the Accounts Receivable controlling account.The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach, as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Aging Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts? If using QuickBooks or general ledger, ignore Steps 2, 3, and 4.The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Smoltz Company reported the following information for the current year: cost of goods sold, $252,500; increase in inventory, $21,700; and increase in accounts payable, $12,200. What is the amount of cash paid to suppliers that Smoltz would report on its statement of cash flows under the direct method? a. $218,600 c. $262,000 b. $243,000 d. $286,400What accounting method (cash or accrual) would you recommend for the following businesses? a. A gift shop with average annual gross receipts of 900,000. b. An accounting partnership with average annual gross receipts of 12 million. c. A drywall subcontractor who works on residences and has annual gross receipts of 3 million. d. An incorporated insurance agency with average annual gross receipts of 28 million. e. A sole proprietor operating a retail clothing store with average annual gross receipts of 12 million. f. A sole proprietor operating a widget manufacturing plant with average annual gross receipts of 27 million.This problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter. Days cash is outstanding for merchandise: 54.04 days Combining the information provided by various ratios can enhance your understanding of the financial condition of a business. Review the information provided for Na Pali Coast Company in the Mastery Problem. Using this information, respond to the following questions: REQUIRED 1. Compute the average number of days required to sell inventory and collect cash from customers buying on account. 2. Note that Na Pali Coast Company also buys inventory on account. On average, how many days pass before Na Pali pays its creditors? 3. Using the information from your answers to parts (1) and (2), compute the number of days from the time Na Pali Coast pays for inventory until it receives cash from customers on account.

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?Block Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square Wholesalers. In return. Block receives a special discount on purchases. Over recent months, Square noticed that purchases by Block had been falling off. At first, Square simply thought that business might be down for Block and was hopeful that their purchases would pick up. When business with Block did not return to a normal level, Square requested financial statements from Block. Squares records indicate that Block purchased 300,000 worth of merchandise during 20-1, the most recent year. Selected information taken from Block's financial statements is as follows: REQUIRED Compute net purchases made by Block during 20-1. Does it appear that Block violated the agreement?