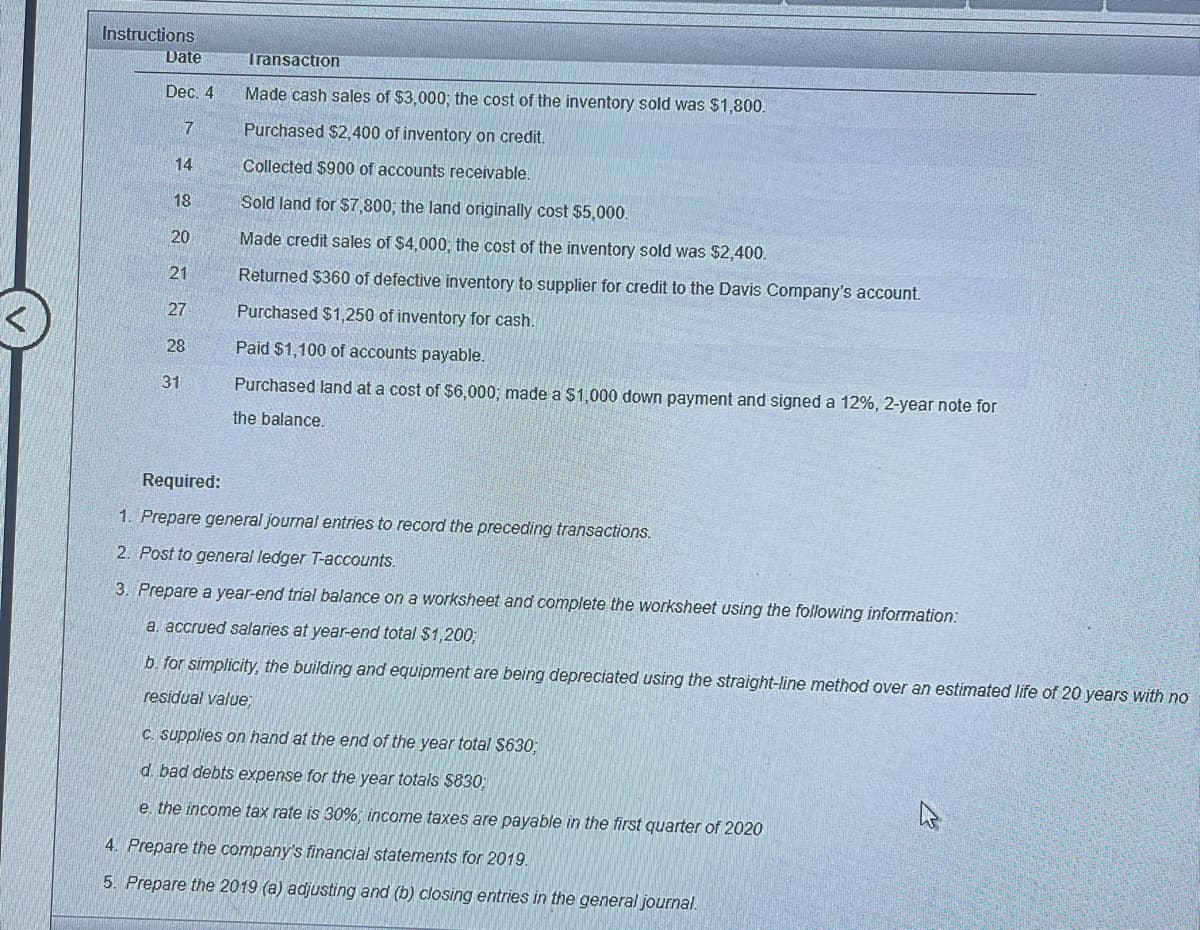

Instructions Date Dec. 4 7 14 18 20 21 27 28 31 Transaction Made cash sales of $3,000; the cost of the inventory sold was $1,800. Purchased $2,400 of inventory on credit. Collected $900 of accounts receivable. Sold land for $7,800; the land originally cost $5,000. Made credit sales of $4,000; the cost of the inventory sold was $2,400. Returned $360 of defective inventory to supplier for credit to the Davis Company's account. Purchased $1,250 of inventory for cash. Paid $1,100 of accounts payable. Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%, 2-year note for the balance. Required: 1. Prepare general journal entries to record the preceding transactions. 2. Post to general ledger T-accounts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: a. accrued salaries at year-end total $1,200; b. for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 years with r residual value; C. supplies on hand at the end of the year total $630; d. bad debts expense for the year totals $830; e. the income tax rate is 30%; income taxes are payable in the first quarter of 2020 4. Prepare the company's financial statements for 2019. 5. Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.

Instructions Date Dec. 4 7 14 18 20 21 27 28 31 Transaction Made cash sales of $3,000; the cost of the inventory sold was $1,800. Purchased $2,400 of inventory on credit. Collected $900 of accounts receivable. Sold land for $7,800; the land originally cost $5,000. Made credit sales of $4,000; the cost of the inventory sold was $2,400. Returned $360 of defective inventory to supplier for credit to the Davis Company's account. Purchased $1,250 of inventory for cash. Paid $1,100 of accounts payable. Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%, 2-year note for the balance. Required: 1. Prepare general journal entries to record the preceding transactions. 2. Post to general ledger T-accounts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: a. accrued salaries at year-end total $1,200; b. for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 years with r residual value; C. supplies on hand at the end of the year total $630; d. bad debts expense for the year totals $830; e. the income tax rate is 30%; income taxes are payable in the first quarter of 2020 4. Prepare the company's financial statements for 2019. 5. Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

Prepare the company income statement for 2019

Transcribed Image Text:Instructions

Date

Dec. 4

7

14

18

20

21

27

28

31

Transaction

Made cash sales of $3,000; the cost of the inventory sold was $1,800.

Purchased $2,400 of inventory on credit.

Collected $900 of accounts receivable.

Sold land for $7,800; the land originally cost $5,000.

Made credit sales of $4,000; the cost of the inventory sold was $2,400.

Returned $360 of defective inventory to supplier for credit to the Davis Company's account.

Purchased $1,250 of inventory for cash.

Paid $1,100 of accounts payable.

Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%, 2-year note for

the balance.

Required:

1. Prepare general journal entries to record the preceding transactions.

2. Post to general ledger T-accounts.

3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information:

a. accrued salaries at year-end total $1,200;

b. for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 years with no

residual value;

c. supplies on hand at the end of the year total $630;

d. bad debts expense for the year totals $830;

e. the income tax rate is 30%; income taxes are payable in the first quarter of 2020

4. Prepare the company's financial statements for 2019.

5. Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.

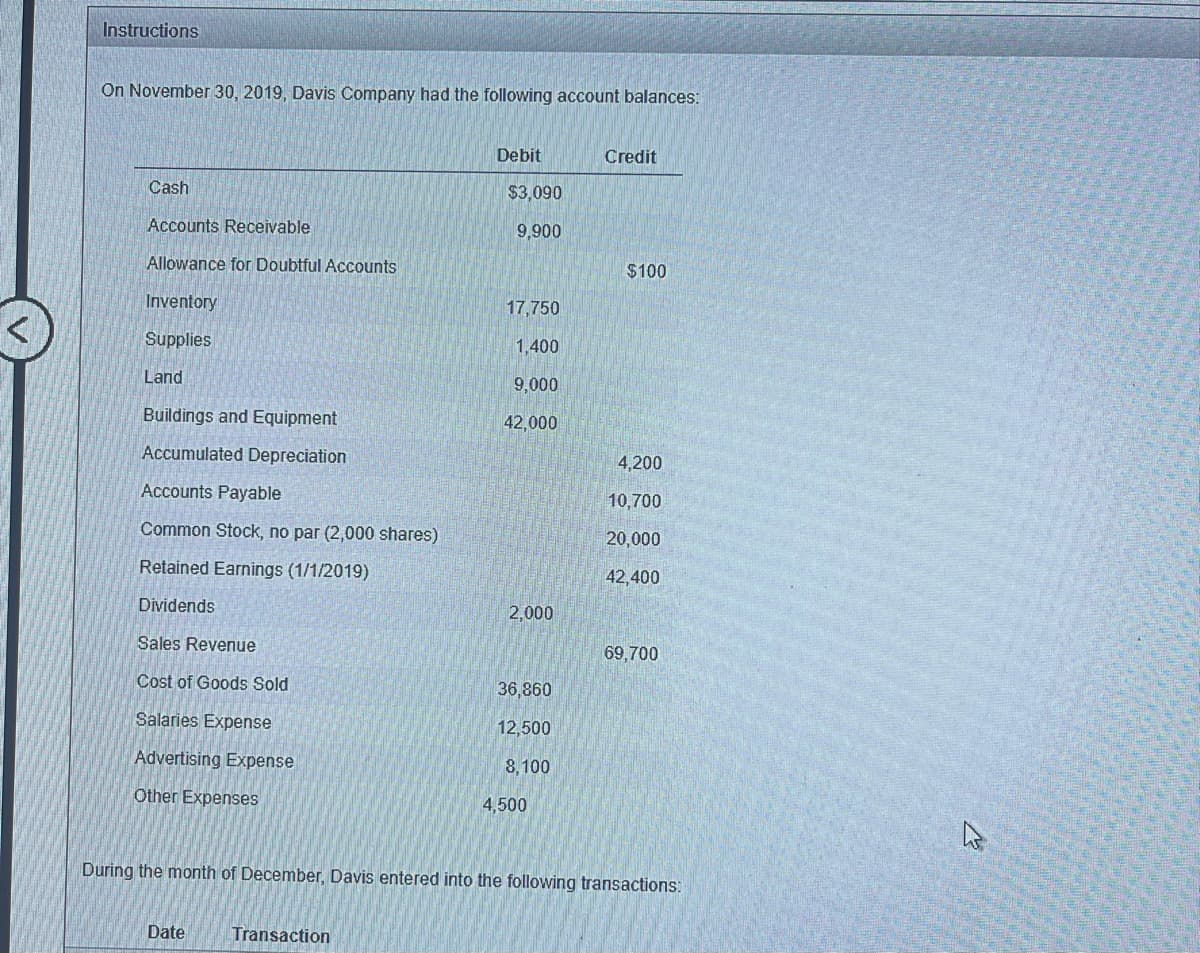

Transcribed Image Text:Instructions

On November 30, 2019, Davis Company had the following account balances:

Cash

Accounts Receivable

Allowance for Doubtful Accounts

Inventory

Supplies

Land

Buildings and Equipment

Accumulated Depreciation

Accounts Payable

Common Stock, no par (2,000 shares)

Retained Earnings (1/1/2019)

Dividends

Sales Revenue

Cost of Goods Sold

Salaries Expense

Advertising Expense

Other Expenses

Date

Debit

Transaction

BOLIGSI

$3,090

9,900

17,750

1,400

9,000

42,000

2,000

36,860

12,500

8,100

4,500

Credit

$100

4,200

10,700

20,000

42,400

During the month of December, Davis entered into the following transactions:

69,700

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,