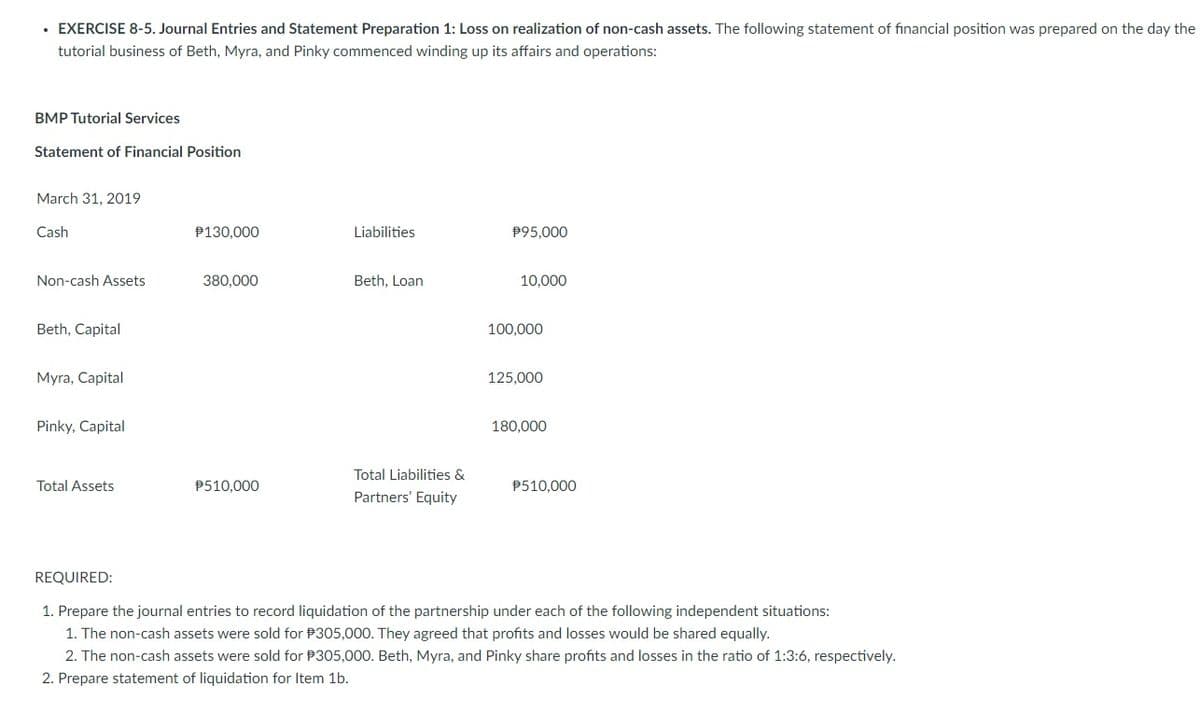

• EXERCISE 8-5. Journal Entries and Statement Preparation 1: Loss on realization of non-cash assets. The following statement of financial position was prepared on the day th tutorial business of Beth, Myra, and Pinky commenced winding up its affairs and operations: BMP Tutorial Services Statement of Financial Position March 31, 2019 Cash P130,000 Liabilities P95,000 Non-cash Assets 380,000 Beth, Loan 10,000 Beth, Capital 100,000 Myra, Capital 125,000 Pinky, Capital 180,000 Total Liabilities & Total Assets P510,000 P510,000 Partners' Equity REQUIRED: 1. Prepare the journal entries to record liquidation of the partnership under each of the following independent situations: 1. The non-cash assets were sold for P305,000. They agreed that profits and losses would be shared equally. 2. The non-cash assets were sold for P305,000. Beth, Myra, and Pinky share profits and losses in the ratio of 1:3:6, respectively. 2. Prepare statement of liquidation for Item 1b.

• EXERCISE 8-5. Journal Entries and Statement Preparation 1: Loss on realization of non-cash assets. The following statement of financial position was prepared on the day th tutorial business of Beth, Myra, and Pinky commenced winding up its affairs and operations: BMP Tutorial Services Statement of Financial Position March 31, 2019 Cash P130,000 Liabilities P95,000 Non-cash Assets 380,000 Beth, Loan 10,000 Beth, Capital 100,000 Myra, Capital 125,000 Pinky, Capital 180,000 Total Liabilities & Total Assets P510,000 P510,000 Partners' Equity REQUIRED: 1. Prepare the journal entries to record liquidation of the partnership under each of the following independent situations: 1. The non-cash assets were sold for P305,000. They agreed that profits and losses would be shared equally. 2. The non-cash assets were sold for P305,000. Beth, Myra, and Pinky share profits and losses in the ratio of 1:3:6, respectively. 2. Prepare statement of liquidation for Item 1b.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 6AP

Related questions

Question

Transcribed Image Text:• EXERCISE 8-5. Journal Entries and Statement Preparation 1: Loss on realization of non-cash assets. The following statement of financial position was prepared on the day the

tutorial business of Beth, Myra, and Pinky commenced winding up its affairs and operations:

BMP Tutorial Services

Statement of Financial Position

March 31, 2019

Cash

P130,000

Liabilities

P95,000

Non-cash Assets

380,000

Beth, Loan

10,000

Beth, Capital

100,000

Myra, Capital

125,000

Pinky, Capital

180,000

Total Liabilities &

Total Assets

P510,000

P510,000

Partners' Equity

REQUIRED:

1. Prepare the journal entries to record liquidation of the partnership under each of the following independent situations:

1. The non-cash assets were sold for P305,000. They agreed that profits and losses would be shared equally.

2. The non-cash assets were sold for P305,000. Beth, Myra, and Pinky share profits and losses in the ratio of 1:3:6, respectively.

2. Prepare statement of liquidation for Item 1b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,