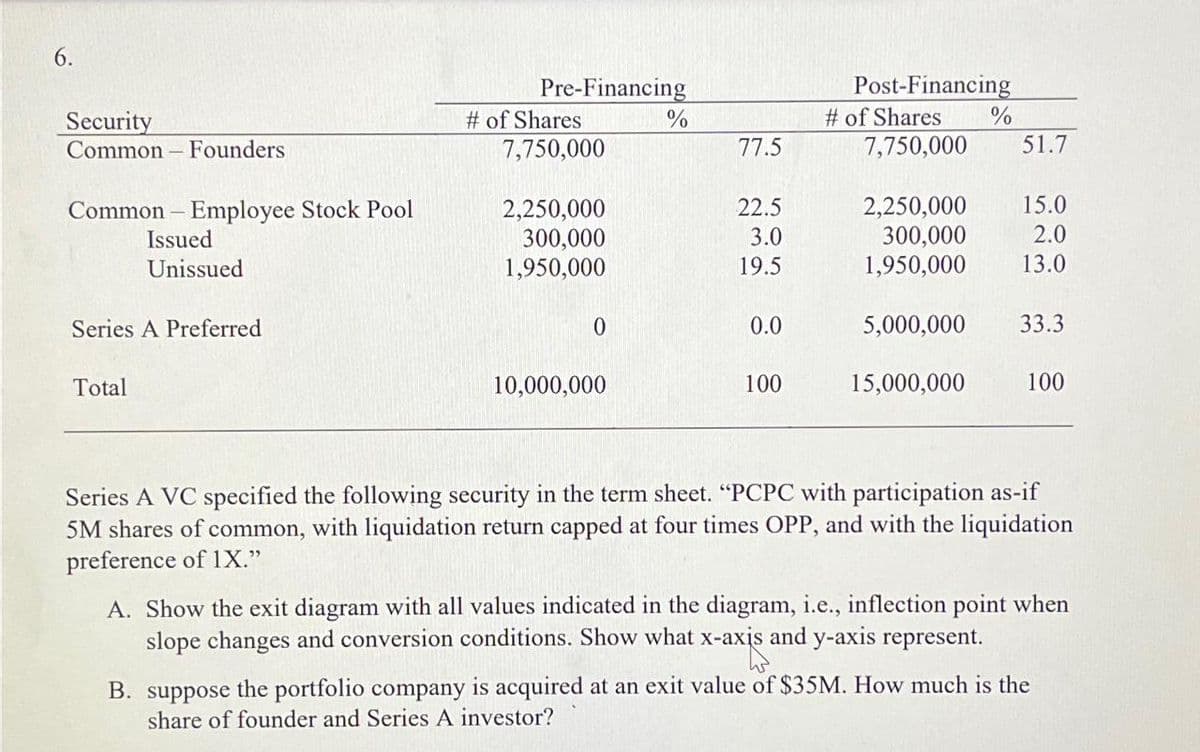

6. Pre-Financing Post-Financing Security # of Shares % # of Shares % Common-Founders 7,750,000 77.5 7,750,000 51.7 Common Employee Stock Pool 2,250,000 22.5 2,250,000 15.0 Issued 300,000 3.0 300,000 2.0 Unissued 1,950,000 19.5 1,950,000 13.0 Series A Preferred 0 0.0 5,000,000 33.3 Total 10,000,000 100 15,000,000 100 Series A VC specified the following security in the term sheet. "PCPC with participation as-if 5M shares of common, with liquidation return capped at four times OPP, and with the liquidation preference of 1X." A. Show the exit diagram with all values indicated in the diagram, i.e., inflection point when slope changes and conversion conditions. Show what x-axis and y-axis represent. B. suppose the portfolio company is acquired at an exit value of $35M. How much is the share of founder and Series A investor?

6. Pre-Financing Post-Financing Security # of Shares % # of Shares % Common-Founders 7,750,000 77.5 7,750,000 51.7 Common Employee Stock Pool 2,250,000 22.5 2,250,000 15.0 Issued 300,000 3.0 300,000 2.0 Unissued 1,950,000 19.5 1,950,000 13.0 Series A Preferred 0 0.0 5,000,000 33.3 Total 10,000,000 100 15,000,000 100 Series A VC specified the following security in the term sheet. "PCPC with participation as-if 5M shares of common, with liquidation return capped at four times OPP, and with the liquidation preference of 1X." A. Show the exit diagram with all values indicated in the diagram, i.e., inflection point when slope changes and conversion conditions. Show what x-axis and y-axis represent. B. suppose the portfolio company is acquired at an exit value of $35M. How much is the share of founder and Series A investor?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.1E

Related questions

Question

Transcribed Image Text:6.

Pre-Financing

Post-Financing

Security

# of Shares

%

# of Shares

%

Common-Founders

7,750,000

77.5

7,750,000

51.7

Common Employee Stock Pool

2,250,000

22.5

2,250,000

15.0

Issued

300,000

3.0

300,000

2.0

Unissued

1,950,000

19.5

1,950,000

13.0

Series A Preferred

0

0.0

5,000,000

33.3

Total

10,000,000

100

15,000,000

100

Series A VC specified the following security in the term sheet. "PCPC with participation as-if

5M shares of common, with liquidation return capped at four times OPP, and with the liquidation

preference of 1X."

A. Show the exit diagram with all values indicated in the diagram, i.e., inflection point when

slope changes and conversion conditions. Show what x-axis and y-axis represent.

B. suppose the portfolio company is acquired at an exit value of $35M. How much is the

share of founder and Series A investor?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning