(f) The IASB's Conceptual Framework for Financial Reporting 2010 (IFRS Framework) requires financial statements to be prepared on the basis that they comply with certain accounting concepts, underlying assumptions and (qualitative) characteristics. Three of these are: i Accruals ii Comparability iii Materiality Briefly explain the meaning of each of the above concepts/assumptions.

(f) The IASB's Conceptual Framework for Financial Reporting 2010 (IFRS Framework) requires financial statements to be prepared on the basis that they comply with certain accounting concepts, underlying assumptions and (qualitative) characteristics. Three of these are: i Accruals ii Comparability iii Materiality Briefly explain the meaning of each of the above concepts/assumptions.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

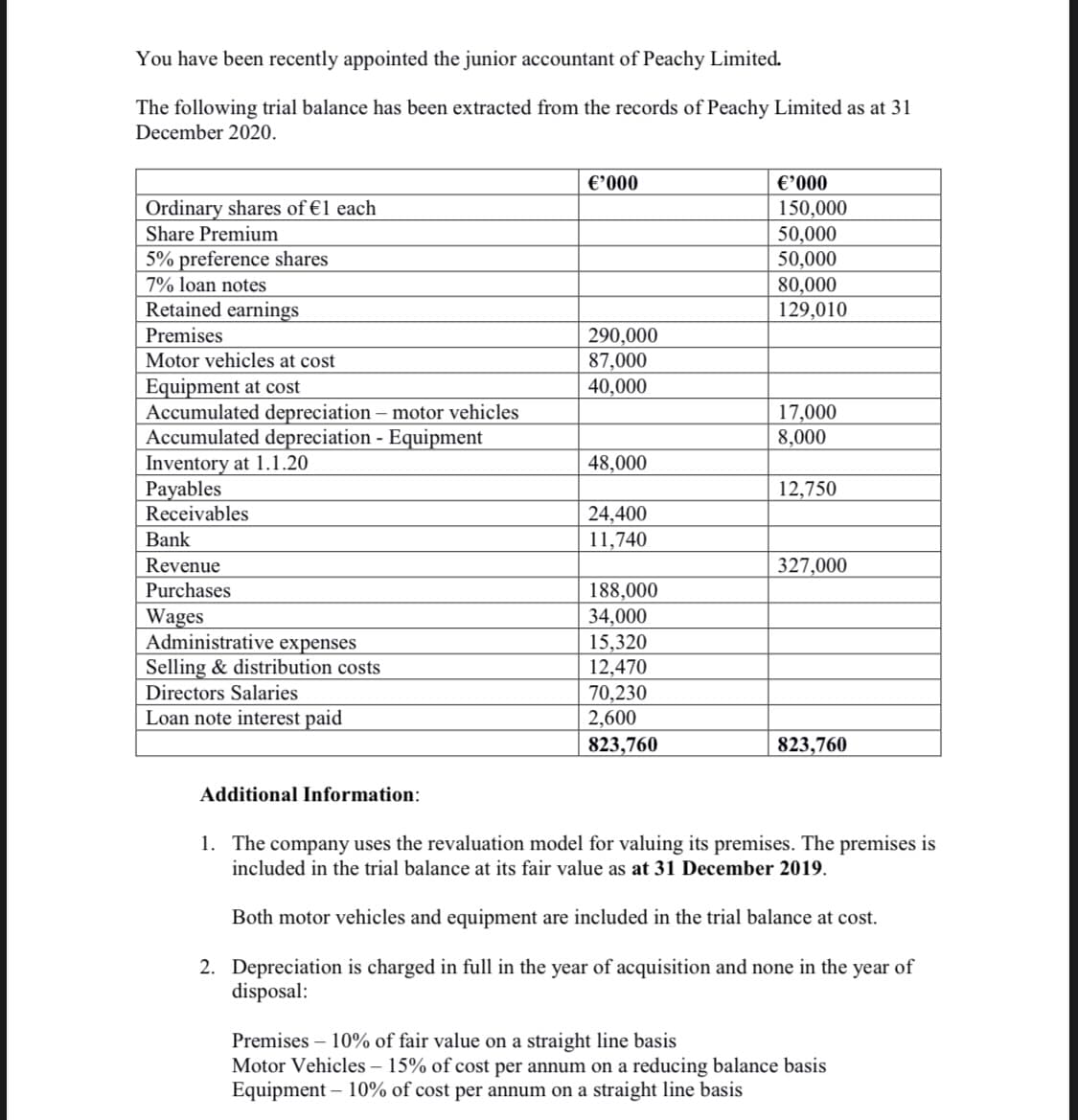

Transcribed Image Text:You have been recently appointed the junior accountant of Peachy Limited.

The following trial balance has been extracted from the records of Peachy Limited as at 31

December 2020.

€’000

€'000

Ordinary shares of €1 each

150,000

50,000

50,000

80,000

129,010

Share Premium

5% preference shares

7% loan notes

Retained earnings

Premises

290,000

87,000

40,000

Motor vehicles at cost

Equipment at cost

Accumulated depreciation – motor vehicles

Accumulated depreciation - Equipment

Inventory at 1.1.20

Payables

Receivables

17,000

8,000

48,000

12,750

24,400

Bank

11,740

Revenue

327,000

Purchases

188,000

34,000

Wages

Administrative expenses

Selling & distribution costs

15,320

12,470

70,230

2,600

Directors Salaries

Loan note interest paid

823,760

823,760

Additional Information:

1. The company uses the revaluation model for valuing its premises. The premises is

included in the trial balance at its fair value as at 31 December 2019.

Both motor vehicles and equipment are included in the trial balance at cost.

2. Depreciation is charged in full in the year of acquisition and none in the

disposal:

year

of

Premises – 10% of fair value on a straight line basis

Motor Vehicles – 15% of cost per annum on a reducing balance basis

Equipment – 10% of cost per annum on a straight line basis

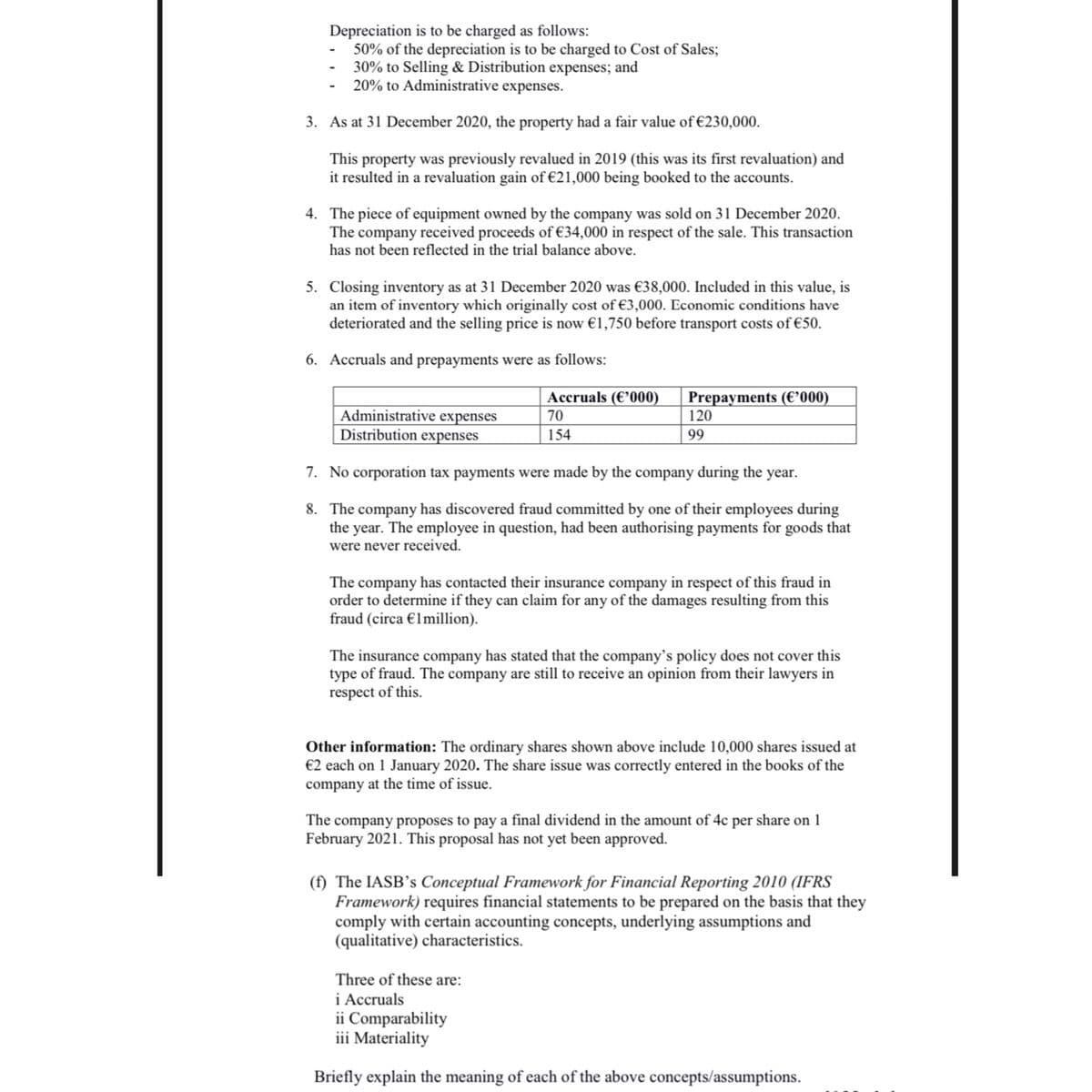

Transcribed Image Text:Depreciation is to be charged as follows:

- 50% of the depreciation is to be charged to Cost of Sales;

30% to Selling & Distribution expenses; and

20% to Administrative expenses.

3. As at 31 December 2020, the property had a fair value of €230,000.

This property was previously revalued in 2019 (this was its first revaluation) and

it resulted in a revaluation gain of €21,000 being booked to the accounts.

4. The piece of equipment owned by the company was sold on 31 December 2020.

The company received proceeds of €34,000 in respect of the sale. This transaction

has not been reflected in the trial balance above.

5. Closing inventory as at 31 December 2020 was €38,000. Included in this value, is

an item of inventory which originally cost of €3,000. Economic conditions have

deteriorated and the selling price is now €1,750 before transport costs of €50.

6. Accruals and prepayments were as follows:

Prepayments (€'000)

120

Accruals (€°000)

Administrative expenses

Distribution expenses

70

154

99

7. No corporation tax payments were made by the company during the year.

8. The company has discovered fraud committed by one of their employees during

the year. The employee in question, had been authorising payments for goods that

were never received.

The company has contacted their insurance company in respect of this fraud in

order to determine if they can claim for any of the damages resulting from this

fraud (circa €1million).

The insurance company has stated that the company's policy does not cover this

type of fraud. The company are still to receive an opinion from their lawyers in

respect of this.

Other information: The ordinary shares shown above include 10,000 shares issued at

€2 each on 1 January 2020. The share issue was correctly entered in the books of the

company at the time of issue.

The company proposes to pay a final dividend in the amount of 4c per share on 1

February 2021. This proposal has not yet been approved.

(f) The IASB's Conceptual Framework for Financial Reporting 2010 (IFRS

Framework) requires financial statements to be prepared on the basis that they

comply with certain accounting concepts, underlying assumptions and

(qualitative) characteristics.

Three of these are:

i Accruals

ii Comparability

iii Materiality

Briefly explain the meaning of each of the above concepts/assumptions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning