Explain the income statement

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 23E

Related questions

Question

Explain the income statement.

Transcribed Image Text:Aucby PDF

Sgatares

mcome Stareme

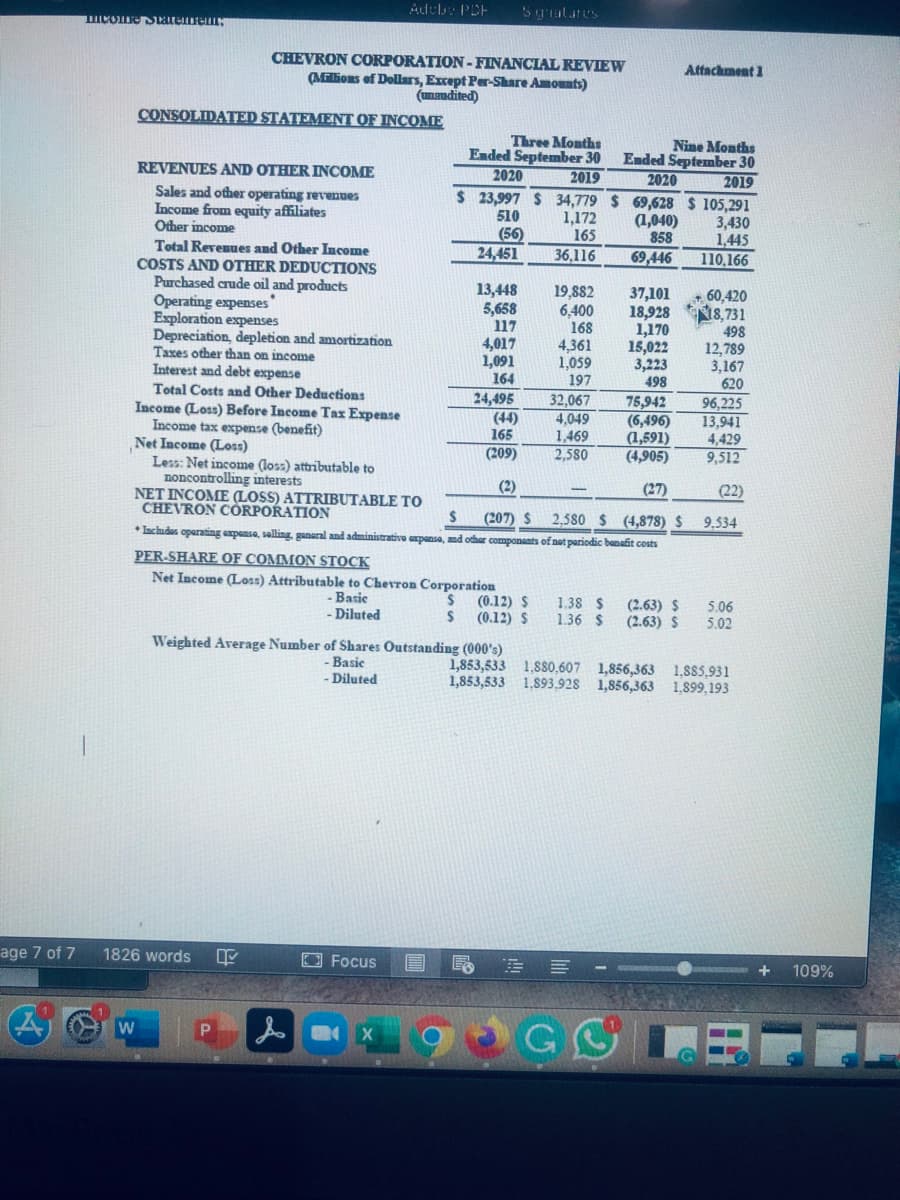

CHEVRON CORPORATION-FINANCIAL REVIEW

Attachment 1

(Millions of Dollars, Except Per-Share Amounts)

(unandited)

CONSOLIDATED STATEMENT OF INCOME

Three Months

Ended September 30

2020

Nine Months

Ended September 30

2019

$ 23,997 $ 34,779 $ 69,628 $ 105,291

REVENUES AND OTHER INCOME

2019

2020

Sales and other operating revenues

Income from equity affiliates

Other income

510

(56)

24,451

1,172

165

(1,040)

858

3,430

1,445

110,166

Total Revenues and Other Income

COSTS AND OTHER DEDUCTIONS

Purchased crude oil and products

Operating expenses

Exploration expenses

Depreciation, depletion and amortization

Taxes other than on income

Interest and debt expense

36,116

69,446

13,448

5,658

117

19,882

6,400

168

4,361

1,059

197

37,101

18,928

1,170

15,022

3,223

498

60,420

N8,731

498

4,017

1,091

164

12,789

3,167

620

96,225

13,941

4,429

Total Costs and Other Deductions

Income (Loss) Before Income Tax Expense

Income tax expense (benefit)

Net Income (Loss)

Less: Net income (loss) attributable to

noncontrolling interests

NET INCOME (LOSS) ATTRIBUTABLE TO

CHEVRON CÒRPORATION

24,495

(44)

165

32,067

4,049

1,469

2,580

75,942

(6,496)

(1,591)

(4,905)

(209)

9,512

(2)

(27)

(22)

(207) S

(4,878) $

* Iachudes operating expense, selling, ganeral and administrativo axpansa, and othar componants of not pariodic banafit costs

2,580 $

9,534

PER-SHARE OF COMMON STOCK

Net Income (Loss) Attributable to Chevron Corporation

Basic

(0.12) $

(0.12) S

1.38 S

1.36 $

(2.63) $

(2.63) $

5.06

5.02

Diluted

Weighted Average Number of Shares Outstanding (000's)

Basic

Diluted

1,853,533 1,880,607 1,856,363 1,885,931

1,853,533 1,893,928 1,856,363 1,899,193

age 7 of 7

1826 words

Focus

109%

Expert Solution

Review of 3 Months(ending september 30):

The given Income Statement is a Consolidated Income Statement of Chevron Corporation giving information about the year 2019 and 2020. It has incurred a loss attributable of $209 million in its last 3 months ending 30 Sept 2020. The profit as compared to last year(2019) same quarter has gone down by $2,787 million. The reason which can be seen as per the income statement is the reduction of revenue from sales and other operating activities as there is no big difference is expense cost in both years. Earning per share has reduced from $1.38 to loss of $0.12 per share.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning