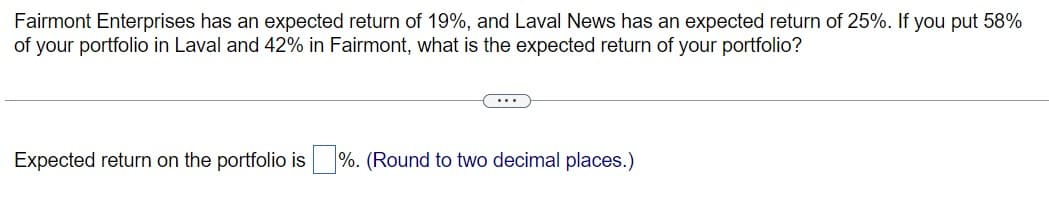

Fairmont Enterprises has an expected return of 19%, and Laval News has an expected return of 25%. If you put 58% of your portfolio in Laval and 42% in Fairmont, what is the expected return of your portfolio? Expected return on the portfolio is ☐ %. (Round to two decimal places.)

Q: You have been given the following return information for a mutual fund, the market index, and the…

A: Alpha of the fund defines the movement of the market through the investment performance which is…

Q: The coupon rate of a bond is typically __________.a. fixed at the time of bond issuanceb.subject to…

A: In this question, we are required to determine the correct statement regarding coupon rate of a…

Q: O A investment opportunity requires an investment today of $48.91 and then in five years, will…

A: Investment today (present value) = $48.91After 5 years, you will get $24 with 0.50 or 50%…

Q: Suppose a ten-year, $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for…

A: A bond is a type of debt security where an investor loans money to an entity, typically a…

Q: Use the following to solve questions a. and b. with excel A house with price of $250,000 20% down…

A: To solve these questions, we would typically use Excel's financial functions to calculate the total…

Q: A company has decided to issue bonds with annual coupon payments. The bonds will have a par value of…

A: Compounding = AnnualPar value = $1000Years to maturity = 20Coupon rate = 9.6%/100 = 0.0960 in…

Q: Try Yourself - Question 2 What annual rate is required for an investment to grow by 33% in 5 years…

A: The objective of the question is to find out the annual interest rate required for an investment to…

Q: The market consensus is that Analog Electronic Corporation has an ROE of 9% and a beta of 1.95. It…

A: Dividend Discount Model (DDM) is a valuation method to assess the intrinsic worth of a stock by…

Q: Scenario Probability Severe recession Mild recession 0.05 Stock Fund Rate of Return -41% Bond Fund…

A: Here, Stock Fund Bond FundScenarioProbabilityRate of ReturnRate of ReturnSevere…

Q: Bond J has a coupon rate of 7 percent and Bond K has a coupon rate of 13 percent. Both bonds have 16…

A: Bond JBond KCoupon7%13%Maturity1616Mode of paymentSemi annualSemi annualPayments per year22YTM10%10%

Q: k algo 10-31 Cash Flows And NPV The Bruin's Den Outdoor Gear is considering a new 6-year project to…

A: The objective of this question is to calculate the Net Present Value (NPV) of a new project that The…

Q: consider a 6 month forwardcontract on a zero - couponbond. the current bond price issh 200 and risk…

A: The objective of the question is to calculate the no-arbitrage forward price of a zero-coupon bond…

Q: If $1125.00 accumulates to $1248.19 in two years, six months compounded semi-annually, what is the…

A: The objective of the question is to find the effective annual rate of interest when the principal…

Q: A project that will provde annual cash flows of $3,050 for nine years costs $10,200 today. a. At a…

A: Net Present Value is a financial measure used to evaluate the profitability of an investment by…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: Weighted average cost of capital refers to the cost associated with the different structure of the…

Q: Esfandiari Enterprises is considering a new three-year expansion project that requires an initial…

A: Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or…

Q: The efficient frontier represents a combination of which of the following? a. Only portfolios

A: The efficient frontier represents a combination of:a. Only portfoliosb. A portfolio of risky…

Q: Am. 112.

A: The objective of the question is to estimate the overhead costs for Bowen plc if it handles…

Q: suppose that you purchase a Baa rated $1,000 semi-annual coupon bond with a 7.4% coupon rate and a…

A: > Given data:> number of periods = 5*2 = 10> Yield to maturity per period = 4.618%/2 =…

Q: 8.2 VWX Ltd, when raising capital for its inaugural balance sheet issued 7,000 £2NV shares at par,…

A: Column A:Enter the total amount for each transaction that occurred during the day.These transactions…

Q: The current debate about what corporate objectives should be

A: The current debate with respect to corporate objectives encompasses a wide range of perspectives,…

Q: 25. Potential buyer Sam wants to increase his credit score before applying for a mortgage loan. What…

A: Mortgage lenders will want to see if you can afford your mortgage before they lend you the money,…

Q: The real risk-free rate, r*, is 1.4%. Inflation is expected to average 1.2% a year for the next 4…

A: The objective of this question is to calculate the default risk premium of an 8-year corporate bond.…

Q: Use the following to solve questions a. and b. with an excel spreadsheet A house with price of…

A: See the answer in the explanation field.Explanation:Answer information:Step 1:Provided:It is assumed…

Q: you deposit money today in an account that pays 13.5% annual interest, how long will it take to…

A: Future value = Present value x (1+i)^twherePresent value = amount deposited today = $1…

Q: Sunshine Corp hired a new CFO and changed firm's policy from zero leverage to some leverage. They…

A: WACC can be referred as the average capital cost based on weights assigned to specific source of…

Q: Your aunt has $760,000 invested at 5.5%, and she now wants to retire. She wants to withdraw $45,000…

A: Here, CurrentAmount $ 760,000.00Interest Rate5.50%Type of AnnuityAnnuity DueAnnual Required…

Q: Wilde Software Development has a 10% unlevered cost of equity. Wilde forecasts the following…

A: Tax Shield:A tax shield refers to any reduction in taxable income due to deductible expenses, such…

Q: Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go…

A: It refers to the offer price earned by evaluating the current value of equity in consideration of…

Q: 1. Assuming that you deposited $100 today in a bank at 6 percent annual interest rate. After four…

A: Principal amount(P) = 100$Rate of interest(R) = 6%Number of years(n) = 4

Q: i need the answer quickly

A: Making decisions by comparing relative costs is known as the incremental method. Sunk cost and…

Q: Consider the following bonds: Which of the bonds A to D is most sensitive to a 1%drop in interest…

A: Bond sensitivity relates to how the worthiness of the bond gets affected when one variable is…

Q: 6. Pre-Financing Post-Financing Security # of Shares % # of Shares % Common-Founders 7,750,000 77.5…

A: The objective of the question is to understand the distribution of shares and the exit value for the…

Q: 21. A winner of sweepstake is given two options: option #1 receives a one-time payment of $…

A: The objective of this question is to calculate the present value of option 2 and compare it with…

Q: One year ago, you purchased a stock at a price of $28.75. The stock pays quarterly dividends of $.35…

A: The objective of this question is to calculate the total capital gains from the investment in a…

Q: The assets of company X have a beta equal to 1. Assume that the company's debt has a beta equal to…

A: Beta serves as a measure of systematic risk. When assessing the beta of the investor's portfolio,…

Q: K Your company currently has 5% coupon-rate bonds (coupons are paid semi-annually) with ten years to…

A: The objective of the question is to find out the coupon rate that needs to be set for the new bonds…

Q: (a) How many years will it take for $7500 to accumulate to $9517.39 at 3% compounded semi-annually?…

A: The money that you have today is valuable more than the same amount in the future due to the time…

Q: please provide correct answers. I will upvote.

A: Here's how to calculate Dani Corporation's WACC:1. Calculate the cost of equity (Ke):We can use the…

Q: Q1) A Zero-Coupon Bond with maturity in 5 years produces a gross yield of 4.5% p.a. effective and…

A: A bond is an instrument that provides the issuing organization access to debt capital from…

Q: If $1125.00 accumulates to $1248.19 in two years, six months compounded semi-annually, what is the…

A: The objective of the question is to find the effective annual rate of interest when the principal…

Q: Rottweiler Obedience School's December 31, 2021, balance sheet showed net fixed assets of…

A: Closing net fixed assets = opening net fixed assets + Net capital spending during the year -…

Q: Shelly Obama Sanders gets a loan for $3,000 and repays the loan in 12 monthly payments of $258.75…

A: Interest payments on a loan represent the cost of borrowing money from a lender. When an individual…

Q: Should I hold Worldcoin long-term? Will the Worldcoin currency still rise? Help with analysis!

A: Let's delve into an analysis of Worldcoin to help you make an informed decision. Worldcoin…

Q: A business has a cost of equity of 9.5 percent and a pretax cost of debt of 5.4 percent. The debt -…

A: The cost of capital is the return rate a company must pay to its investors in order to attract…

Q: Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.4 million…

A: Net income refers to an amount that is being earned by the company from its business after deducting…

Q: Baird Golf has decided to sell a new line of golf clubs. The clubs will sell for $715 per set and…

A: Cost of asset30100000Estimated life7Depreciation4300000Working capital investment1400000Working…

Q: 1. Assuming that you deposited $100 today in a bank at 6 percent annual interest rate. After four…

A: The objective of the question is to calculate the future value of a single sum of money invested…

Q: Morton and Moore LLC (M²) is trying to decide between two machines that are necessary in its…

A: EUAC stands for Equivalent Uniform Annual Cost, and it is a financial metric used to compare…

Q: Wildhorse Company is issuing long-term bonds to raise money for a planned acquisition. The face…

A: Bonds are a type of debt security which large organizations use to raise the capital.When a bond is…

Bhupatbhai

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?Fremont Enterprises has an expected return of 16% and Laurelhurst News has an expected return of 24%. If you put 60% of your portfolio in Laurelhurst and 40% in Fremont, what is the expected return of your portfolio? (Round to 2 decimal places)Fremont Enterprises has an expected return of 14% and Laurelhurst News has an expected return of 19%. If you put 44% of your portfolio in Laurelhurst and 56% in Fremont, what is the expected return of your portfolio? The expected return on the portfolio is \%. (Rounded to two decimal places.)

- What is the expected return of a portfolio that has $8,000 invested in S and $2,000 invested in T? The risk-free rate is 6% and the market portfolio's return is 14%. Do you expect the investment to be a good one for the coming year if betas for the two portfolio components are 0.6 and 1.3, respectively?Tyler Trucks stock has an annual return mean and standard deviation of 10 percent and 26 percent, respectively. Michael Moped Manufacturing stock has an annual return mean and standard deviation of 18 percent and 62 percent, respectively. Your portfolio allocates equal funds to Tyler Trucks stock and Michael Moped Manufacturing stock. The return correlation between Tyler Trucks and Michael Moped Manufacturing is .5. What is the smallest expected loss for your portfolio in the coming month with a probability of 5 percent?You have invested 30 percent of your portfolio in Jacob, Inc., 40 percent in Bella Co., and 30 percent in Edward Resources. What is the expected return of your portfolio if Jacob, Bella, and Edward have expected returns of 0.07, 0.13, and 0.09 respectfully?

- The stock of Jones Trucking is expected to return 16 percent annually with a standard deviation of 7 percent. The stock of Bush Steel Mills is expected to return 21 percent annually with a standard deviation of 13 percent. The correlation between the returns from the two securities has been estimated to be +0.4. The beta of the Jones stock is 1.1, and the beta of the Bush stock is 1.4. The risk-free rate of return is expected to be 6 percent, and the expected return on the market portfolio is 16 percent. The current dividend for Jones is $5. The current dividend for Bush is $7. What is the expected return from a portfolio containing the two securities if 30 percent of your wealth is invested in Jones and 70 percent is invested in Bush? Round your answer to one decimal place. % What is the expected standard deviation of the portfolio of the two stocks? Round your answer to two decimal places. % Which stock is the better buy in the current market? Round your answers to one decimal…The stock of Jones Trucking is expected to return 16 percent annually with a standard deviation of 7 percent. The stock of Bush Steel Mills is expected to return 21 percent annually with a standard deviation of 13 percent. The correlation between the returns from the two securities has been estimated to be +0.4. The beta of the Jones stock is 1.1, and the beta of the Bush stock is 1.4. The risk-free rate of return is expected to be 6 percent, and the expected return on the market portfolio is 16 percent. The current dividend for Jones is $5. The current dividend for Bush is $7. What is the expected return from a portfolio containing the two securities if 30 percent of your wealth is invested in Jones and 70 percent is invested in Bush? Round your answer to one decimal place. % What is the expected standard deviation of the portfolio of the two stocks? Round your answer to two decimal places. % Which stock is the better buy in the current market? Round your answers to one decimal…Suppose that you invested S400, 000 in U.S Rubber, $600, 000 in Sony, and S 1,000,000 in JVC. Sony is expected to earn 18% and JVC is expected to earn 12%. What is the expected return of your portfolio?

- The current risk-free rate of return, rRF, is 4 percent and the market risk premium, RPM, is 8 percent. If the beta coefficient associated with a firm's stock is 1.6, what should be the stock's required rate of return? Round your answer to one decimal place. ´%Equity has a beta of 1.35 and an expected return of 16 percent. A risk-free asset currently earns 4.8 percent. (a) What is the expected return on a portfolio that is equally invested in the two assets? (b) If a portfolio of the two assets has a beta of 0.95, what are the portfolio weights? (c) If a portfolio of the two assets has an expected return of 8 percent, what is its beta? (d) If a portfolio of the two assets has a beta of 2.70, what are the portfolio weights? How do you interpret the weights for the two assets in this case? ExplainBased on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 11 % and 14 %, respectively. The beta of A is 0.8 % while that of B is 1.5. The T-bill is currently 6 %, while the expected rate of return of the S&P 500 index is 12 %. The standard deviation of portfolio A is 10 % annually, while that of B is 31 % , and that of the index is 20 %: If you currently hold a market index portfolio, would you choose to add either of these portfolios to your holdings? Explain. If instead you could invest only in bills and one of these portfolios, which would you choose, and why? Investor Y, who put K1 in large stocks (the S & P 500 portfolio) on December 31, 1925, and re-invested all dividends in that portfolio, would have ended on December 31, 2003, with K1992.80.