Feb 01 Take $4,000 cash out of Big Bank to pay for February's warehouse rent. Feb 04 Sale of inventory to a customer - selling price $62,000 - cost of inventory sold $16,000- customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer – selling price $88,000 – cost of inventory sold $22,000- customer will pay in the future. Sale of inventory to a customer- selling price $110,000 - cost of inventory sold $28,000 will pay for the remaining amount of the sale in 30 days. Feb 18 - customer pays $40,000 cash which is deposited in Little Bank - customer Feb 22 Purchase additional inventory-pay $17,000 cash out of Big Bank for the inventory. Feb 27 Take $23,000 cash out of Little Bank to pay employees for wages they have earned. Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to Big Bank for February-interest will be paid in June. Feb 28 Adjust the Interest Payable-Little Bank account to record the $450 of interest owed to Little Bank for February- interest will be paid in March. Feb 28

Feb 01 Take $4,000 cash out of Big Bank to pay for February's warehouse rent. Feb 04 Sale of inventory to a customer - selling price $62,000 - cost of inventory sold $16,000- customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer – selling price $88,000 – cost of inventory sold $22,000- customer will pay in the future. Sale of inventory to a customer- selling price $110,000 - cost of inventory sold $28,000 will pay for the remaining amount of the sale in 30 days. Feb 18 - customer pays $40,000 cash which is deposited in Little Bank - customer Feb 22 Purchase additional inventory-pay $17,000 cash out of Big Bank for the inventory. Feb 27 Take $23,000 cash out of Little Bank to pay employees for wages they have earned. Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to Big Bank for February-interest will be paid in June. Feb 28 Adjust the Interest Payable-Little Bank account to record the $450 of interest owed to Little Bank for February- interest will be paid in March. Feb 28

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Need a general journal entry

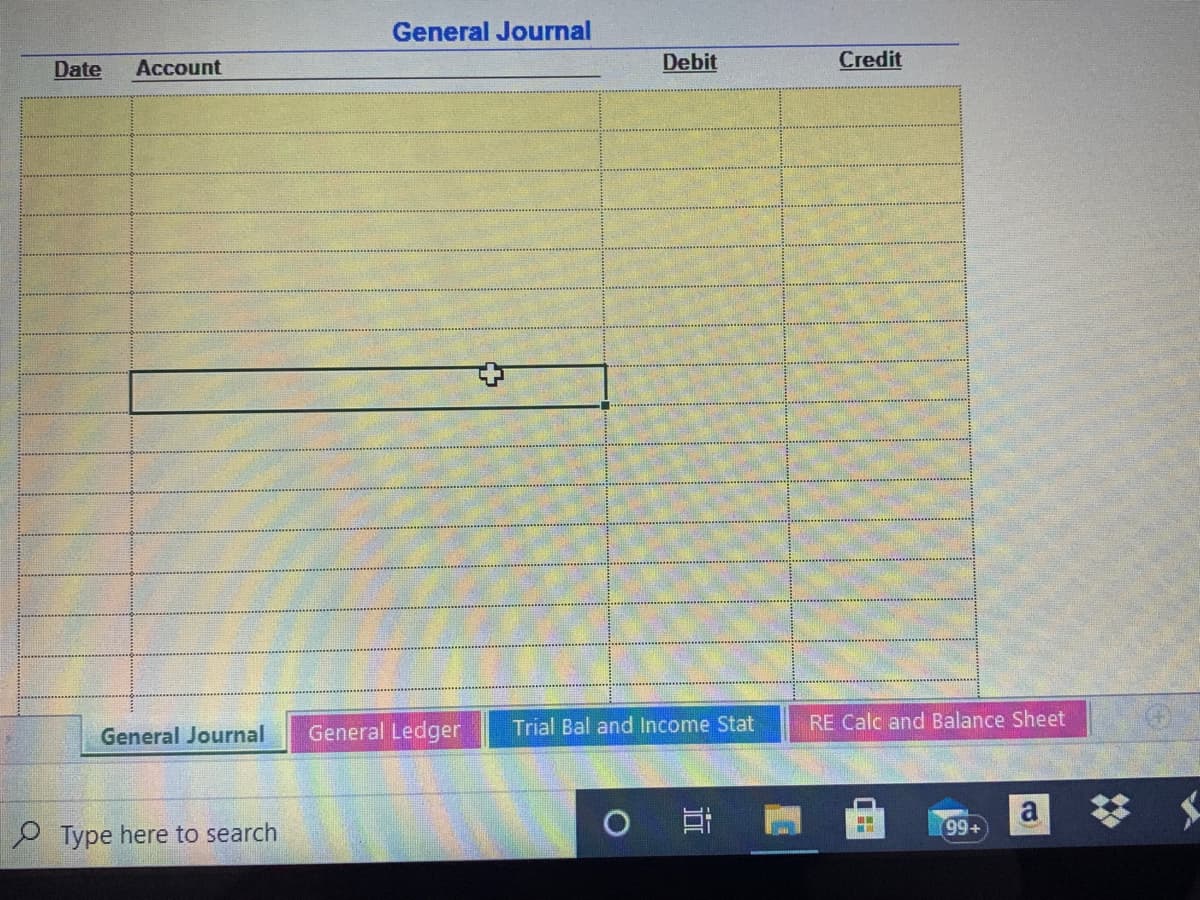

Transcribed Image Text:General Journal

Date

Account

Debit

Credit

General Ledger

Trial Bal and Income Stat

RE Calc and Balance Sheet

General Journal

%23

99+

P Type here to search

近

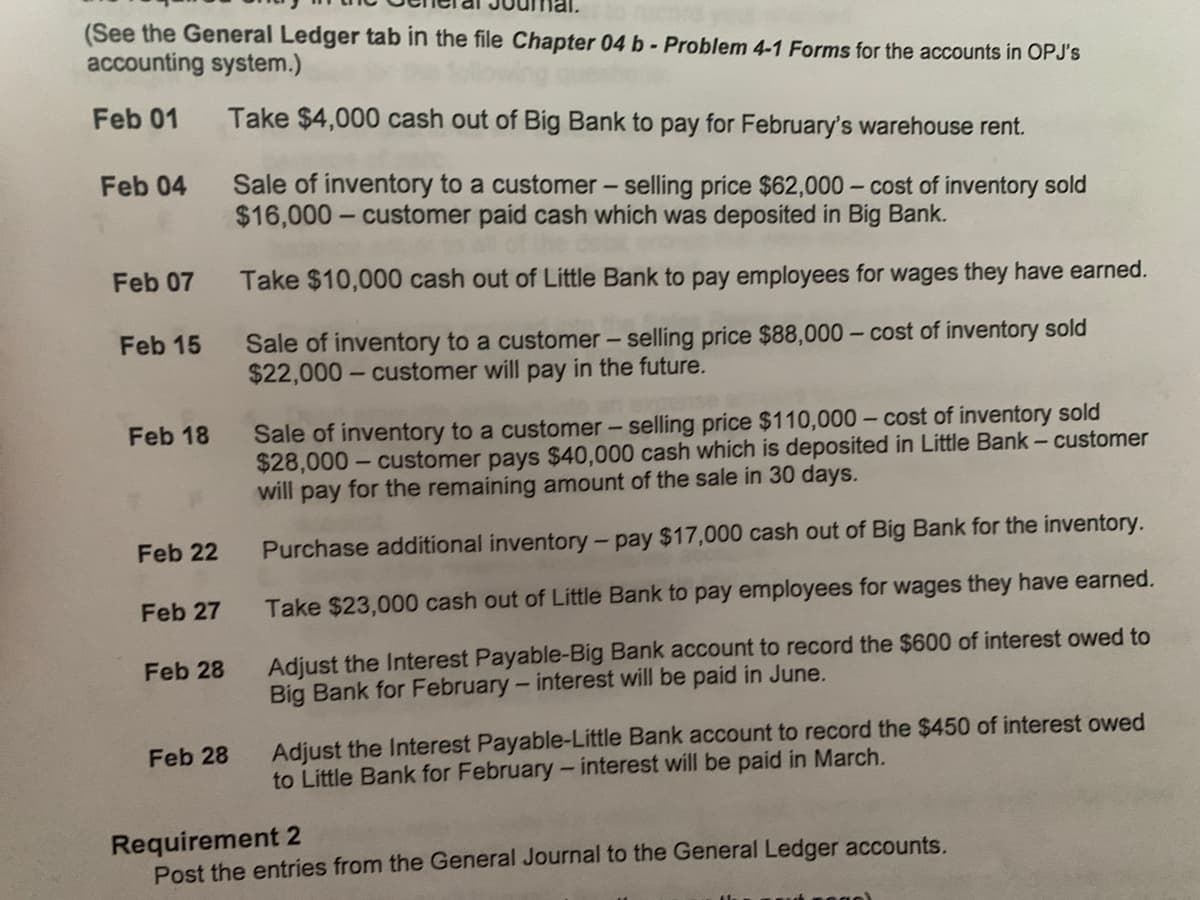

Transcribed Image Text:(See the General Ledger tab in the file Chapter 04 b- Problem 4-1 Forms for the accounts in OPJ's

accounting system.)

Feb 01

Take $4,000 cash out of Big Bank to pay for February's warehouse rent.

Feb 04

Sale of inventory to a customer - selling price $62,000 - cost of inventory sold

$16,000- customer paid cash which was deposited in Big Bank.

Feb 07

Take $10,000 cash out of Little Bank to pay employees for wages they have earned.

Feb 15

Sale of inventory to a customer – selling price $88,000 – cost of inventory sold

$22,000- customer will pay in the future.

Sale of inventory to a customer - selling price $110,000 - cost of inventory sold

$28,000 - customer pays $40,000 cash which is deposited in Little Bank- customer

will pay for the remaining amount of the sale in 30 days.

Feb 18

Feb 22

Purchase additional inventory- pay $17,000 cash out of Big Bank for the inventory.

Feb 27

Take $23,000 cash out of Little Bank to pay employees for wages they have earned.

Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to

Big Bank for February-interest will be paid in June.

Feb 28

Adjust the Interest Payable-Little Bank account to record the $450 of interest owed

to Little Bank for February- interest will be paid in March.

Feb 28

Requirement 2

Post the entries from the General Journal to the General Ledger accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning