f. Explain briefly the difference between price risk and reinvestment risk. Which of e following bords has the most price risk? Which has the most reinvestment risk? A1-year tond with a 9% arnual coupon A5-year bond with a 9% annual A5-year band with a zero coupon A 10-year bond with a 9% annual coupon A 10-year bond with a zero coupon coupon

f. Explain briefly the difference between price risk and reinvestment risk. Which of e following bords has the most price risk? Which has the most reinvestment risk? A1-year tond with a 9% arnual coupon A5-year bond with a 9% annual A5-year band with a zero coupon A 10-year bond with a 9% annual coupon A 10-year bond with a zero coupon coupon

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 18PROB

Related questions

Question

7-19 ....part f

Transcribed Image Text:Chapter 7 Bonds and Their Valuation

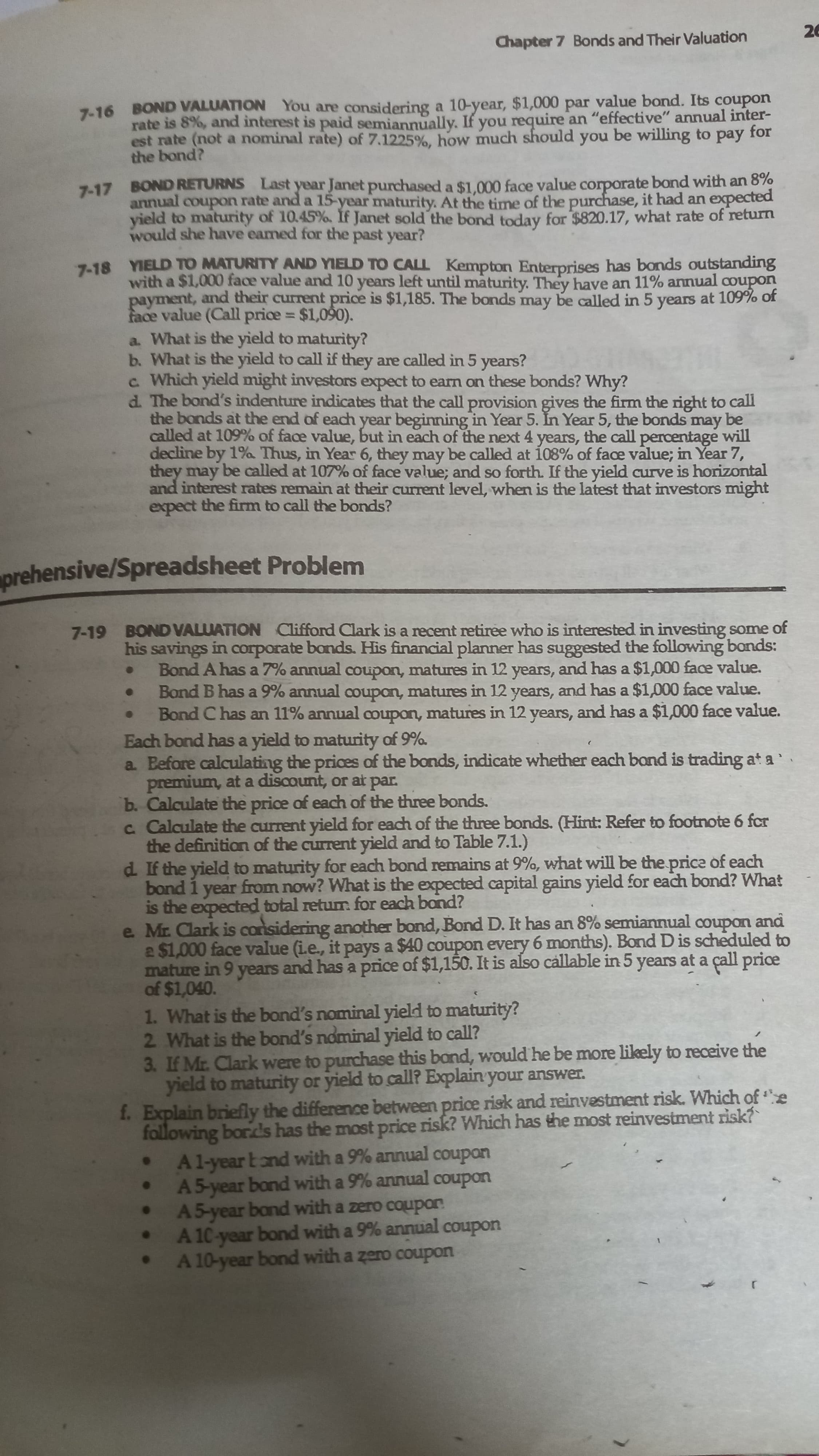

7-16 BOND VALUATION You are considering a 10-year, $1,000 par value bond. Its coupon

rate is 8%, and interest is paid semiannually. If you require an "effective" annual inter-

est rate (not a nominal rate) of 7.1225%, how much should you be willing to pay for

the bond?

7-17 BOND RETURNS Last year Janet purchased a $1.000 face value corporate bond with an 8%

annual couporn rate and a 15-year maturity. At the time of the purchase, it had an expected

yield to maturity of 10.45%. If Janet sold the bond today for $820.17, what rate of return

would she have eamed for the past year?

7-18 YIELD TO MATURITY AND YIELD TO CALL Kempton Enterprises has bonds outstanding

with a $1,000 face value and 10 years left until maturity. They have an 11% annual couporn

payment, and their current price is $1,185. The bonds may be called in 5 years at 109% of

face value (Call price $1,090).

a. What is the yield to maturity?

b. What is the yield to call if they are called in 5 years?

c Which yield might investors expect to earn on these bonds? Why?

d. The bond's indenture indicates that the call provision gives the firm the right to call

the bonds at the end of each year beginning in Year 5. In Year 5, the bonds may be

called at 109% of face value, but in each of the next 4 years, the call percentage will

decline by 1%a Thus, in Year 6, they may be called at 108% of face value; in Year 7,

they may be called at 107% of face value; and so forth. If the yield curve is horizontal

and interest rates remain at their current level, when is the latest that investors might

expect the firm to call the bonds?

%3D

prehensive/Spreadsheet Problem

7-19 BONDVALUATION Clifford Clark is a recent retiree who is interested in investing some of

his savings in corporate bonds. His financial planner has suggested the following bonds:

Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond C has an 11% annual ooupon, matures in 12 years, and has a $1,000 face value.

Each bond has a yield to maturity of 9%.

a Before calculating the prices of the bonds, indicate whether each bond is trading at a

premium, at a discount, or at par.

b. Calculate the price of each of the three bonds.

c Calculate the current yield for each of the three bonds. (Hint: Refer to footnote 6 fcr

the definition of the current yield and to Table 7.1.)

d. If the yield to maturity for each bond remains at 9%, what will be the price of each

bond 1 year from now? What is the expected capital gains yield for each bond? What

is the expected total retum. for each bond?

e Mr. Clark is considering another bond, Bornd D. It has an 8% semiannual ooupon and

a $1,000 face value (ie., it pays a $40 coupon every 6 months). Bond D is scheduled to

mature in 9 years and has a price of $1,150. It is also callable in 5 years at a çall price

of $1,040.

1. What is the bond's nominal yield to maturity?

2 What is the bond's nominal yield to call?

3. If Mr. Clark were to purchase this bond, would he be more likely to receive the

yield to maturity or yield to call? Explain your answer.

f. Explain briefly the difference between price risk and reinvestment risk. Which of e

following bords has the most price risk? Which has the most reinvestment risk?

A1-year Eond with a 9% annual coupon

• A5-year bond with a 9% annual coupon

. A5-year bond with a zero coupon

. A 10-year bond with a 9% annual coupon

A 10-year bond with a zero coupon

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning