Ice was exracted from the books of Syarikat Wawa at 31 2020: Particulars RM Capital Carriage in Carriage out Purchases Office equipment Motor vehicle Sales 63,030 1,620 800 145,800 10,000 8,500 232,950 68,000 3,600 8,400 4,300 9,600 3,180 28,400 16,440 Wages and salaries Rent and rates Lighting and heating Vehicles running cost Telephone expenses General office expenses Debtors Creditors Provision for depreciation: Motor vehicle 4,250 4,000 500 Office equipment Provision for doubtful debts Drawings Cash at bank Cash in hand Stock as at 1 April 2019 Return inwards Return outwards 13,570 6,200 300 8,000 3,800 2,900 Additional information as at 31 Mac 2020. Stock on hand was valued at RM8,800 Rent and rates prepaid RM1,200 Wages and salaries RM1,750 iv. ii. ii. Depreciation is to be provided as follows: a. Motor vehicles b. Office equipment 50 % reducing balance method 20% straight line method

Ice was exracted from the books of Syarikat Wawa at 31 2020: Particulars RM Capital Carriage in Carriage out Purchases Office equipment Motor vehicle Sales 63,030 1,620 800 145,800 10,000 8,500 232,950 68,000 3,600 8,400 4,300 9,600 3,180 28,400 16,440 Wages and salaries Rent and rates Lighting and heating Vehicles running cost Telephone expenses General office expenses Debtors Creditors Provision for depreciation: Motor vehicle 4,250 4,000 500 Office equipment Provision for doubtful debts Drawings Cash at bank Cash in hand Stock as at 1 April 2019 Return inwards Return outwards 13,570 6,200 300 8,000 3,800 2,900 Additional information as at 31 Mac 2020. Stock on hand was valued at RM8,800 Rent and rates prepaid RM1,200 Wages and salaries RM1,750 iv. ii. ii. Depreciation is to be provided as follows: a. Motor vehicles b. Office equipment 50 % reducing balance method 20% straight line method

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 41E

Related questions

Question

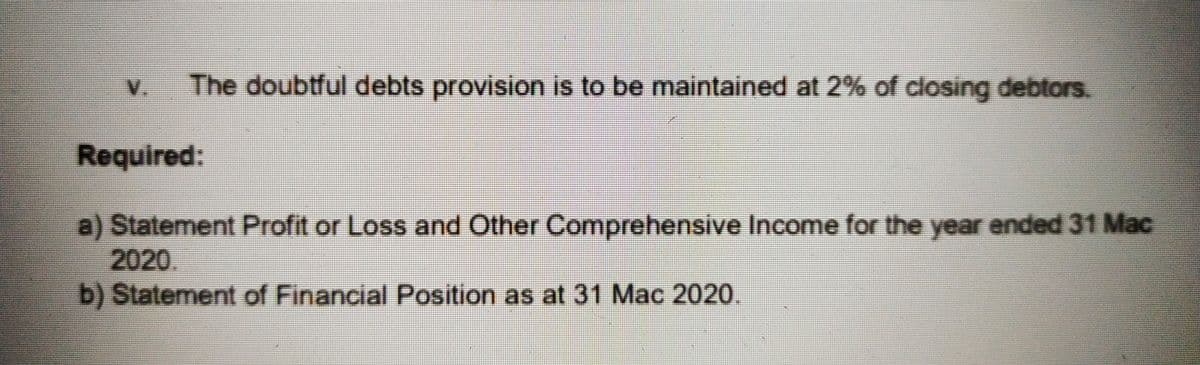

Transcribed Image Text:V.

The doubtful debts provision is to be maintained at 2% of closing debtors.

Required:

a) Statement Profit or Loss and Other Comprehensive Income for the year ended 31 Mac

2020.

b) Statement of Financial Position as at 31 Mac 2020.

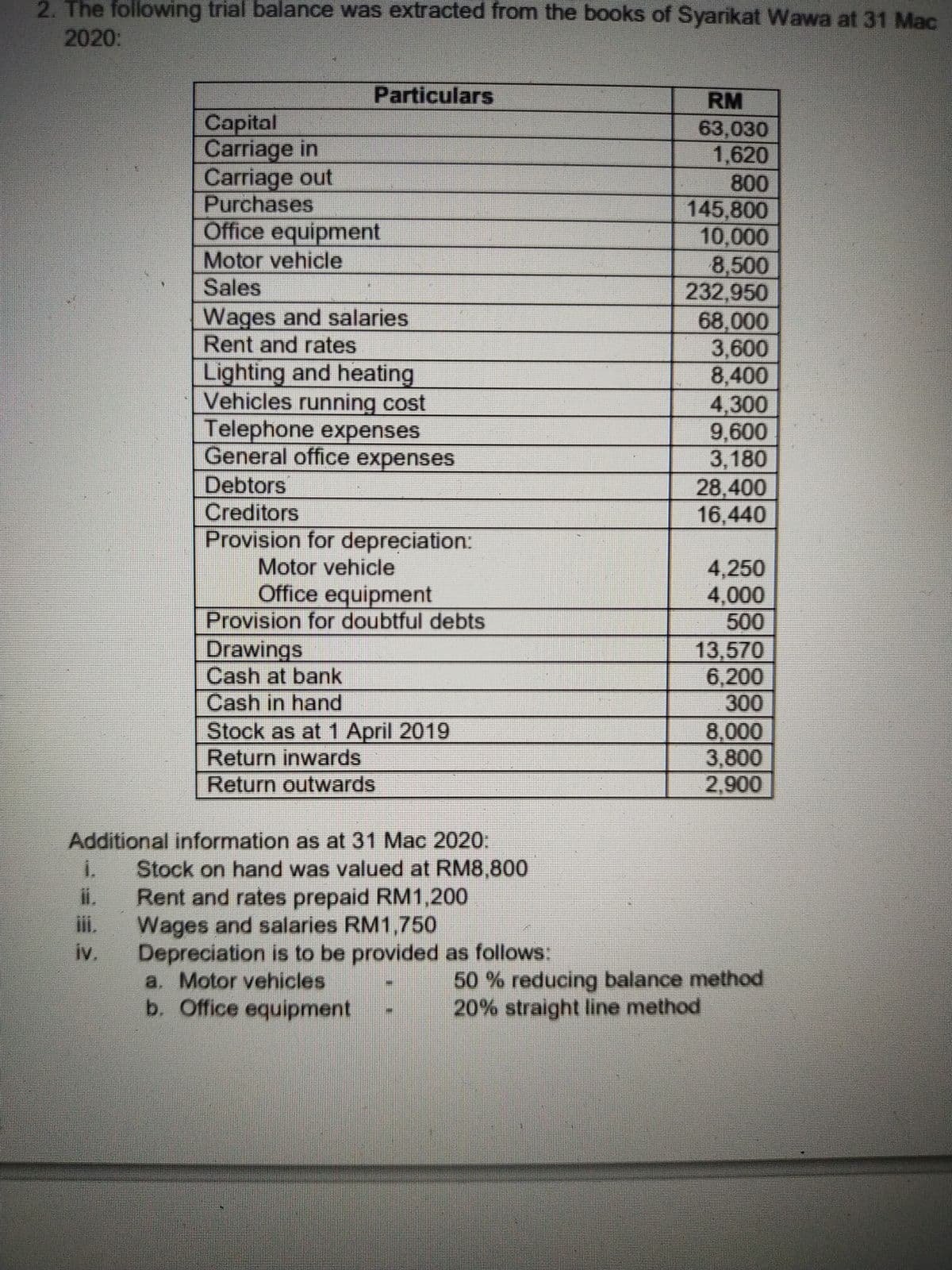

Transcribed Image Text:2. The following trial balance was extracted from the books of Syarikat Wawa at 31 Mac

2020:

Particulars

RM

63,030

1,620

800

145,800

10,000

8,500

232,950

68,000

3,600

8,400

4,300

9,600

3,180

28,400

16,440

Capital

Carriage in

Carriage out

Purchases

Office equipment

Motor vehicle

Sales

Wages and salaries

Rent and rates

Lighting and heating

Vehicles running cost

Telephone expenses

General office expenses

Debtors

Creditors

Provision for depreciation:

Motor vehicle

Office equipment

Provision for doubtful debts

Drawings

Cash at bank

Cash in hand

Stock as at 1 April 2019

Return inwards

Return outwards

4,250

4,000

500

13,570

6,200

300

8,000

3,800

2,900

Additional information as at 31 Mac 2020.

Stock on hand was valued at RM8,800

Rent and rates prepaid RM1,200

Wages and salaries RM1,750

iv.

i.

i.

i.

Depreciation is to be provided as follows:

a. Motor vehicles

b. Office equipment

50% reducing balance method

20% straight line method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning