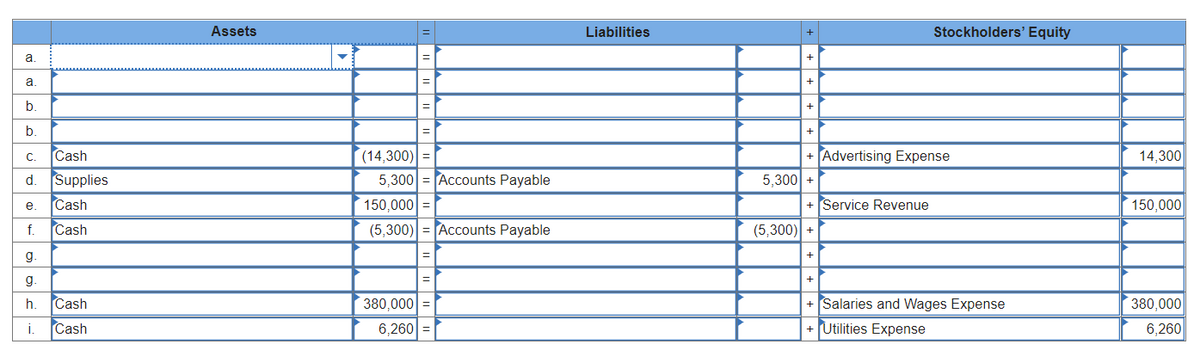

f. Cash (5,300) = Accounts Payable (5,300

Q: Nissley Wedding Fantasy Corporation makes very elaborate wedding cakes to order. The owner of the…

A: Solution: Activity cost assigned to product = Estimated usage of allocation based * Activity rate…

Q: Chilton Day School allocates marketing and administrative costs to its three schools on the basis of…

A: Calculation of cost allocation are as follows

Q: Dick's Draperies has gross sales $15,000 per month, half of which are on credit (paid with 30 days).…

A: Cash Flow statement shows the cash inflows and cash outflows of a company. Cash inflows are mainly…

Q: Cameron Corporation manufactures custom-made purses. The following data pertain to Job XY5: Direct…

A: Solution Total cost refers to the cost which include direct material, direct labor and total…

Q: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has…

A: A company's projection of cash inflows and outflows over a certain time period is determined by…

Q: A machine has an initial cost of P50,010.596 and a salvage value of P13,779.901 after 7 years. What…

A: Depreciation :— It is decrease in the value of assets due to continuos use of asset. Straight…

Q: WEELER COMPANY Comparative Balance Sheets December 31 Assets Cash Accounts receivable Merchandise…

A: (a) Weller CompanyStatement of Cash FlowsFor the Year ended December 31, 2010 Cash flows from…

Q: A corporation has 12 000 ordinary shares and options to purchase 1 500 ordinary shares at R10 per…

A: Earnings Per share Earnings per share (EPS) measures a firm's profitability on a per-share basis…

Q: In 2022, Nitai (age 40) contributes 10 percent of his $123,000 annual salary to a Roth 401(k)…

A: Because contributions to Roth IRAs are made with money that has already been taxed, there is no…

Q: When calculating the weighted average number of shares outstanding, the number of shares are not tim…

A: Outstanding shares are calculated by deducting the treasury stock from the shares issued by the…

Q: Exercise 12-4A Use the direct method to determine cash flows from operating activities The following…

A: CASH FLOW FROM OPERATING ACTIVITIES Cash flow from Operating Activities include Generating…

Q: I b) Electroz Ltd has the following data concerning a model electric car it manufactures:< Variable…

A: Cost Plus Pricing Method :— It is a pricing method in which target price is calculated by adding…

Q: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of…

A: A note receivable is a promissory note form in which one person promises to pay the money to another…

Q: Use the following information to answer questions 5-20. On December 31, 2016 the following Trial…

A: Income statement provide the information about the business entities' annual gross profit or net…

Q: controversy, the ipany initiated light of esting system follow: Activity Cost Pool Removing asbestos…

A: First stage allocation of cost to activity cost pools is based on total cost and percentage of usage…

Q: Using the table below, complete a Vertical Analysis. Round answers to 1 decimal place. Paragraph V…

A: VERTICAL ANALYSIS OF BALANCE SHEET Vertical Analysis of a Balance sheet provides the Percentage…

Q: The trial balance of Pacilio Security Services Inc. as of January 1, 2019, had the following norma.…

A: a) Journal entries:

Q: Cox Electric makes electronic components and has estimated the following for a new design of one of…

A: Answer:- Profit model:- A profit model will take into account all expenses and income related to a…

Q: Q2. Consult Paragraphs 3-6 of Quality Control Standard No. 20 (QC 20). Considering the example in…

A: Introduction: Quality Control Standard: It provides that a CPA firm should have a system of quality…

Q: Clayton participates in his employer's nonqualified deferred compensation plan. For 2022, he is…

A: Income after taxes refers to the amount that is to be left after making all the deductions from…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 1 0.943 2 0.890 0.840…

A: FUTURE VALUE Future value is the value of an asset at a specific date. Future value is the value of…

Q: A machine has a first cost of P88,155.25 and has an expected salvage value after 10 years…

A: Depreciation refers to an accounting method used to allocate the cost of a tangible or physical…

Q: The following data were taken from the statement of realization and liquidation of DLR Corporation…

A: The financial position of the company can be arrived from the income statement prepared by the…

Q: When a financial institution is a mutual association, it means that it is owned by the Group of…

A: Mutual Association a savings and lending organisation that doesn't have stakeholders and instead…

Q: Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars):…

A: WACC is the Weighted Average Cost of Capital. It means the average tax cost of capital from all the…

Q: Compute Mr. Boyd's realized and recognized gain on his exchange of property for stock, and determine…

A: Given in the question: Contribution by Mr. Boyd Fair Market Value Adjusted Tax Basis…

Q: Elizabeth Sales decided to create a branch in Naga City at the start of 20XX. The branch operation…

A: Journal entries is the transactions, which helps us to keeping or making records of transactions of…

Q: As a result of improvements in product engineering, United Automation is able to sell one of its two…

A: Introduction: Equivalent annual cost reveals the cost per year of any project to take decision…

Q: 0J une 2017 (the last day of the financial (Marks: 25 year) Moore Retailers sold one of their office…

A: Ans. For calculating the profit or loss, we need to consider the accumulated depreciation amount and…

Q: mison'srelevant range is sales of between$120,000 and $630,000. Prepare contribution margin…

A: Solution... Contribution margin Ratio = Contribution margin / sales = $315,000 / $525,000 =…

Q: Pharoah Inc. issued 12900 shares of no-par common stock with a stated value of $5 per share. The…

A: A journal entry records a business transaction in the accounting system of a company. Journal…

Q: _____ management exists to provide advice and assistance to those responsible for attaining the…

A: Ans. There are various management who look out the specific duties they are assigned for.

Q: SOLVE THE FOLLOWING USING EXCEL 1. Determine the utilization and efficiency for each of the…

A: Efficiency The ability to do a task with little to no waste, effort or energy is referred to as…

Q: What is fraud?

A: Misstatement risk: It implies to a risk that the financial statements of the company are…

Q: P.Q. Enterprises operates a wholesale business. At the 2020 year end, the accounts receivable…

A: When the chances of non-collection of account receivables increase they are written off as bad…

Q: What is the company's current breakeven in units and in dollars? 2. If the company expects to sell…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: A CNC (computer numerical control) machine produces a particular part in batches of 125 units. Each…

A: Sometimes, manufacturers manufacture the product not in a single unit but rather, it produces in…

Q: Headland Woodcrafters sells $233,600 of receivables to Commercial Factors, Inc. on a full guarantee…

A: Journal entries serve as the official record of all business activities. In the widest definition, a…

Q: Tom sold mutual fund shares he had owned 3 years so that he could use the proceeds to return to…

A: In USA as per IRS rules for tax years 2021 & 2022 the capital gain tax is 0% , 15% &…

Q: Cameron Ltd acquired a 60% holding in Gambia many years ago. At 31 December 2019 Cameron held…

A: When the transactions happened within the same group of companies, these are known as intercompany…

Q: ts neighbors on weekends by babysitting their children. Stephanie reported $13,700 of earnings from…

A: Standard deduction refers to the concept of determining a certain segment of the income of an entity…

Q: Molly and Justin are considering contributing $5,000 to their favorite, tax deductible charity. This…

A: Amount contributed to charity = $5,000 Marginal tax rate = 28% Molly and Justin can reduce their tax…

Q: Compute the activity-based overhead rates using the following budgeted data for each of the activity…

A: Overhead rate is defined as the allocation of the cost of production to the products or services.…

Q: The following information can be obtained by examining a company's balance sheet and income…

A: Cash flow statement mainly contain three activities : (1) Operating activity (2) Investing…

Q: FIFO Method, Valuation of Goods Transferred Out and Ending Work in Process McCourt Company uses the…

A: Work-in-progress inventory is that which has been started but still requires finishing before it can…

Q: What are the total variable manufacturing costs of the Deluxe paper product? Answer:

A: To calculate Total Variable Manufacturing Costs, first we have to calculate variable manufacturing…

Q: The real risk-free rate is 2.50%. Inflation is expected to be 2.00% this year and 4.75% during the…

A: Given Information: Real Risk free rate (r) = 2.5% Maturity Risk Premium (MRP) = 0 Inflation this…

Q: Demand at Nature Trails Ski Resort has a seasonal pattern. Demand is highest during the winter, as…

A: Season Year 1 Year 2 Fall 188 221 Winter 1357 1630 Spring 537 555 Summer 695 793 Total…

Q: Consequences of Multiple Cash Distributions. At the beginning of the current (non-leap) year,…

A: Accumulated Earning and Profit The financial term "accumulated earnings and profits" (E&P)…

Q: Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As…

A: The computation of shareholders' equity takes into account treasury stock, outstanding shares, extra…

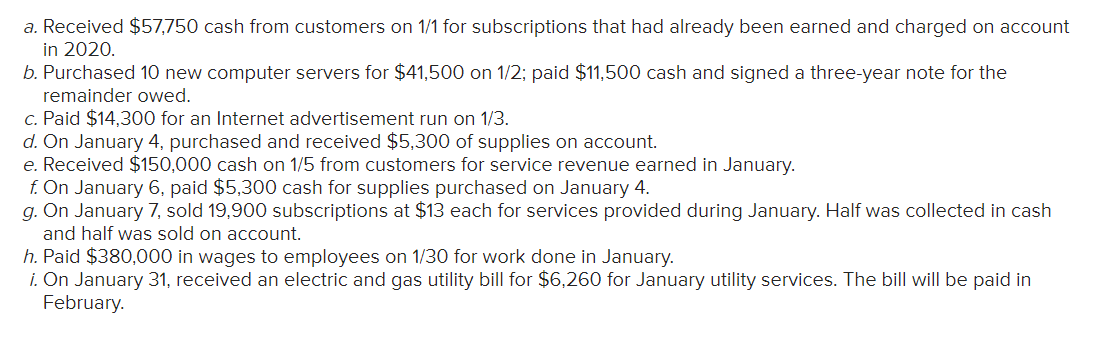

How do I fill in correctly the

A

B

G

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Im sorry but I am having a little difficult time reading some of the words. May I ask what the words say for parts a, b, and g?

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.McMasters Inc. specializes in BBQ accessories. In order for the company to expand its business, they take out a long-term loan in the amount of $800,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 9%. Each year on December 31, the company pays down the principal balance by $50,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. B. Compute the interest accrued on December 31 of the first year. C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year.Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the bank in the amount of $310,000. The terms of the loan are 6.5% annual interest rate, payable in three months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on February 24, and the entry for payment of the short-term note and final interest payment on April 24. Round to the nearest cent if required.

- Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of $650,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 8.5%. Each year on December 31, the company pays down the principal balance by $80,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. B. Compute the interest accrued on December 31 of the first year. C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year.Mohammed LLC is a growing consulting firm. The following transactions take place during the current year. A. On June 10, Mohammed borrows $270,000 from a bank to cover the initial cost of expansion. Terms of the loan are payment due in four months from June 10, and annual interest rate of 5%. B. On July 9, Mohammed borrows an additional $100,000 with payment due in four months from July 9, and an annual interest rate of 12%. C. Mohammed pays their accounts in full on October 10 for the June 10 loan, and on November 9 for the July 9 loan. Record the journal entries to recognize the initial borrowings, and the two payments for Mohammed.Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% annual interest rate and payable in 8 months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. Round to the nearest cent if required.

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business sets up a line of credit with a supplier. The company purchases $10,000 worth of equipment on credit. Terms of purchase are 5/10, n/30. B. A customer purchases a watering hose for $25. The sales tax rate is 5%. C. Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $250 per season ticket. Each customer purchased two season tickets. D. A company issues 2,000 shares of its common stock with a price per share of $15.Discuss how each of the following transactions for Watson, International, will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. An investor invests an additional $25,000 into a company receiving stock in exchange. B. Services are performed for customers for a total of $4,500. Sixty percent was paid in cash, and the remaining customers asked to be billed. C. An electric bill was received for $35. Payment is due in thirty days. D. Part-time workers earned $750 and were paid. E. The electric bill in C is paid.

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.