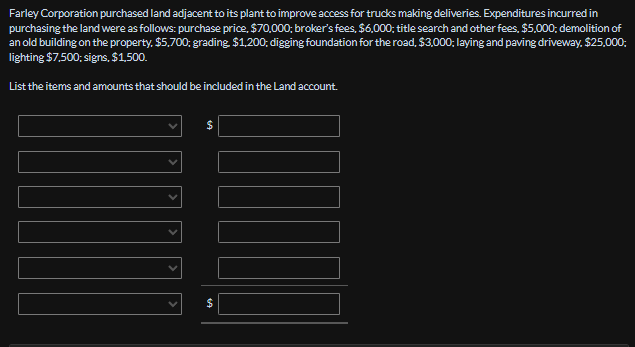

Farley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account. $ $

Farley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account. $ $

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:Farley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in

purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of

an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000;

lighting $7,500; signs, $1,500.

List the items and amounts that should be included in the Land account.

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,