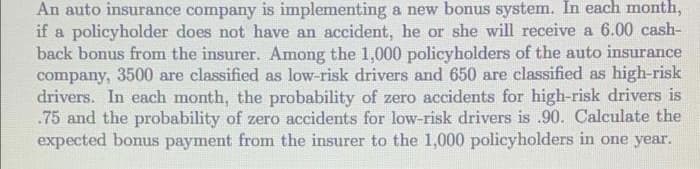

An auto insurance company is implementing a new bonus system. In each month, if a policyholder does not have an accident, he or she will receive a 6.00 cash- back bonus from the insurer. Among the 1,000 policyholders of the auto insurance company, 3500 are classified as low-risk drivers and 650 are classified as high-risk drivers. In each month, the probability of zero accidents for high-risk drivers is .75 and the probability of zero accidents for low-risk drivers is .90. Calculate the expected bonus payment from the insurer to the 1,000 policyholders in one year.

An auto insurance company is implementing a new bonus system. In each month, if a policyholder does not have an accident, he or she will receive a 6.00 cash- back bonus from the insurer. Among the 1,000 policyholders of the auto insurance company, 3500 are classified as low-risk drivers and 650 are classified as high-risk drivers. In each month, the probability of zero accidents for high-risk drivers is .75 and the probability of zero accidents for low-risk drivers is .90. Calculate the expected bonus payment from the insurer to the 1,000 policyholders in one year.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 71IIP

Related questions

Question

Transcribed Image Text:An auto insurance company is implementing a new bonus system. In each month,

if a policyholder does not have an accident, he or she will receive a 6.00 cash-

back bonus from the insurer. Among the 1,000 policyholders of the auto insurance

company, 3500 are classified as low-risk drivers and 650 are classified as high-risk

drivers. In each month, the probability of zero accidents for high-risk drivers is

.75 and the probability of zero accidents for low-risk drivers is .90. Calculate the

expected bonus payment from the insurer to the 1,000 policyholders in one year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning