Explain how the closure of the overseas branch and the onerous contract should be treated in accordance with IFRS Standards. Solve only (c)

Explain how the closure of the overseas branch and the onerous contract should be treated in accordance with IFRS Standards. Solve only (c)

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 13QE

Related questions

Question

i need the answer quickly

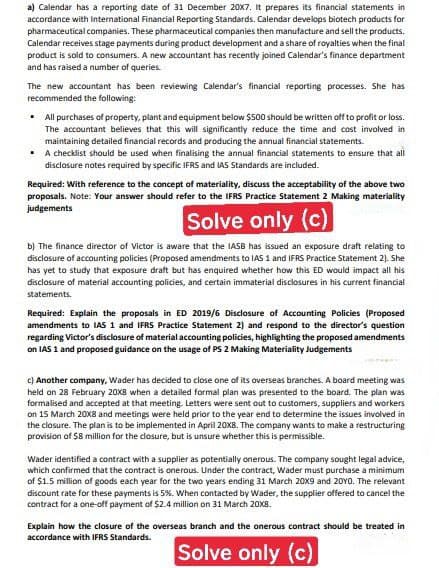

Transcribed Image Text:a) Calendar has a reporting date of 31 December 20X7. It prepares its financial statements in

accordance with International Financial Reporting Standards. Calendar develops biotech products for

pharmaceutical companies. These pharmaceutical companies then manufacture and sell the products.

Calendar receives stage payments during product development and a share of royalties when the final

product is sold to consumers. A new accountant has recently joined Calendar's finance department

and has raised a number of queries.

The new accountant has been reviewing Calendar's financial reporting processes. She has

recommended the following:

• All purchases of property, plant and equipment below $500 should be written off to profit or loss.

The accountant believes that this will significantly reduce the time and cost involved in

maintaining detailed financial records and producing the annuai financial statements.

• A checklist should be used when finalising the annual financial statements to ensure that all

disclosure notes required by specific IFRS and LAS Standards are included.

Required: With reference to the concept of materiality, discuss the acceptability of the above two

proposals. Note: Your answer should refer to the IFRS Practice Statement 2 Making materiality

judgements

Solve only (c)

b) The finance director of Victor is aware that the IASB has issued an exposure draft relating to

disclasure of accounting policies (Proposed amendments to IAS 1 and IFRS Practice Statement 2). She

has yet to study that exposure draft but has enquired whether how this ED would impact alt his

disclosure of material accounting policies, and certain immaterial disclosures in his current financial

statements.

Required: Explain the proposals in ED 2019/6 Disclosure of Accounting Policies (Proposed

amendments to LAS 1 and IFRS Practice Statement 2) and respond to the director's question

regarding Victor's disclosure of material accounting policies, highlighting the proposed amendments

on IAS 1 and proposed guidance on the usage of PS 2 Making Materiality Judgements

e) Another company, Wader has decided to close one of its averseas branches. A board meeting was

held on 28 February 20x8 when a detailed formal plan was presented to the board. The plan was

formalised and accepted at that meeting. Letters were sent out to customers, suppliers and workers

on 15 March 20X8 and meetings were held prior to the year end to determine the issues involved in

the closure. The plan is to be implemented in April 20XB. The company wants to make a restructuring

provision of $B million for the closure, but is unsure whether this is permissible.

Wader identified a contract with a supplier as potentially onerous. The company sought legal advice,

which confirmed that the contract is onerous. Under the contract, Wader must purchase a minimum

of $1.5 million of goods each year for the two years ending 31 March 20x9 and 20Y0. The relevant

discount rate for these payments is 5%. When contacted by Wader, the supplier offered to cancel the

contract for a one-off payment of $2.4 million on 31 March 20X8.

Explain how the closure of the overseas branch and the onerous contract should be treated in

accordance with IFRS Standards.

Solve only (c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub