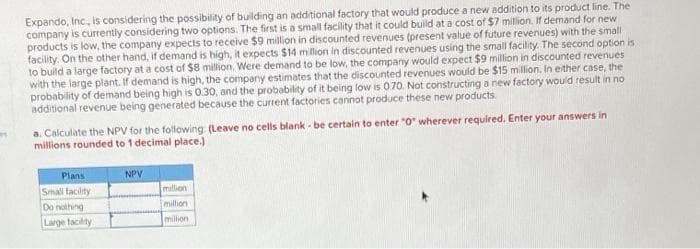

Expando, Inc, is considering the possibility of building an additional factory that would produce a new ld company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $9 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $14 milion in discounted revenues using the small facility. The second option is to build a large factory at a cost of $8 milion. Were demand to be low, the company would expect $9 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $15 milion. In either case, the probability of demand being high is 0.30, and the probability of it being low is 070. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products a. Calculate the NPv for the following (Leave no cells blank - be certain to enter "0" wherever required. Enter your answers in millions rounded to 1 decimal place) Plans NPV Small tacity Do nothing Large tacty milion milon milon

Expando, Inc, is considering the possibility of building an additional factory that would produce a new ld company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $9 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $14 milion in discounted revenues using the small facility. The second option is to build a large factory at a cost of $8 milion. Were demand to be low, the company would expect $9 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $15 milion. In either case, the probability of demand being high is 0.30, and the probability of it being low is 070. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products a. Calculate the NPv for the following (Leave no cells blank - be certain to enter "0" wherever required. Enter your answers in millions rounded to 1 decimal place) Plans NPV Small tacity Do nothing Large tacty milion milon milon

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 30P

Related questions

Question

Transcribed Image Text:Expando, Inc, is considering the possibility of building an additional factory that would produce a new addition to its product line. The

company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new

products is low, the company expects to receive $9 million in discounted revenues (present value of future revenues) with the small

facility. On the other hand, if demand is high, it expects $14 milon in discounted revenues using the small facility. The second option is

to build a large factory at a cost of $8 million. Were demand to be low, the company would expect $9 million in discounted revenues

with the large plant. If demand is high, the company estimates that the discounted revenues would be $15 million. In either case, the

probability of demand being high is 0.30, and the probability of it being low is 070. Not constructing a new factory would result in no

additional revenue being generated because the current factories caninot produce these new products.

a. Calculate the NPV for the following (Leave no cells blank - be certain to enter "0" wherever required, Enter your answers in

millions rounded to 1 decimal place.)

Plans

NPV

Small tacility

million

Do nothing

million

Large facility

milion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,