Explain the difference between the Fair Value Method and the Equity Method in recording investments. If PT A buys 30% of PT B's shares and has no significant influence significant which method to choose? Explain!

Explain the difference between the Fair Value Method and the Equity Method in recording investments. If PT A buys 30% of PT B's shares and has no significant influence significant which method to choose? Explain!

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 18E: Trading Securities Pear Investments began operations in 2020 and invests in securities classified as...

Related questions

Question

Note: RP AND IDR SAME

The book I use: Intermediate Accounting, Kieso, ifrs Edition, Fourth Edition.

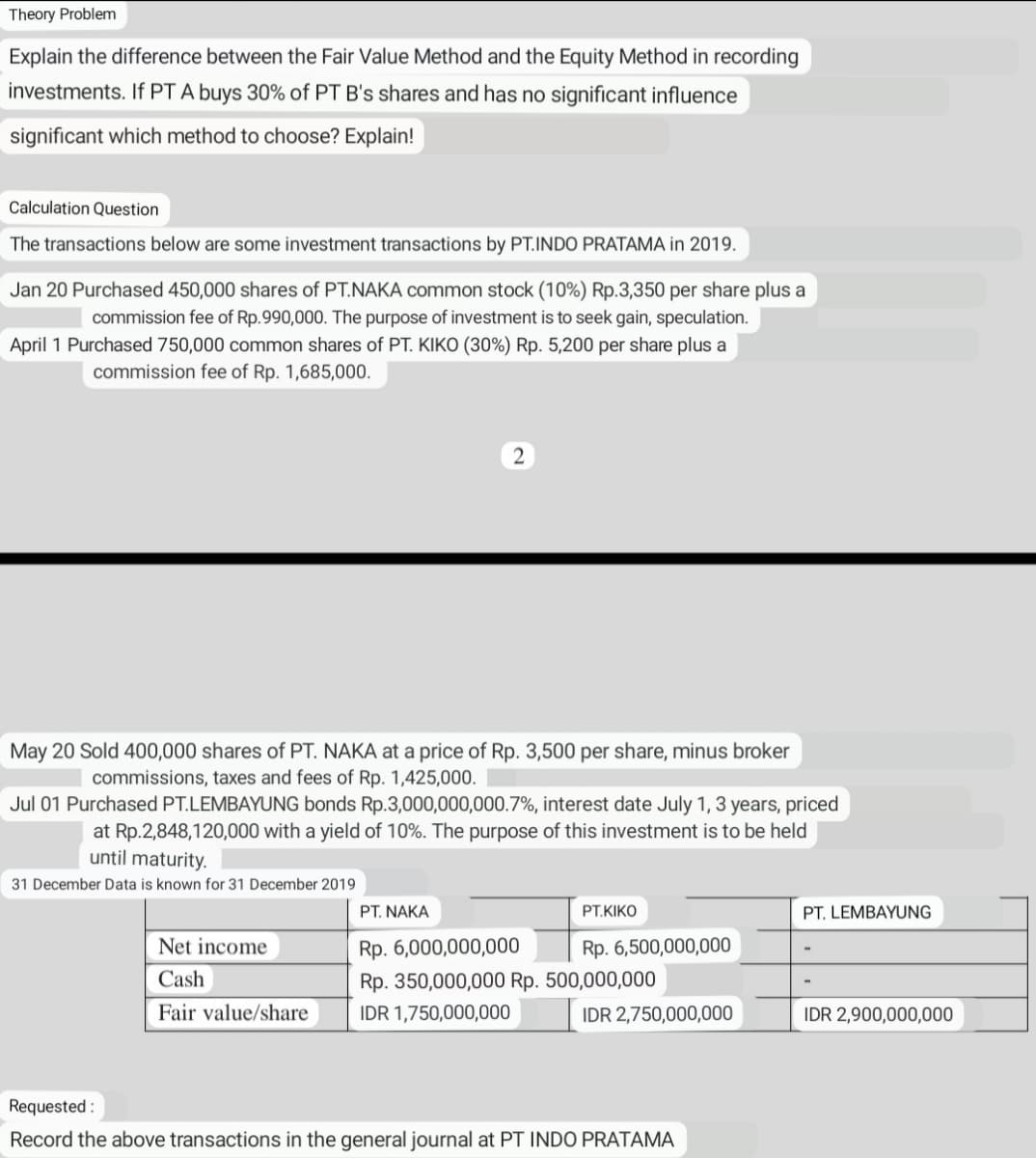

Transcribed Image Text:Theory Problem

Explain the difference between the Fair Value Method and the Equity Method in recording

investments. If PT A buys 30% of PT B's shares and has no significant influence

significant which method to choose? Explain!

Calculation Question

The transactions below are some investment transactions by PT.INDO PRATAMA in 2019.

Jan 20 Purchased 450,000 shares of PT.NAKA common stock (10%) Rp.3,350 per share plus a

commission fee of Rp.990,000. The purpose of investment is to seek gain, speculation.

April 1 Purchased 750,000 common shares of PT. KIKO (30%) Rp. 5,200 per share plus a

commission fee of Rp. 1,685,000.

2

May 20 Sold 400,000 shares of PT. NAKA at a price of Rp. 3,500 per share, minus broker

commissions, taxes and fees of Rp. 1,425,000.

Jul 01 Purchased PT.LEMBAYUNG bonds Rp.3,000,000,000.7%, interest date July 1, 3 years, priced

at Rp.2,848,120,000 with a yield of 10%. The purpose of this investment is to be held

until maturity.

31 December Data is known for 31 December 2019

Net income

Cash

Fair value/share

PT.KIKO

PT. NAKA

Rp. 6,000,000,000

Rp. 350,000,000 Rp. 500,000,000

IDR 1,750,000,000

Rp. 6,500,000,000

IDR 2,750,000,000

Requested:

Record the above transactions in the general journal at PT INDO PRATAMA

PT. LEMBAYUNG

IDR 2,900,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning